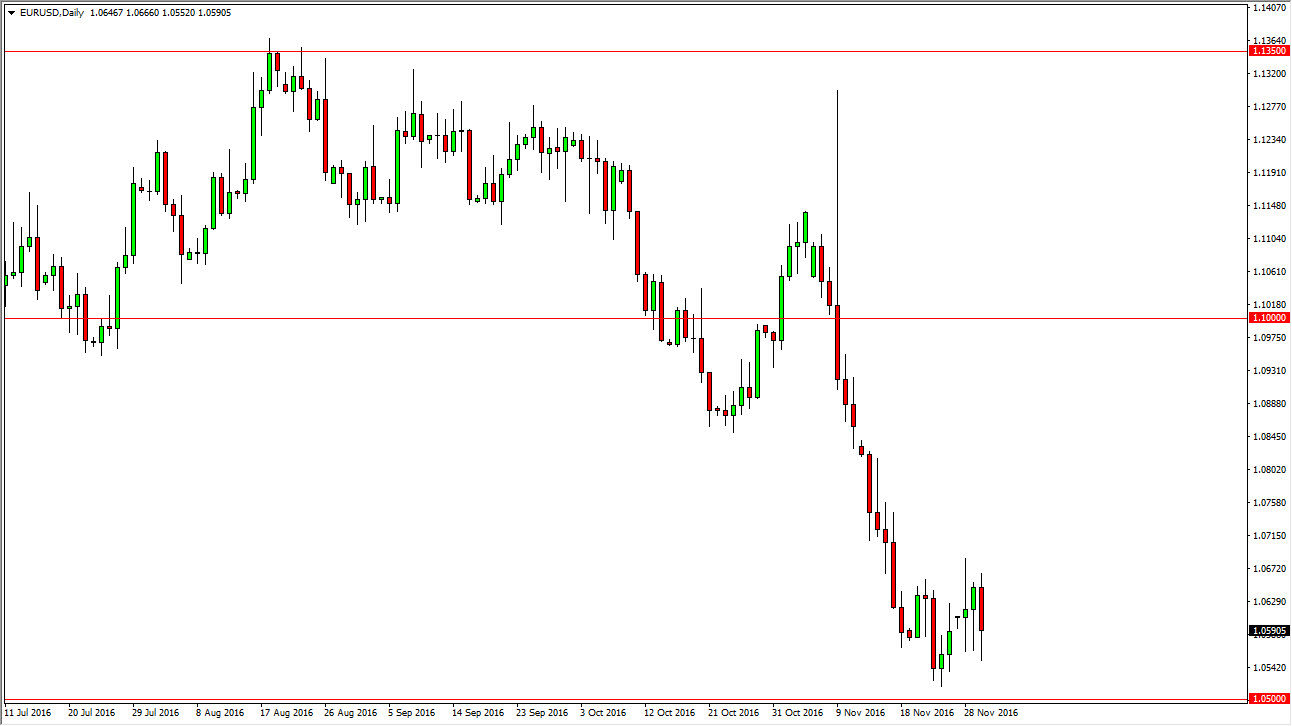

EUR/USD

The EUR/USD pair has been very negative for quite some time, and during the day on Wednesday only continued to be more of the same. I believe that the 1.05 level below continues offer quite a bit of support, but I think it gets broken given enough time. I think that every time we rally you have to be looking for short-term exhaustive candles to start selling. The Federal Reserve is likely to raise interest rates during the month of December, and quite frankly the European Union is light years away from being able to do the same. We have to worry about the Italian referendum, and of course the banking system on the whole when it comes to the continent. With this, this is a market that continues offer selling opportunities again and again.

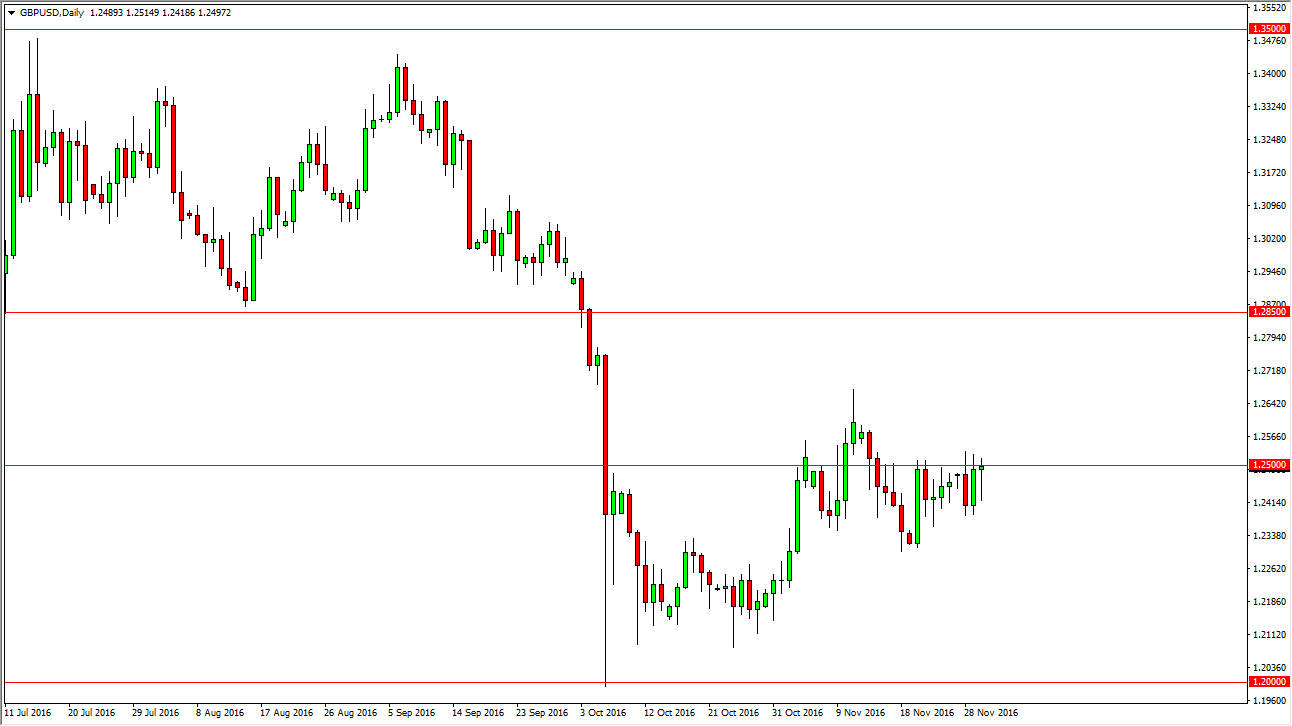

GBP/USD

The British pound initially fell during the day on Wednesday, but turned around at the 1.24 level to bounce and form a bit of a hammer. The hammer is a bullish candle, and if we can break above the top of the hammer, the market could try to continue grinding higher. I think that’s likely to happen but I also think that it’s going to be a very choppy move to the upside, and as a result I feel that this isn’t necessarily a move to the upside I want to be involved in. It’s not to say that some traders may not want to be but I recognize that this is going to be more trouble than it’s worth. Also, I believe that it gives enough time for sellers to get involved at higher levels, taking advantage of “value in the greenback”, as the concerns and uncertainty when it comes to the United Kingdom at the moment will continue to weigh upon the value of the British pound in general.