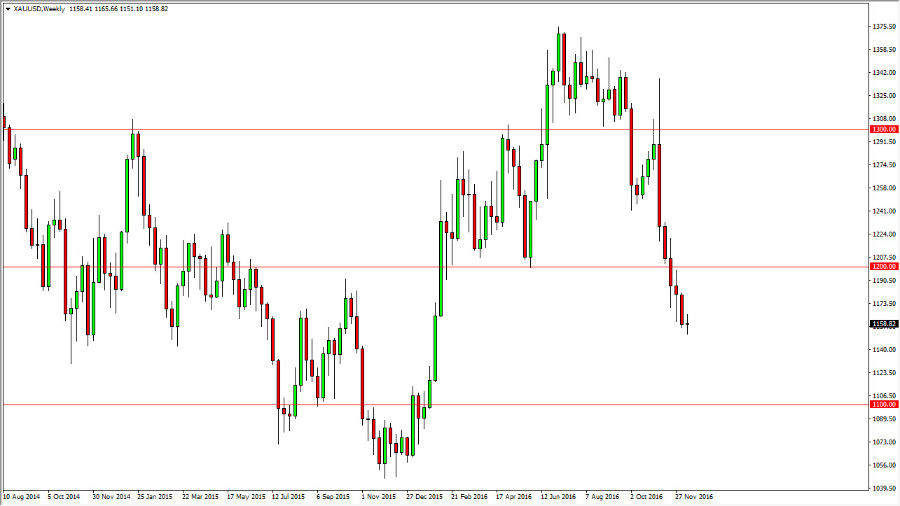

Gold markets have been extraordinarily bearish over the last several months, and with that being the case I don’t have an interest in buying this market. Quite frankly, I think that we will get a little bit of a bounce soon, but that should end up being a nice selling opportunity. I recognize of the $1200 level which had been so supportive in the past should know be the ceiling in this market. I think that anytime we go higher and reach towards that level, the sellers will jump in and punish gold. Keep in mind that the Federal Reserve is likely to raise interest rates, and that of course is negative for gold. This will be especially true if they signal that there are going to be several interest-rate hikes, which is a real possibility.

$1100

I think that we will reach down towards the $1100 level by the end of the quarter, but we may have a bounce first in order to pick up more sellers. After all, the market can go in a straight line to any one direction, and we have slowed down rather drastically after the initial shock of the election of Donald Trump. Speaking of Donald Trump, he is very vocal about how the Federal Reserve needs to be raising interest rates, and although the Federal Reserve is supposed to be a nonpolitical entity, the reality is that it feels pressure as well. Quite frankly, the zero interest rate policy has gone too long anyway, so really interesting to see whether or not they will continue to raise interest rates. I suspect they will have to, as they have failed to act far too many times in the past. That’s not to say that it’s the right decision, just simply that they will have to.

I think it will be volatile going forward, but every time we rally I start selling as I believe that $1100 is very interesting for most traders, and will be our target.