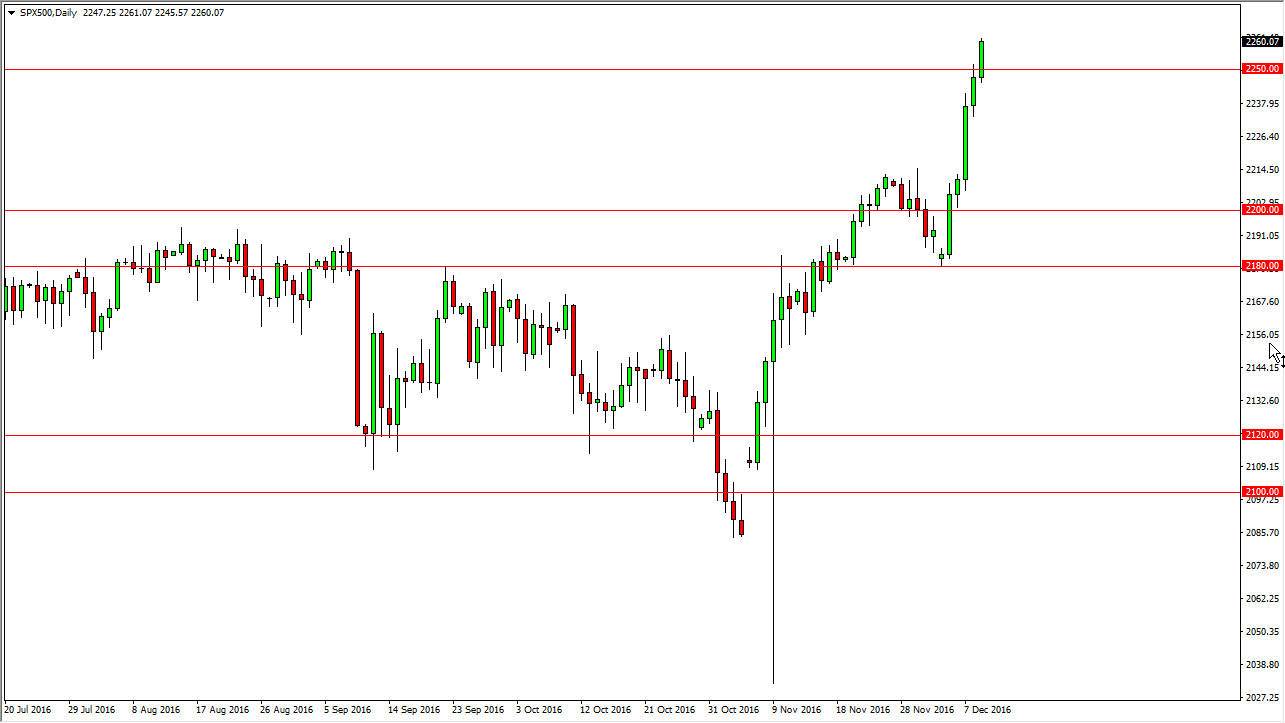

S&P 500

The S&P 500 broke out to the upside during the day on Friday, clearing the 2250 handle. It looks as if the S&P 500 will continue to be bullish, and as a result I like the idea of buying pullbacks again and again. After all, the US indices are stronger than any of the other ones around the world that I follow, so I have no argument for shorting this market. I think that the 2200 level below continues to be a bit of a “floor”, and to be honest with you I would be very surprised if we not only found buyers there but at levels even higher. The market is a bit overextended at the moment, so I’m hoping to get that pullback rather shortly so I can continue to take advantage of what has been a very bullish market.

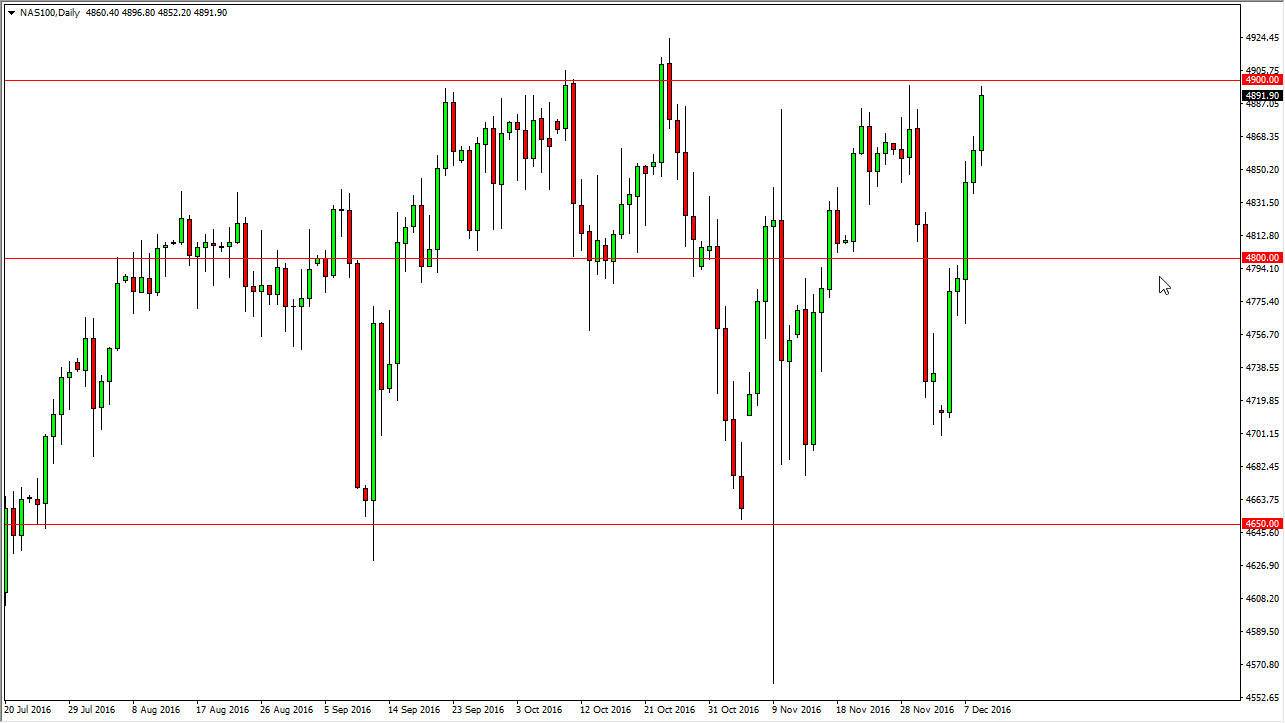

NASDAQ 100

The NASDAQ 100 rallied on Friday, testing the 4900 level above. That’s an area that should continue to be resistive, but if we can get above there I think that the market will continue to reach towards the 5000 handle. That is an area that has been on my radar for some time, and thus I feel that sooner or later that we will find yourselves testing that area. I think a pullback at this point will be a nice buying opportunity going forward as it represents value. I believe that the 4800 level should be basically the “floor” in this market going forward. I have no interest in shorting the NASDAQ 100 as the US indices all look very healthy and of course the US economy is probably the best one that I follow.

I recognize that we are bit overextended in the short-term, but that simply should lead to a little bit of exhaustion that we can take advantage of. I have no interest in shorting because I recognize how bullishness move is been, and that stock markets around the world continue to break out. Speaking of which, the NASDAQ 100 has been a bit of a laggard as of late, so I think it’s got some catching up to do.