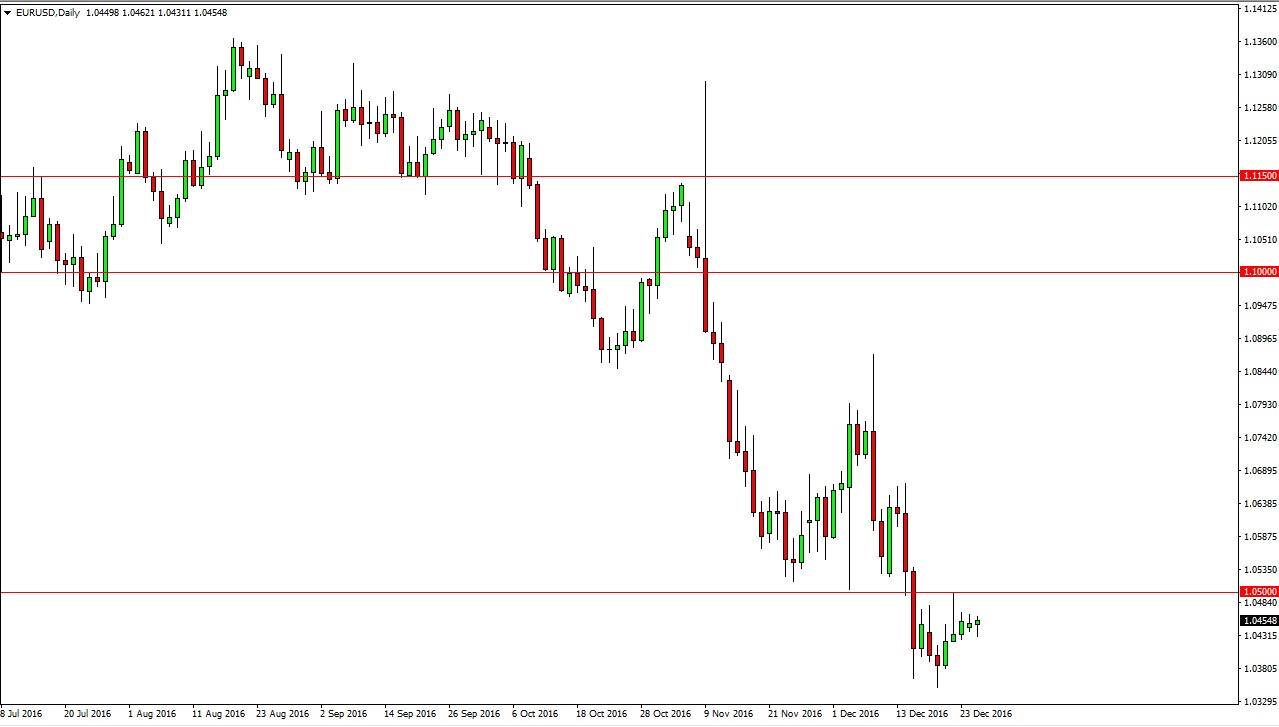

EUR/USD

The EUR/USD pair initially fell on Tuesday, but bounced enough to form a slightly positive candle while this is a positive outcome for the day, do not see any reason to start going long at this point. After all, the 1.05 level will continue to be resistive, as it was once so important as far as support is concerned. Because of this, I remain very hesitant to go long and am currently looking for an exhaustive candle to start selling. Once I get that candle, I will not hesitate to short this market as I believe we will reach towards the 1.03 level and then eventually the parity handle. Because of this, it’s simply a matter of waiting for signs of exhaustion to take advantage of “value” in the US dollar.

GBP/USD

It was a reasonably quiet session on Tuesday, as volume might have been an issue as we are between Christmas and the New Year’s Day holiday. Because of this, any rally barely raises any type of concern at this point, and I am willing to sell any bounce as it should offer plenty of value in the greenback. The Federal Reserve will more than likely raise interest rates again over the next year, and at the same point we have the Bank of England not being anywhere near able to do the same thing. Because of this, I feel that eventually the sellers will continue to be attracted to this market as we will have to test the 1.21 level below, and then eventually the 1.20 level under that. I have no interest in buying, as the concerns around the British pound and more specifically the United Kingdom leaving the European Union should continue to be a bit of an anchor around the neck when it comes to the British pound.