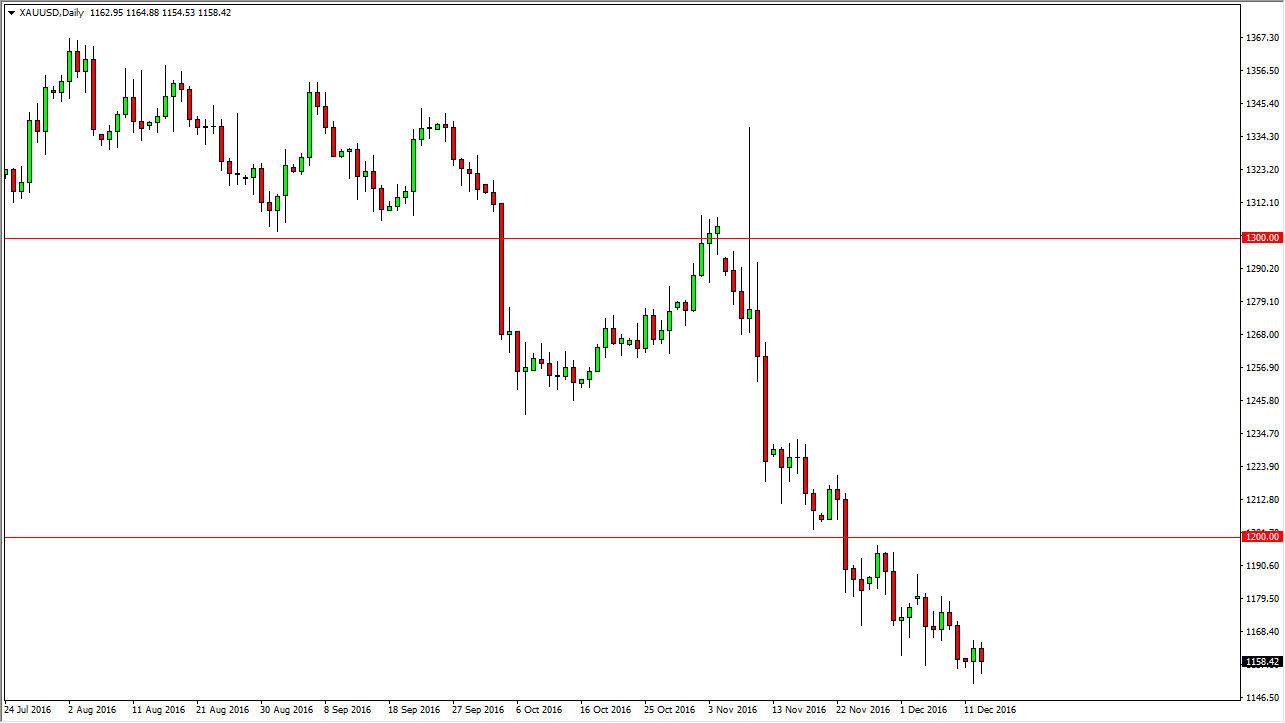

Gold markets had a slightly negative session on Tuesday, as we continue to bounce around the $1160 level. I believe that there is a significant amount of support, at least psychologically, at the $1150 level. It looks as if the market may try to bounce from here, but as you can see, every time we have rallied recently, the market has ended up selling off. I think that the $1200 level will continue to be resistive and essentially the “ceiling” in this market, so until we break above there I don’t have any interest in buying this market as the gold markets will continue to be influenced by the US dollar, and more importantly the interest-rate policy of the Federal Reserve. As the interest-rate in the United States goes higher, it takes less of those US dollars to buy gold.

Soft support

The $1150 level looks to be soft support, meaning that sooner or later I would anticipate that the sellers would get involved in break down below there. After all, there’s nothing on the longer-term charts to make me believe that we are going to bounce significantly, and as a result I think it’s only a matter of time by my estimation that we start selling again. Exhaustive candles are an opportunity to take advantage of “value” in the US dollar, and I think that the $1100 level is a little bit more interesting from a longer-term chart perspective, and most certainly the $1000 level is. Because of this, this is a market that continues to grind lower, although I am the first to admit that there will be bumps and bounces from time to time. Look at those as opportunities to go short in this marketplace.

It is not until we break above the $1200 level on a daily close that I would even remotely consider buying gold, and mainly under the premise that the Federal Reserve was not going to raise interest rates.