Gold ended the week down $23.01 at $1159.20 an ounce, under pressure from higher risk appetite and the prospect of higher interest rates. Expectations that further interest rate hikes are to come next year continues to support the U.S. dollar and a broad rally in equities reduced the demand for safe-haven assets. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 136380 contracts, from 151570 a week earlier.

The main event this week will be the Federal Reserve policy meeting, kicking off Tuesday. Traders see an increase in borrowing costs as a certainty, so therefore the focus is now on whether the U.S. central bank will hint of further monetary tightening in 2017. Unlike last year, the Fed may sound slightly more cautious. The Fed originally said it would raise rates four times this year but has instead left rates untouched in a range between 0.25% and 0.5%.

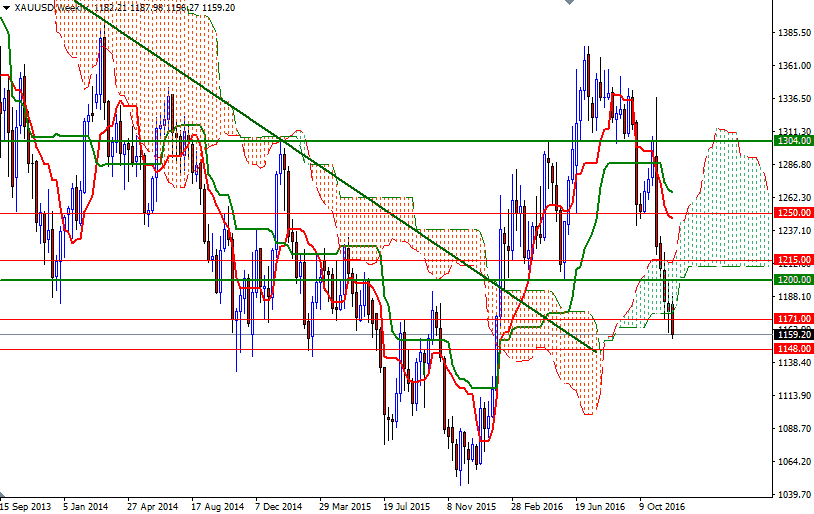

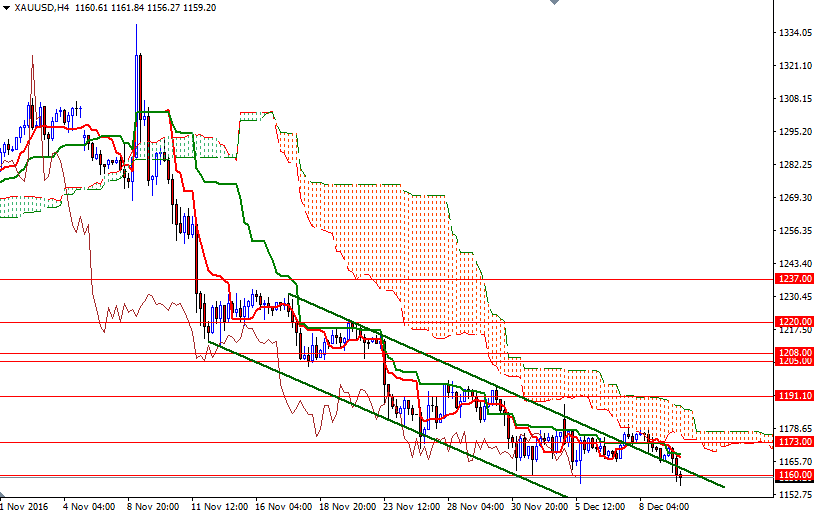

Trading below the weekly, daily and 4-hourly Ichimoku clouds indicates that the downside risks remain. We also have bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses almost on all time frames. If the XAU/USD pair can't recover quickly and climb back above 1165/0, the market will have a tendency to visit the 1148/5 region which stand out as an obvious key support. But of course, in order to reach there, the bears have to drag prices below 1154/3. It is quite possible that XAU/USD will continue its bearish tendencies if the 1148/5 support gives way. In that case, 1138/4 and 1123 will be the next possible targets. To the upside there will be hurdles such as 1173/1 and 1182/79. Closing beyond 1182 could lead to short-covering and consequently we could see a test of the 1191/88 zone. Penetrating this barrier cloud could prolong the bullish momentum and open a path to 1197/5. Once above that, we could see a push up towards 1208/5.