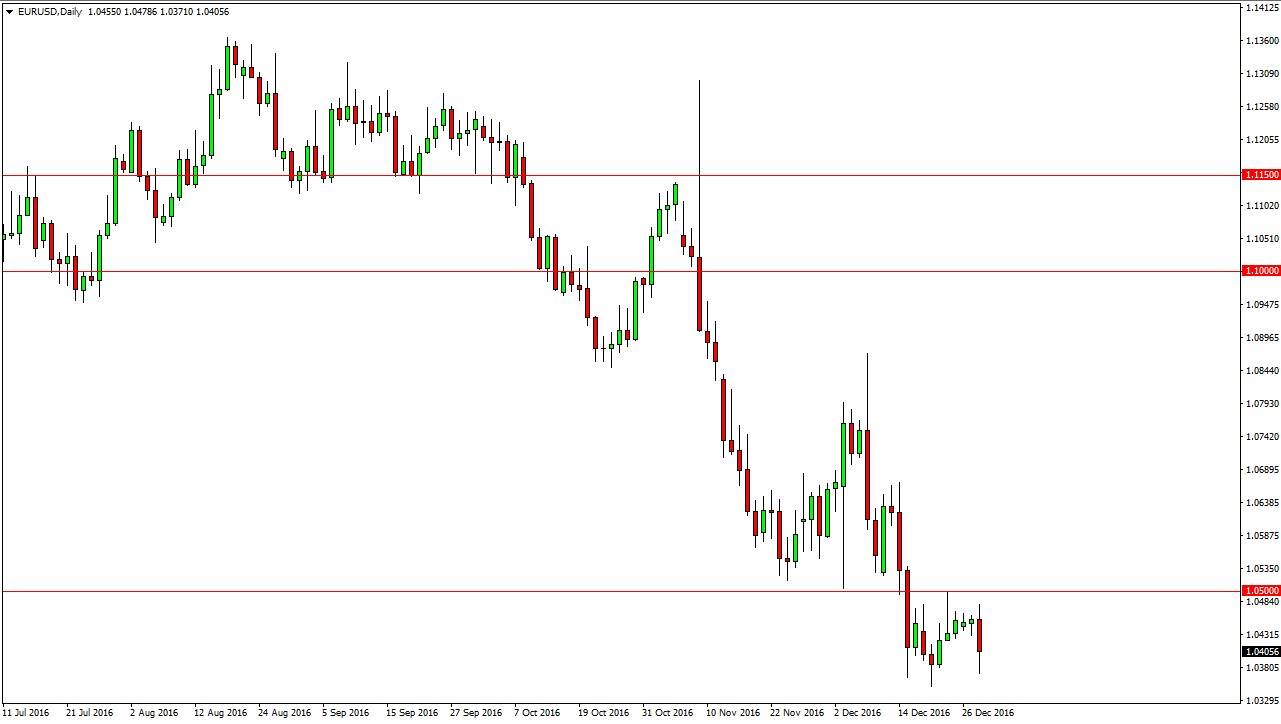

EUR/USD

The EUR/USD pair during the day on Wednesday rallied, but found enough resistance near the 1.05 level above to turn the market around. Because of this, it looks as if the market is still trying to roll over, as we are more than likely going to fall to the 1.03 level, and perhaps even the parity level after that. I recognize there is a lot of bearish pressure in this market, even though there is quite a bit of volatility now. A lot of this will probably have to do with the time of year, but with the European Central Bank extending quantitative easing by nine months, it makes sense that we continue to see the seller step into this market every time again.

GBP/USD

The British pound had a negative session again during the day on Wednesday, as we continue to see various pressure on the British pound mainly due to fears about leaving the European Union. Ultimately though, you keep in mind that the other side of the currency pair features the US dollar, which of course has a central bank that’s ready to raise interest rates repeatedly. Rallies should continue to be selling opportunities, especially with exhaustive candles appearing as they show a significant opportunity to pick up the US dollar “on the cheap.”

The 1.20 level underneath should be targeted, as it is the most recent low that the market has seen. If we breakdown below their, the market should then reach to the 1.15 level underneath. Longer-term charts show this level as being crucial, and I think it will continue to be an area where buyers get involved. I have no interest in buying this pair, and I think that no matter what happens, the sellers are going to step in and take advantage of the stronger US dollar over the longer-term.