NZD/USD Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at 0.7110.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7072.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

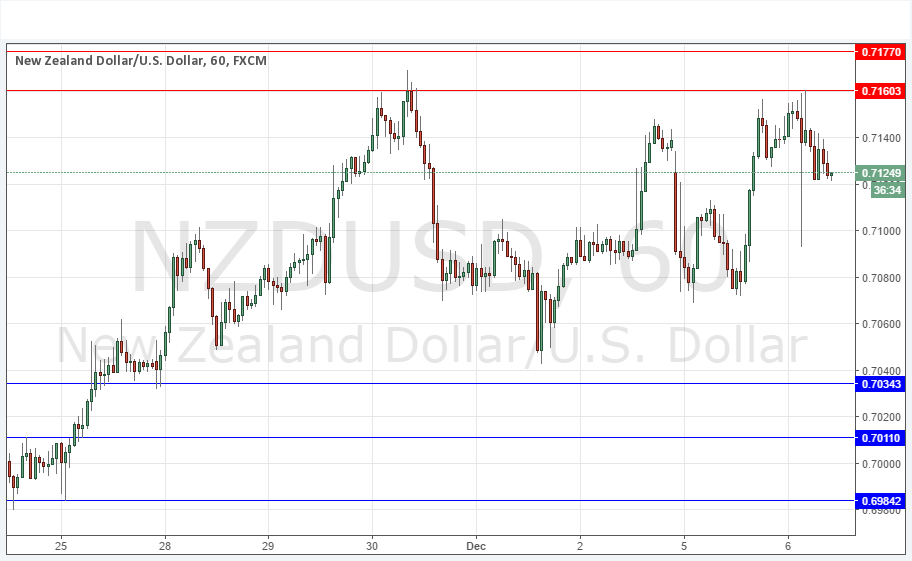

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7160.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

This pair broke the resistance at 0.7110 but reversed clearly after making a long-term double top at the 0.7160 price level. Below, there is a bullish Quasimodo making a supportive floor at the 0.7072 level. Within this area, we are probably now going to see a consolidation pattern, and it is difficult to predict much more than that.

There is nothing due today regarding the USD. Concerning the NZD, there will be a release of GDT Price Index data, followed by testimony from the Governor of the RBNZ before Parliament at 10pm London time.