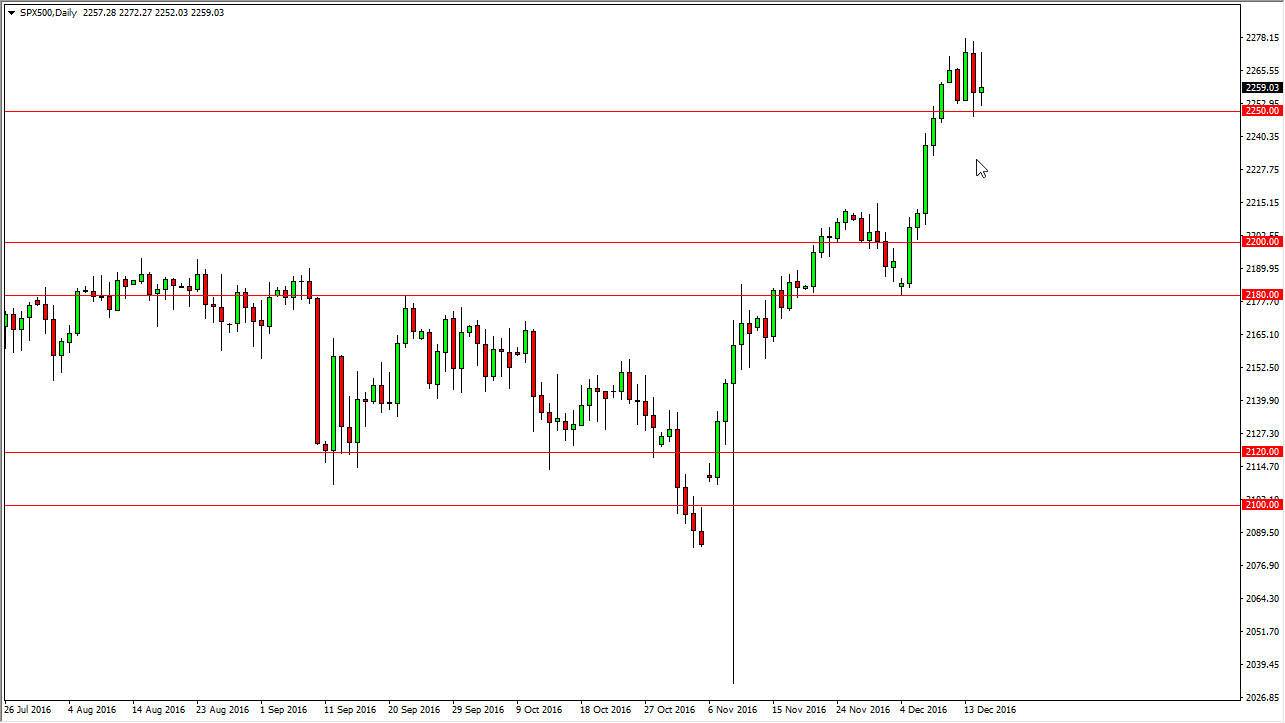

S&P 500

The S&P 500 found a bit of volatility during the session on Thursday, as we continue to hover above the 2250 handle. I think this area will act as a bit of a floor going forward, and although the candle looks a bit negative, even if we broke down below this level I would not be interested in selling. I think that the market has plenty of support below, extending all the way down to at least the 2200 level. Because of this, I am simply waiting for an impulsive positive candle, or some type of supportive candle after a pullback in order to take advantage of value. I believe the S&P 500 still has quite a way to go to the upside.

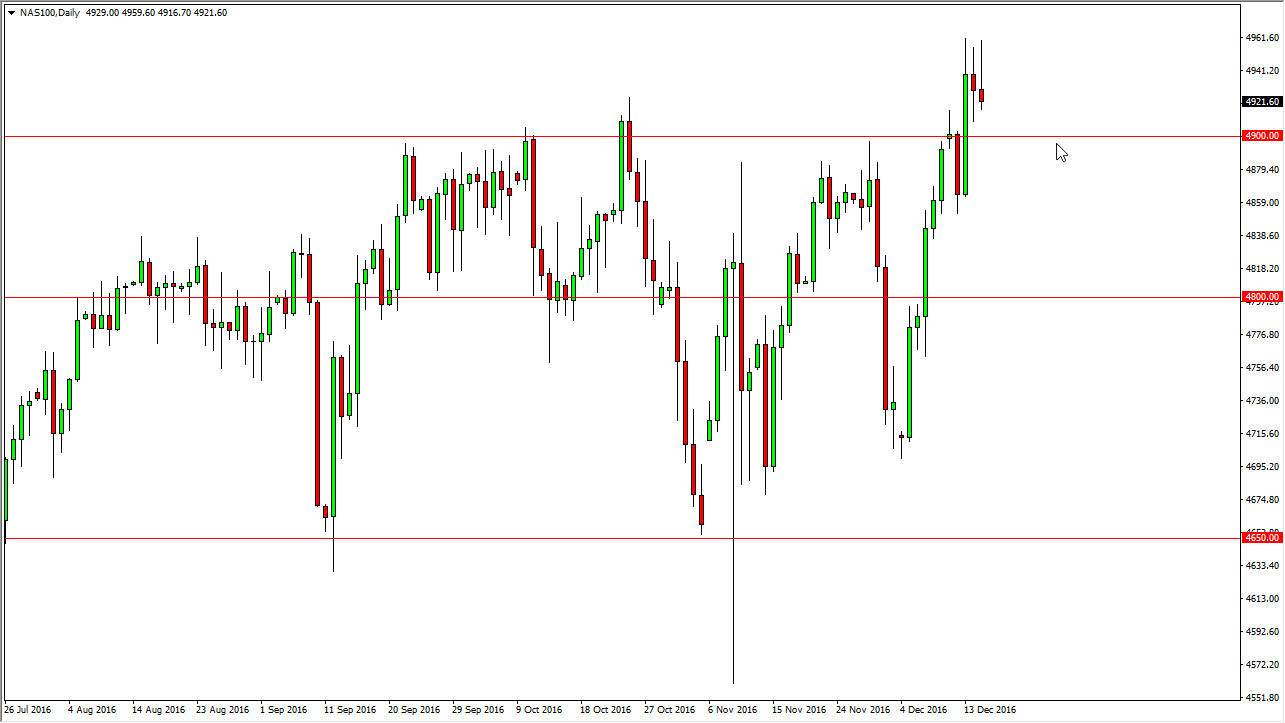

NASDAQ 100

The NASDAQ 100 initially rallied on Thursday but turned around to form a bit of a shooting star. However, I see quite a bit of support just below at the previously resistive 4900 level. I think if we can find a supportive candle in this area it’s time to start taking advantage of what should be market participants trying to get involved in a market that they missed the breakout on. I believe that we will reach towards the 5000 level given enough time, and perhaps even higher than that. However, on the first to admit that the 5000 level will be significant from a psychological standpoint, and that means that the market will probably have to build up quite a bit of momentum to finally break out. I think that the writing is on the wall so to speak, and with that there’s no way to sell this market. It would take some type of serious break down and change of attitude overall in order to see this market start falling with any significance. Because of this, this is one of my favorite markets to be involved in and I will continue to buy.