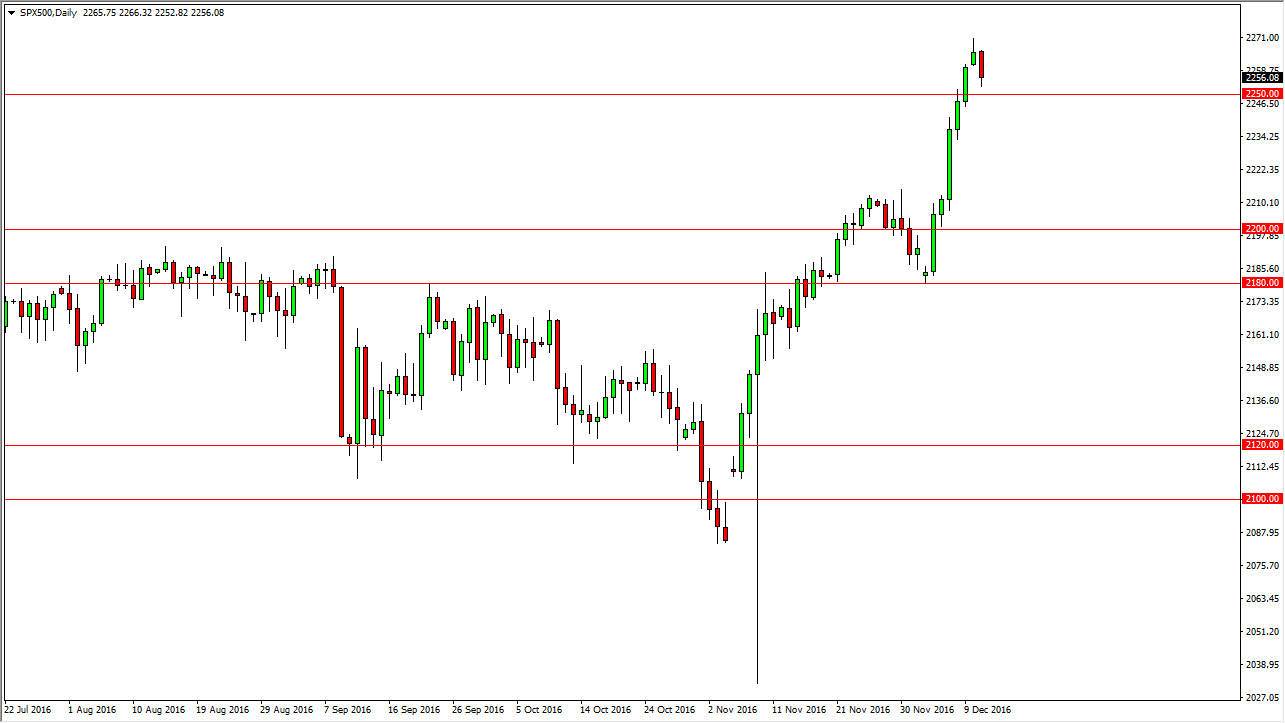

S&P 500

The S&P 500 fell slightly during the day on Monday, as we continue to see an overall bullish trend. I believe that the market needs to pull back and reach to lower levels to find buyers. Supportive candles will be reasons to go long as far as I’m concerned, and I have zero interest whatsoever in trying to short this market. I believe that the 2200 level is essentially the “floor” in this market, but quite frankly I don’t even think will reach that low. The market should continue to go higher, perhaps reaching towards 2500 over the longer term timeframe, but in the meantime I think pullbacks do nothing but offer value that you can take advantage of going forward.

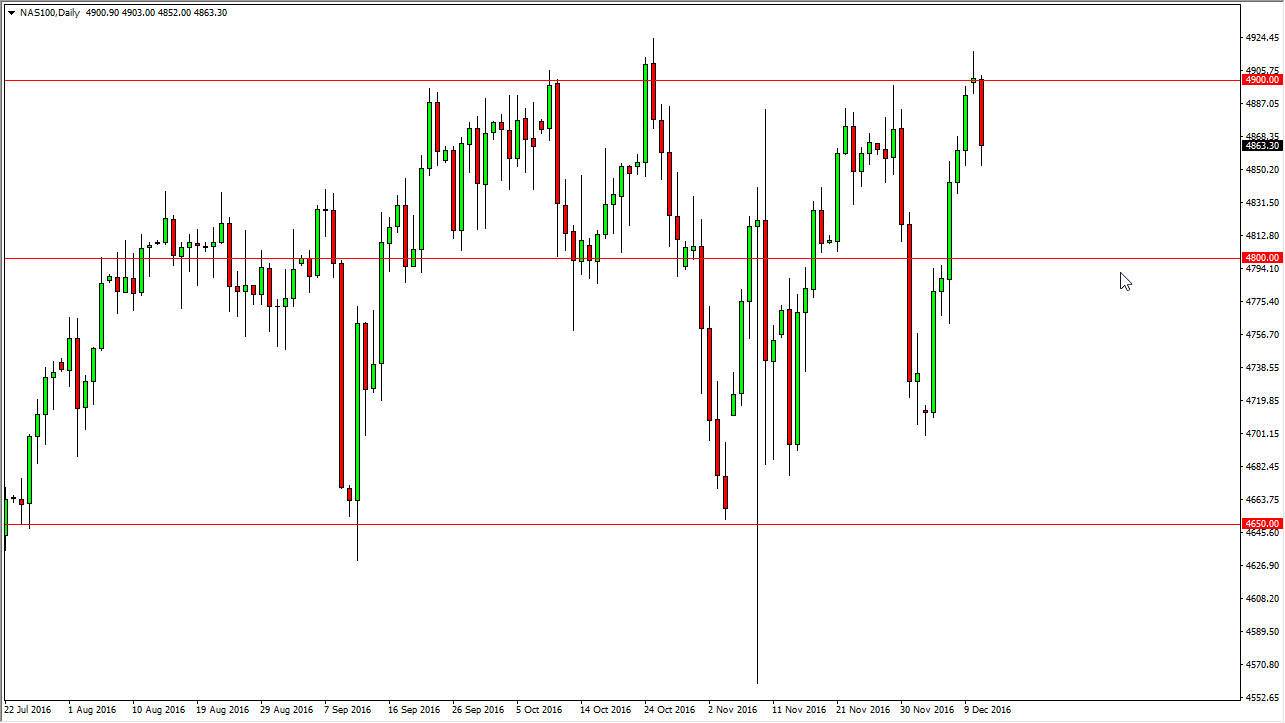

NASDAQ 100

The NASDAQ 100 fell after initially trying to break above the 4900 level. We did manage to do it for a very short amount of time at the open on Monday, but you can see that we fell rather significantly. I think that the market has gotten a little bit ahead of itself at this point, so I’m waiting to see a supportive candle or a bounce or something like that so that I can continue to go long of this market. I believe that the 4800 level below is support, and therefore it’s essentially the “floor” in this market.

If we can break above the highs that we formed on Monday, then I believe that the market will probably aim for my longer-term target: 5000. Ultimately, this is a market that I think that will continue to see bullish pressure and I have absolutely no interest in shorting as US indices in general look very positive. In fact, the US indices are obviously the strongest in the world, and because of this I have no interest whatsoever in selling.