Gold prices fell $3.87 on Thursday as global equities strengthened and the dollar rallied. Major U.S. stock indexes set fresh record highs and the greenback was boosted by a fall in the euro after the European Central Bank extended its bond-buying program even as it cut the amount of purchases. With the ECB meeting out of the way attention has turned to next week's Federal Reserve meeting. Although the possibility of the Fed hiking interest rates by 25bps next week has been almost fully priced in, the prospect of further rate hikes continues to put pressure on the market.

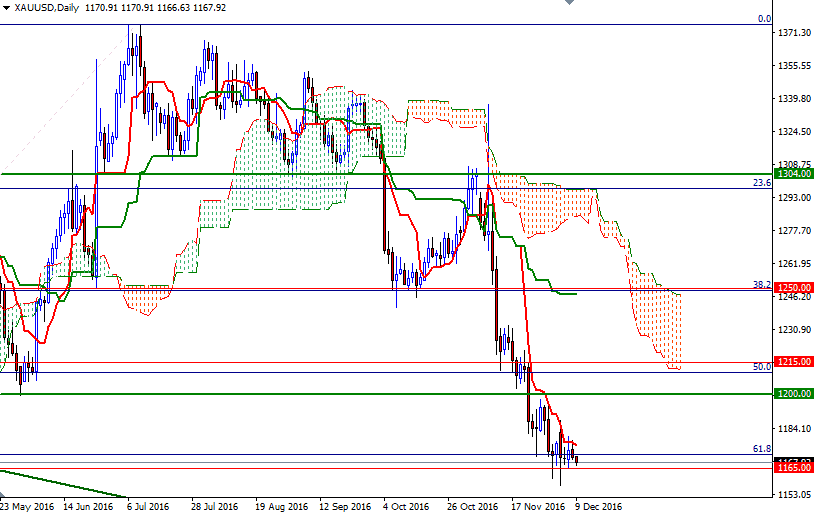

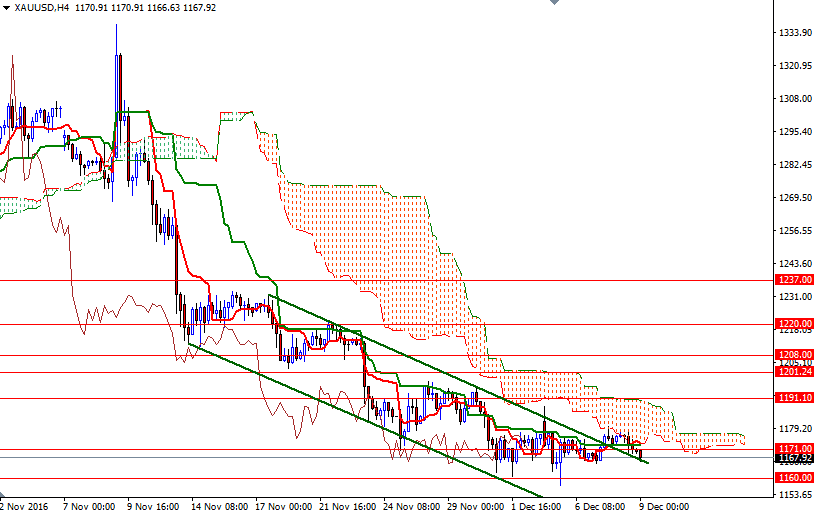

So far this week gold prices have been continuously held in check by the Ichimoku cloud on the 4-hour chart while buying interest in the 1165/0 zone put a floor in trading range. The XAU/USD pair is currently in the process of testing the support at the 1165 level. Dropping through 1165 would suggest that the bears are getting ready to challenge the 1160 level. A weekly close below 1160 could open up the risk of a move towards 1148/5.

On the other hand, if XAU/USD recover quickly and climbs back above 1173/1 area where the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) converge on the H4 chart, a push higher is possible. In that case, keep an eye on the 1180.20-1178 area as it holds the key to 1191/88. If the market can pass through, it is quite possible that prices will gain some traction and march towards 1197/5.