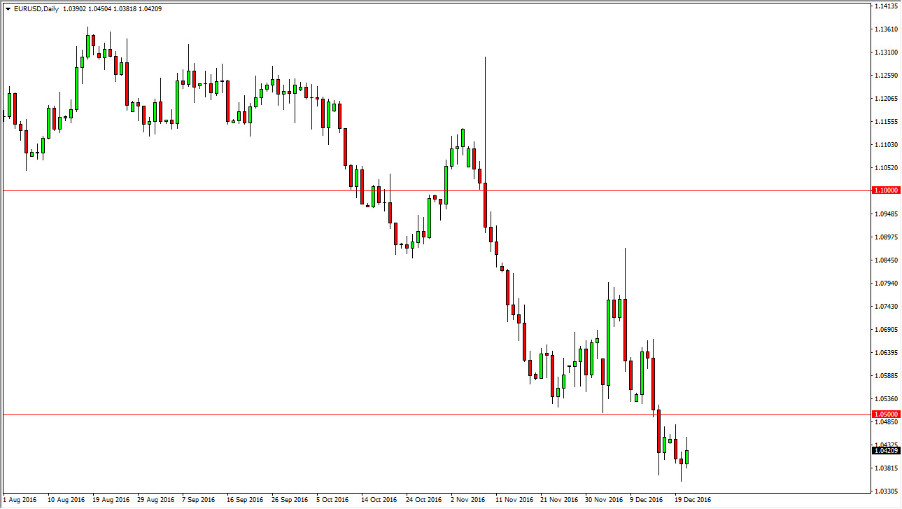

EUR/USD

The Euro rallied on Wednesday, as we continue to see quite a bit of volatility in the Forex markets overall. Ultimately, the 1.05 level above should be resistive, as it was previously so supportive. I’m looking for some type of exhaustive candle in order to start selling again, as I believe that the US dollar continues to strengthen against other currencies around the world, and the Euro of course has quite a bit a lot of problems associated with that, not the least of which is that the European Central Bank extended quantitative easing by at least 9 months, and that of course works against the value of the currency itself.

GBP/USD

The GBP/USD pair had a volatile session on Wednesday as we bounced around below the bottom of the uptrend line that had been supporting the market. I think that the market will continue to see quite a bit of choppiness as there is a lack of conviction in the market at the moment. After all, that is almost Christmas and therefore liquidity will be an issue. Liquidity been so alone does not lend itself to push the market in any great way, so with that in mind I feel that short-term trades are probably about as good as this gets. I believe that the previous uptrend line will continue to offer resistance, and an exhaustive candle in that area is a short-term selling opportunity. I believe that a break above that uptrend line will then have to deal with the 1.25 level above which is massively resistive as well.

Alternately, if we can break down below the bottom of the hammer from the Tuesday session, the market should then reach down to the 1.21 handle, which has been massively supportive in the past. A break down below there should send the market to the 1.20 handle.