The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 26th December 2016

Last week, I predicted that the best trades for this week were likely to be long USD against the Japanese Yen and the Euro. Both these trades were small losers, averaging a small loss of -0.28%. The USD did increase in strength last week, in line with the long-term bull trend in the greenback, but only against the British Pound and the Australian and New Zealand Dollars.

The Forex market seems to be staying in a more predictable mode now, with increased signs that the strong rally in the USD since 8th November is well-established.

I therefore suggest that the best trades this week are likely to be long USD against the British Pound and the Australian Dollar, to spread the risk somewhat.

Fundamental Analysis & Market Sentiment

Fundamental factors are playing a role right now most notably on the USD. Two weeks ago, the FOMC raised the base rate by 0.25%, and the market was expecting that, but the surprise which made the market more bullish on the USD was the upward revision of projections for further tightening through more rate hikes during 2017 and beyond.

There are not really any other fundamental or sentimental factors to pick out this week. It is worth pointing out that volume is likely to be thin due to the holiday season in many major financial centers, most notably London.

Technical Analysis

USDX

The U.S. Dollar made another new 14 year high, printing a bullish candle within the scope of a wider bullish trend that is manifested over both the long and short terms. Bullish, bullish, bullish.

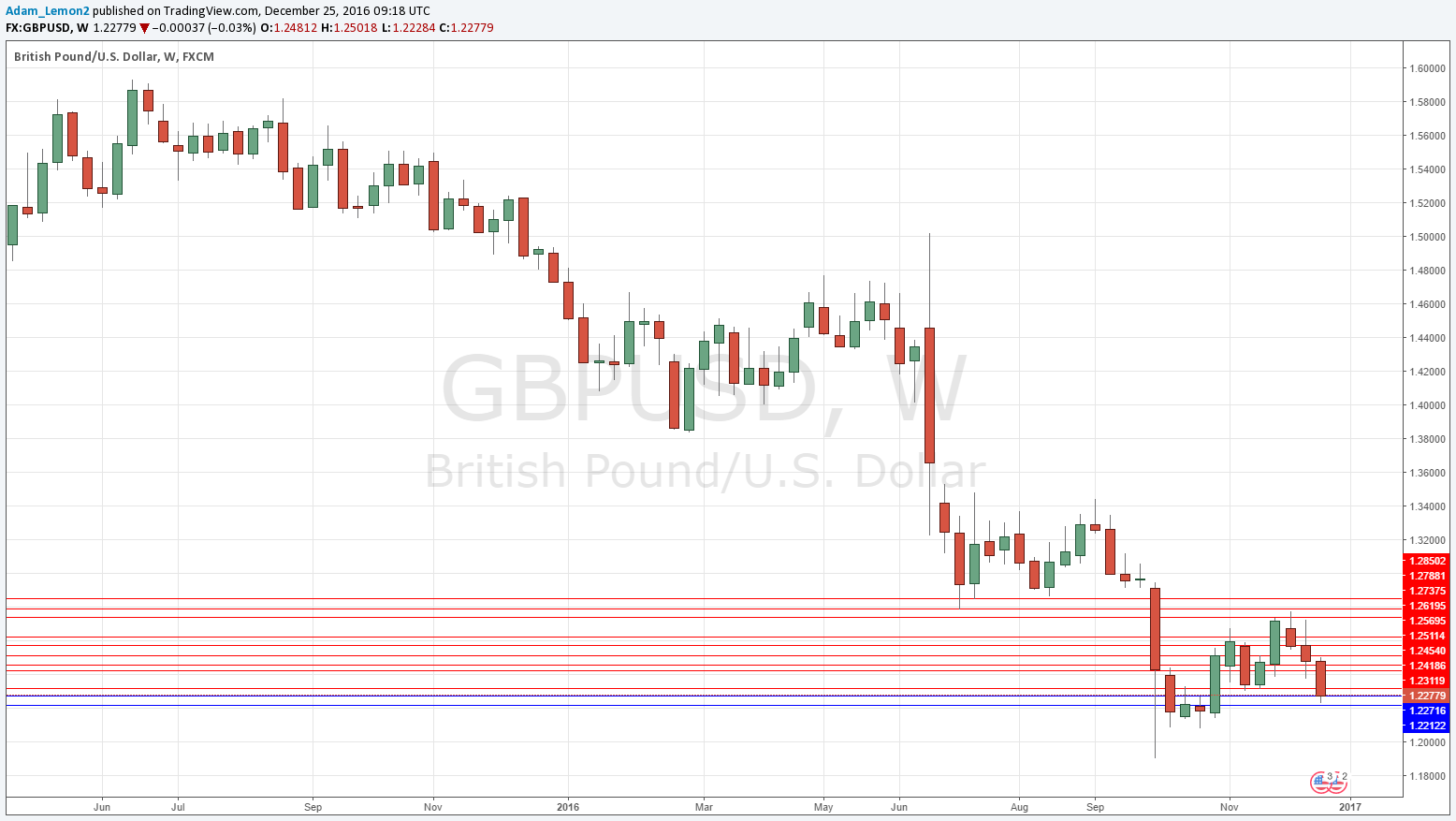

GBP/USD

A strongly bullish week with a strongly bullish candle. Note that the price is now approaching a historical multi-year low area with bearish momentum. A note of caution – there may be strong support at the low.

AUD/USD

A strongly bearish week with a very strongly bullish candle closing right on its low. Note that the price is now approaching a historical multi-month low area with bearish momentum. A note of caution – the 0.7150 area below was a major inflection and price-flipping point, so there might be strong support if and when it is tested again.

Conclusion

Bullish on the U.S. Dollar, bearish on the British Pound and Australian Dollar.