The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 11th December 2016

Last week, I predicted that the best trades for this week were likely to be long GBP against the Japanese Yen and the U.S. Dollar. The average result of these trades was a little negative at -0.43%. The best result was long GBP/JPY. The market turned, with the USD increasing in strength notably.

The Forex market seems to be moving into a more predictable mode now, with increased signs that the strong rally in the USD since 8th November is finding new legs.

I therefore suggest that the best trades this week are likely to be long USD against the Japanese Yen and the Swiss Franc, to spread the risk somewhat.

Fundamental Analysis & Market Sentiment

Fundamental factors are playing a role right now most notably on the USD, as crucial economic data releases continue to come in above the market’s expectations. Last Friday saw a high consumer sentiment level. The market is already expecting the FOMC to raise the base rate by 0.25% this week, but the fact it is now finally going to happen focuses the market more firmly upon a bullish USD. We are also getting a trending December flow.

There are not really any other fundamental or sentimental factors to pick out this week.

Technical Analysis

USDX

The U.S. Dollar printed a bullish engulfing candle within the scope of a wider bullish trend. Note however that the high is still below both the highs printed over the previous two weeks.

USD/JPY

Another strongly bullish week with a strongly bullish candle making a new high, within the context of continuing strong bullish momentum. Note that the price is at a 10-month high level.

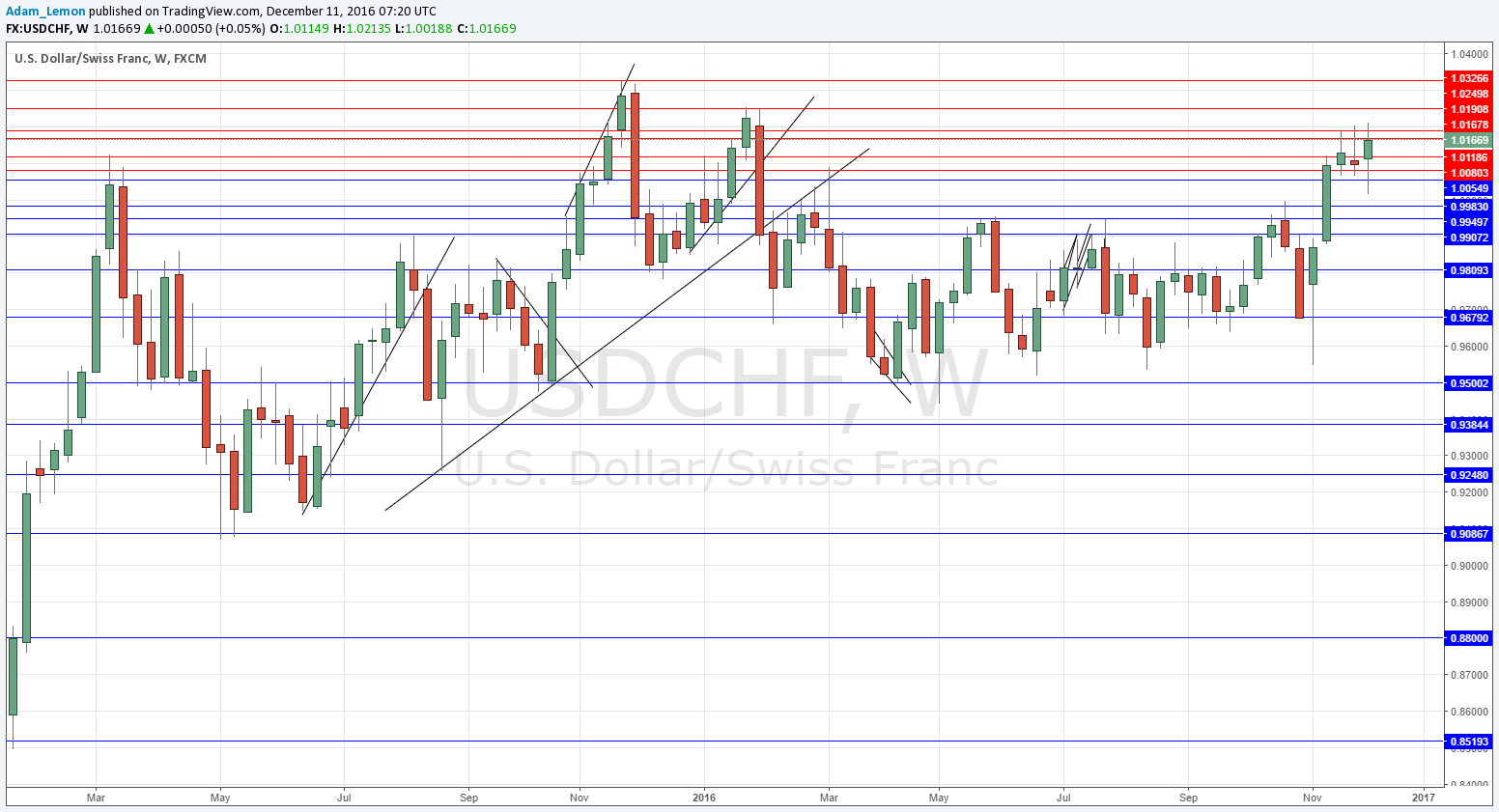

USD/CHF

This pair also made a new 10-month high, but the close was weaker, and there is a more strongly defined area of resistance ahead at about 1.0190. The close was also some way off the high.

Conclusion

Bullish on the U.S. Dollar, bearish on the Japanese Yen and Swiss Franc, especially on the Japanese Yen.