The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 4th November 2016

Last week, I predicted that the best trades for this week were likely to be long USD, GBP and AUD against the Japanese Yen. The average result of these trades was positive and quite nicely so, at 1.08%. The best result was long GBP/JPY which are the respective strongest and weakest of all the major currencies right now.

The Forex market seems to be moving into a less predictable mode now, with increased signs that the strong rally in the USD since 8th November is beginning to run out of steam.

I therefore suggest that the best trades this week are likely to be long GBP against both the Japanese Yen and the U.S. Dollar, in order to spread the risk somewhat.

Fundamental Analysis & Market Sentiment

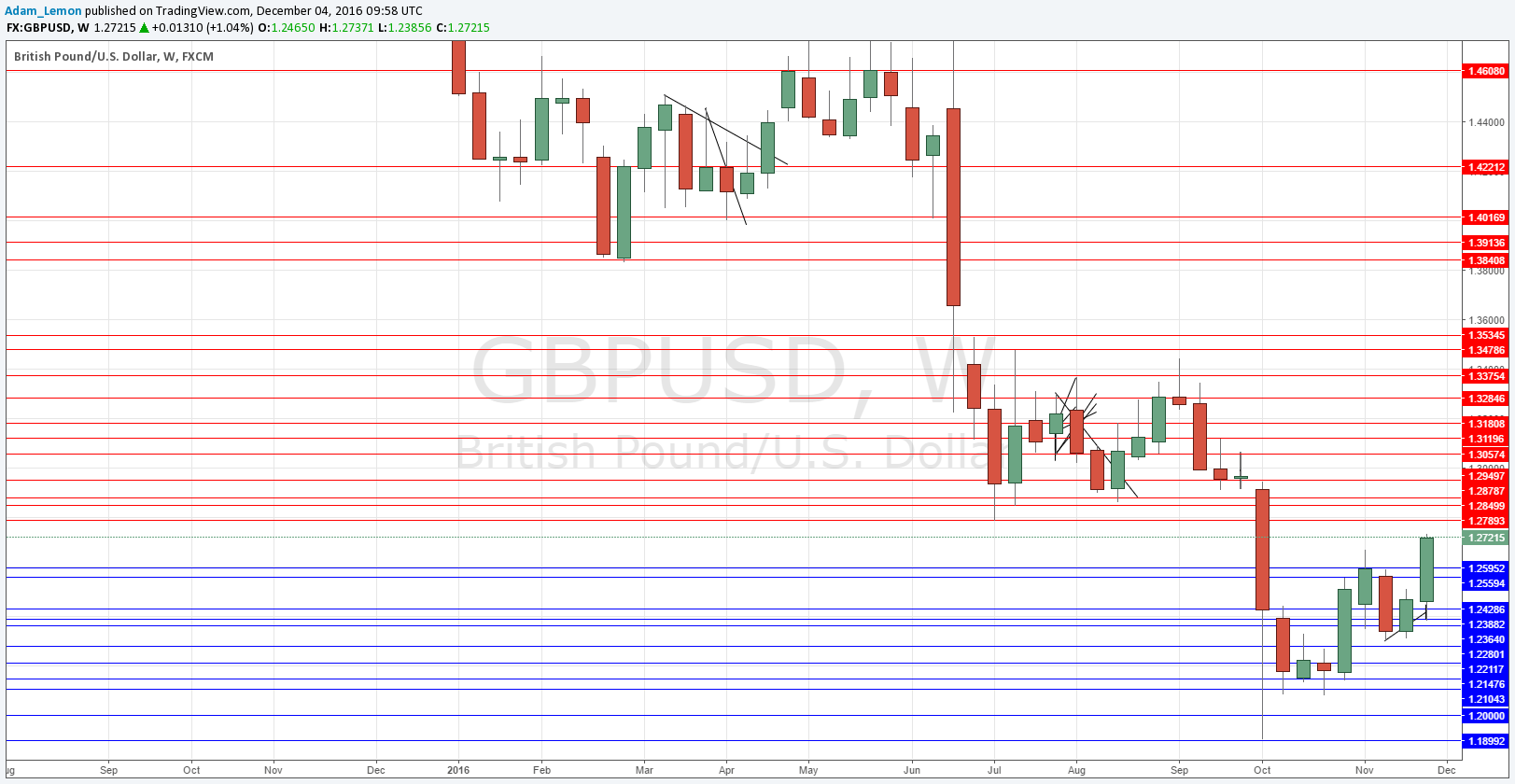

Fundamental factors are playing a role right now most notably on the GBP, as it becomes increasingly likely that the U.K. is going to stay within some sort of common market arrangement linked to the E.U. The market likes this and the result is an increase in value by the GBP. If the British Government continues with its appeal against the Article 50 ruling and wins it, we can expect the Pound to fall again sharply.

Sentiment remains weak on “haven” currencies such as the Japanese Yen, Swiss Franc and precious metals.

Technical Analysis

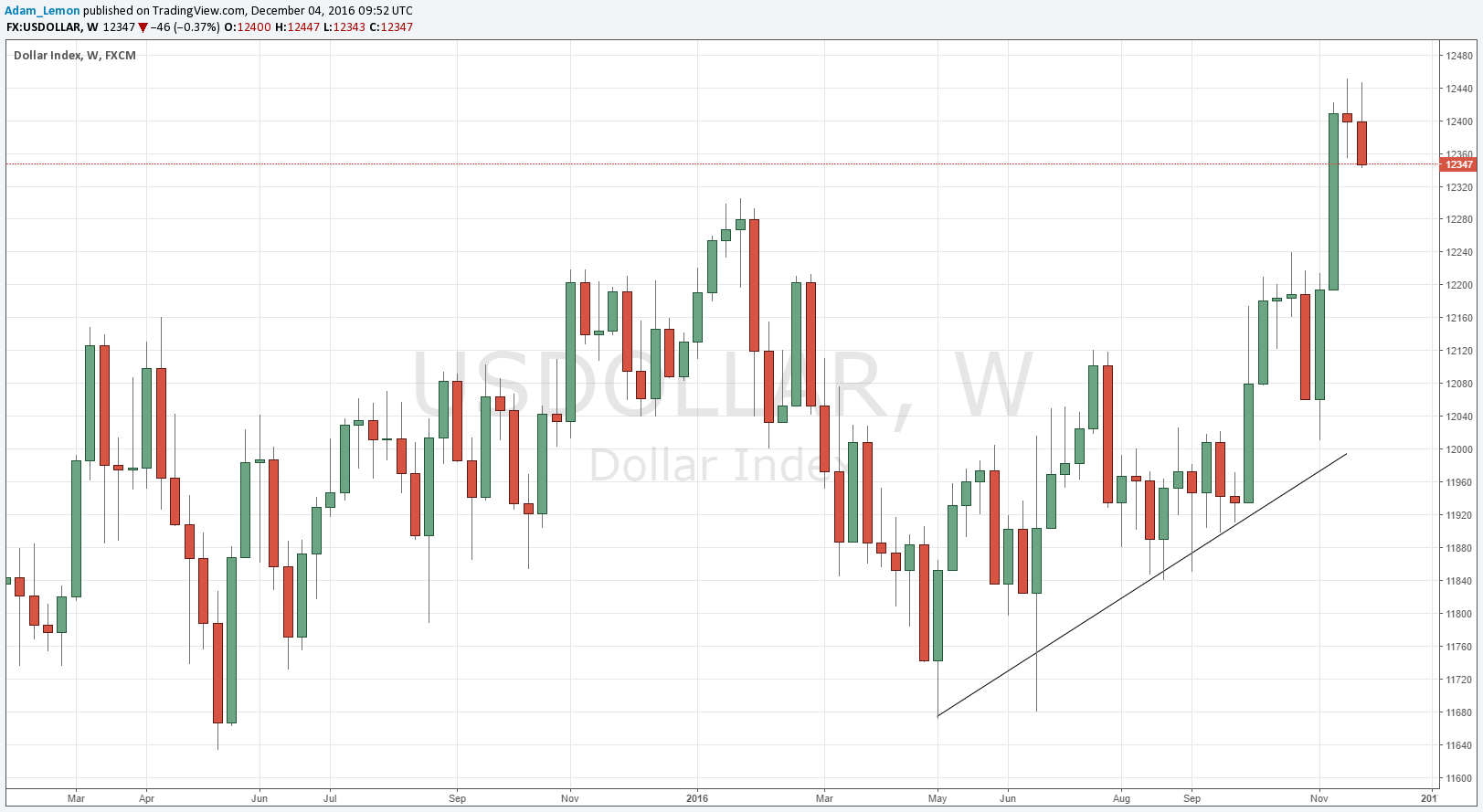

USDX

The U.S. Dollar failed to make a new high this week, and closed bearishly very near its range low, which is usually a bearish sign. This week’s candle also has a long upper wick and was close to forming as a bearish outside candle. This suggests that although the long-term trend remains bullish, the short-term momentum suggests some further downwards movement.

GBP/JPY

The strongest mover of the week of all the major pairs, rising by a total of a little more than 2% in value. This pair is now at the heart of the Forex market which is truly centered upon Yen weakness, taking over from U.S. Dollar dominance.

GBP/USD

This pair also had a fairly strong rise, especially towards the end of the week as the U.S. Dollar began to fall. It looks as if it has the momentum to reach the 1.2800 area so overall, a bullish outlook.

Conclusion

Bullish on the British Pound, bearish on the Japanese Yen and U.S. Dollar.