EUR/USD Signal Update

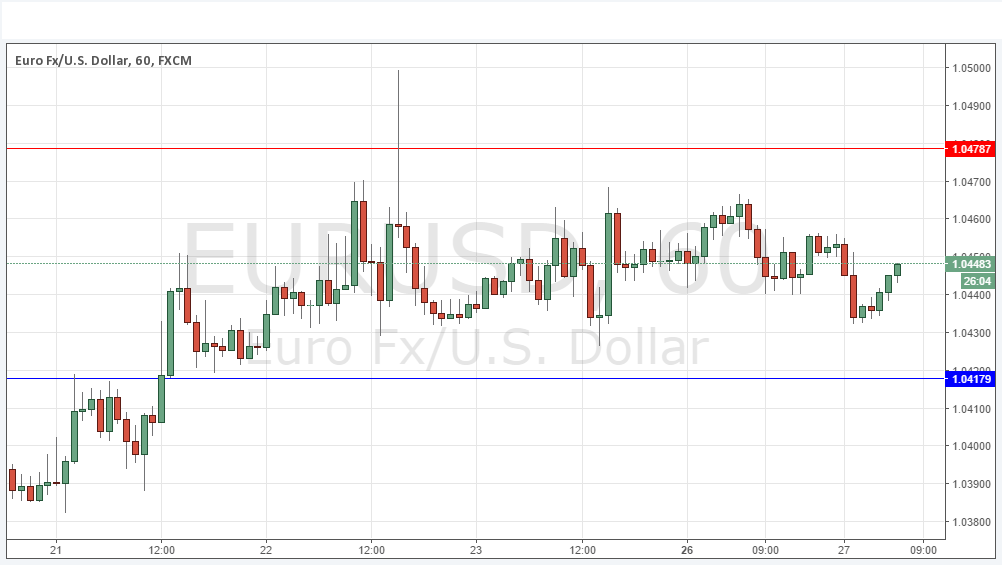

Last Thursday’s signals produced a small yet profitable short trade following the bearish pin candle forming on the hourly chart which rejected the resistance level identified at 1.0479. If anything remains of this trade, it is probably a good idea to close the rest of it as the next move looks completely uncertain.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 1pm and 5pm London time today only.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0418 or 1.0350.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0479.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Today the market finally returns properly (or at least semi-properly) from the Christmas holiday break, although London is still closed so it is a good idea not to open any new trades until New York opens later.

The price, unsurprisingly, has been drifting sideways in thin volume between the new support which formed and held last week at 1.0417 and 1.0479. There is a long-term downwards trend.

It is difficult to say what is most likely to happen next over the short term.

There is nothing due today regarding the EUR, it is a public holiday in much of Europe. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.