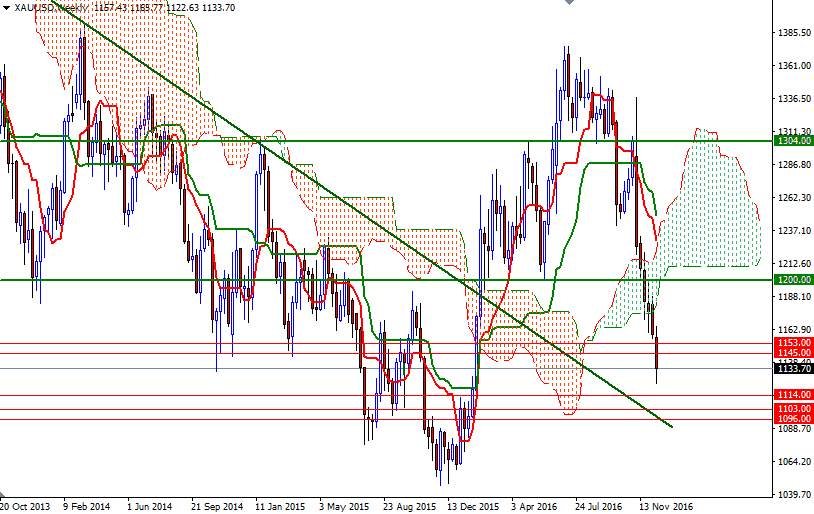

Gold ended the week down by 2% at $1133.70 an ounce, recoding a sixth consecutive weekly loss, as the U.S. dollar's strength against other currencies weighed on the market. The dollar strengthened sharply after the U.S. Federal Reserve announced its first interest rate increase in 2016 and hinted at a faster pace of increases than was previously expected. The decision was widely expected but investors were surprised to see the Fed projects three more increases for 2017, up from the two increases that officials had projected at their September meeting.

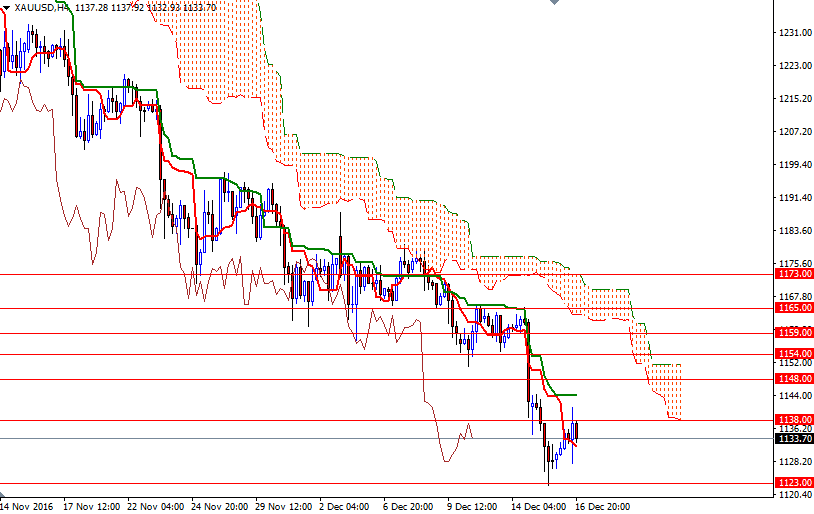

The wider environment remains relatively unfriendly for gold, with the Fed boosting its forecast and investors maintaining a positive view on stocks. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 129311 contracts, from 136380 a week earlier. Last week I had pointed out that it was quite possible that XAU/USD will continue its bearish tendencies and eventually test 1138/4 and 1123 once the market broke below the 1148/5 support. Since prices already hit that low and managed to hold above 1123, I think it will play an important role this week. So far there is no sign to indicate that we have reached the bottom. However, the market has been in free fall since mid-November and the end of the year is approaching. Therefore, the pace and intensity of the selling pressure are likely to decrease. I don't expect to move too far outside of the 1165-1103 range over the next couple of weeks.

There is likely to be a minor resistance at around 1138, followed by a tougher one in the 1148/5 zone. If this resistance is broken, the market will aim for 1154/3. The XAU/USD pair has to push its way through 1160/59 in order to revisit the 1167/5 area, which is the first significant barrier ahead. On the other hand, a successful drop below 1123 would suggest that the bulls will have to wait a little longer as the bears march towards 1114/1. If the fall doesn't halt in that region, it is likely that XAU/USD will test 1103 next.