Gold started the week on the back foot but managed to recover some of its earlier losses at the end of the day. The XAU/USD pair traded as low as $1157.16 after the Institute for Supply Management’s non-manufacturing PMI came in stronger than expected with a print of 57.2 however, found enough support in the vicinity and moved back up. The XAU/USD pair is currently trading at $1173.01, slightly higher than the opening price of $1170.12.

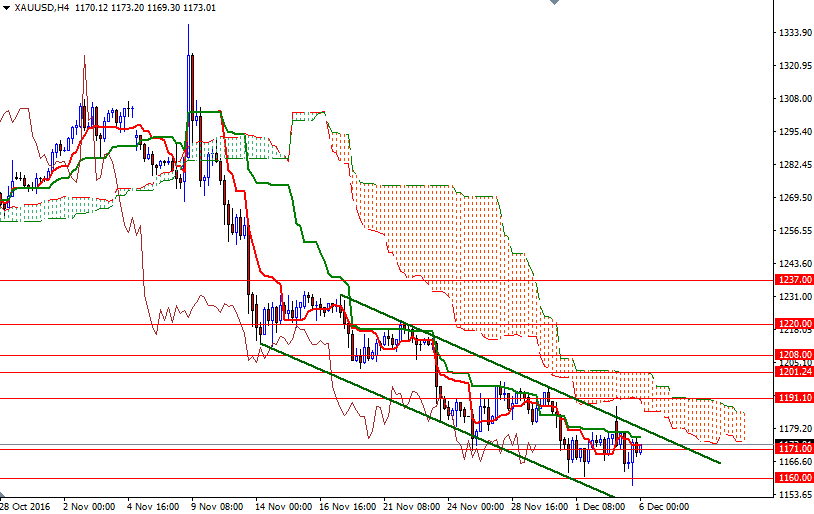

The medium-term outlook remains weak, with the market trading below the Ichimoku clouds on both the daily and 4-hourly charts. Federal Reserve policymakers seems confident that the economy is strengthening enough to warrant an interest rate hike but gold prices may have already factored in the December move. Yesterday’s candle which left a long lower shadow suggests that buying interest emerges around the 1160 level. In other words, there won’t be much room to the downside unless we convincingly break down below the 1165/0 zone.

If XAU/USD makes a sustained break below 1160, then look for further downside with 1154/3 and 1148/5 as targets. To the upside, the initial resistance sit at the 1177.50 level where the daily Tenkan-Sen (nine-period moving average, red line) and the upper line of the descending channel coincide. The bulls will have to pass through 1177.50, so that they can approach the Ichimoku cloud on the H4 chart. If the market passes through 1191.10, then the 1202/0 zone could be tested afterwards.