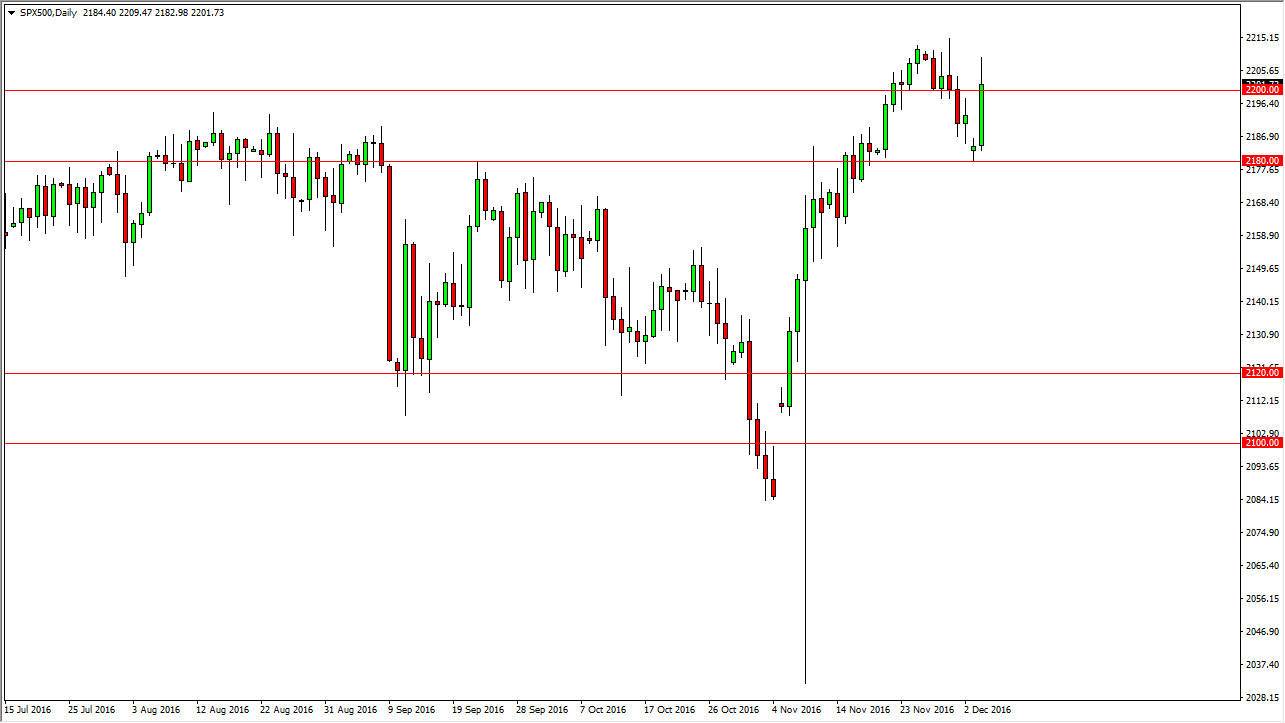

S&P 500

The S&P 500 gapped lower at the open on Monday, but then found enough support at the 2180 handle to turn things around and form a massive green candle. Because of this, we broke above the 2200 level, which in the past has been somewhat important. I believe that were going to continue to go much higher, perhaps breaking above the most recent high. If we do, I feel at that point we will then start reaching towards the 2250 level above. Ultimately, I believe that this market should continue to go to the 2500 handle. I also believe that the 2180 level should continue to offer quite a bit of support, and is essentially the short-term “floor” in this market.

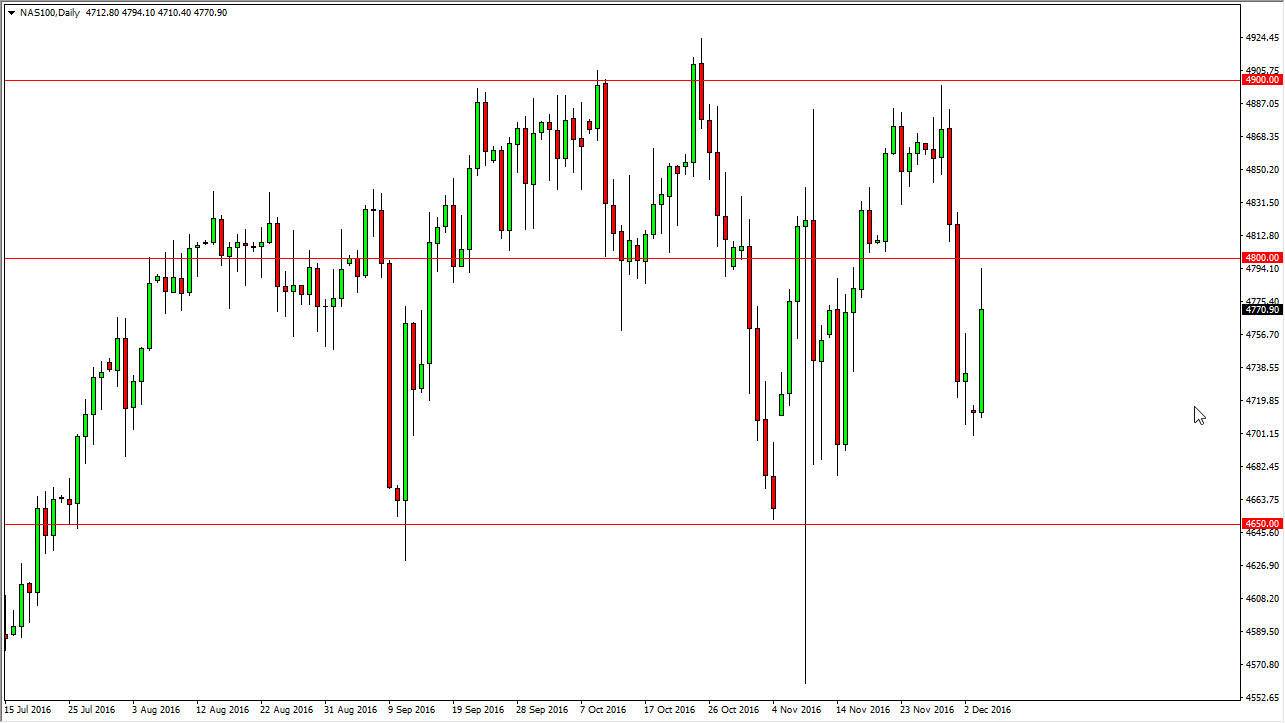

NASDAQ 100

The NASDAQ 100 gapped lower at the open as well, and found quite a bit of support at the 4700 level below to turn things around and slammed into the 4800 level. The NASDAQ 100 has been a bit of a laggard when it comes to the United States indices, so I think it has quite a bit of catching up to do. If we can break above the 4800 level, I think that we will then reach towards the 4900 level. A break above there sends us to the longer-term target that I’ve had for some time: 5000.

I think a pullback here will continue to find buyers, all the way down to the 4700 level. I believe that the market will continue to see buying pressure again and again, and with that I believe that you have to look to short-term pullbacks as potential buying opportunities in an index that has been lagging its compatriots. However, all 3 major indices in the United States tend to move in the same direction, so I don’t see any reason why the NASDAQ 100 won’t follow the S&P 500 and the Dow Jones 30.