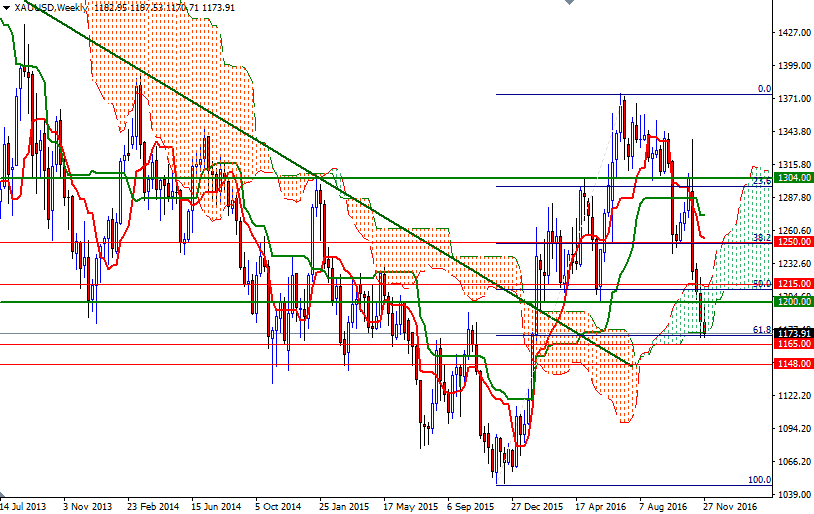

Gold prices settled at $1173.17 an ounce on Wednesday, suffering a loss of 8.14% over the month. The XAU/USD pair, which hit the highest level since September 27 following Donald Trump's surprise election, tumbled as investors unwound bullish bets. The precious metal lost roughly $165 an ounce from the post-election high on the back of the sharp rise in U.S. bond yields and burgeoning appetite for riskier assets. As a result, the monthly candle left a long upper shadow and ultimately ended the month just above a key support zone.

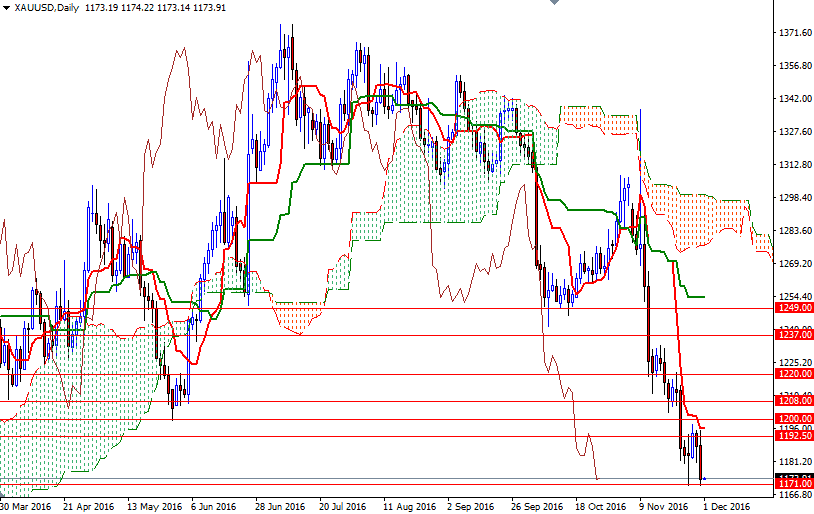

Investors see an increase in borrowing costs this month as a certainty, while the odds of an additional move by June rose to 65%. Traders will be eyeing fresh U.S. economic data closely, particularly the bellwether non-farm payrolls report tomorrow. The markets certainly maintain a positive view for the dollar but it also seems that the dollar's strong run over the past weeks has become a little stretched.

With that in mind, I will keep an eye on the strategic support in the 1165/0 region - but of course in order to reach there the bears have to drag prices below 1171/69 (the 61.8% retracement of the bullish run from 1046.33 to 1375.10) first. If this important support is broken, then look for further downside with 1154/3 and 1148/5 as targets. Once below that, the bears will be aiming for 1138/4. Breaking down below 1134 would pave the way for a test of 1123. In order to ease the bearish pressure, the bulls have to defend the aforementioned support and push prices all the way back above the 1200-1197 area where the top of the 4-hourly Ichimoku cloud sits. On its way up, there will be hurdles such as 1182/0 and 1192.50. Breaking through 1200 convincingly would be an encouraging sign and open a path to 1210/08. Beyond that the bears will be waiting for an ambush in the 1220/15 area.