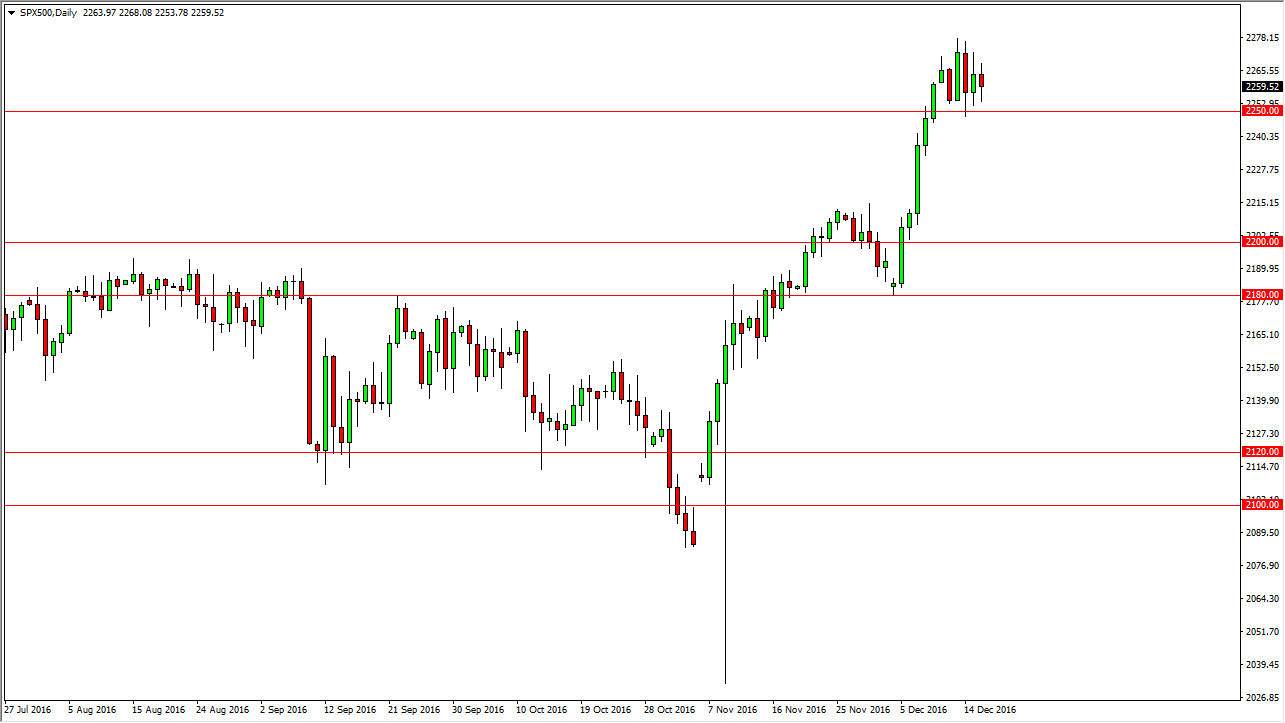

S&P 500

The S&P 500 did very little on Friday as we continue to bang around just above the 2250 handle. This is an area that’s massively supportive, and as a result I do think that we will eventually bounce. Even if we do break down from here, there is more than enough support below at the 2200 level. A supportive candle after a pullback I believe is more than enough reason to go long. This is a market that should continue to find buyers of a longer-term due to the strength of the US economy, and as a result I have no interest in selling. I have a target of 2500 longer-term, but obviously that will take some time. This week will be very quiet more than likely, due to the fact that Christmas is Sunday.

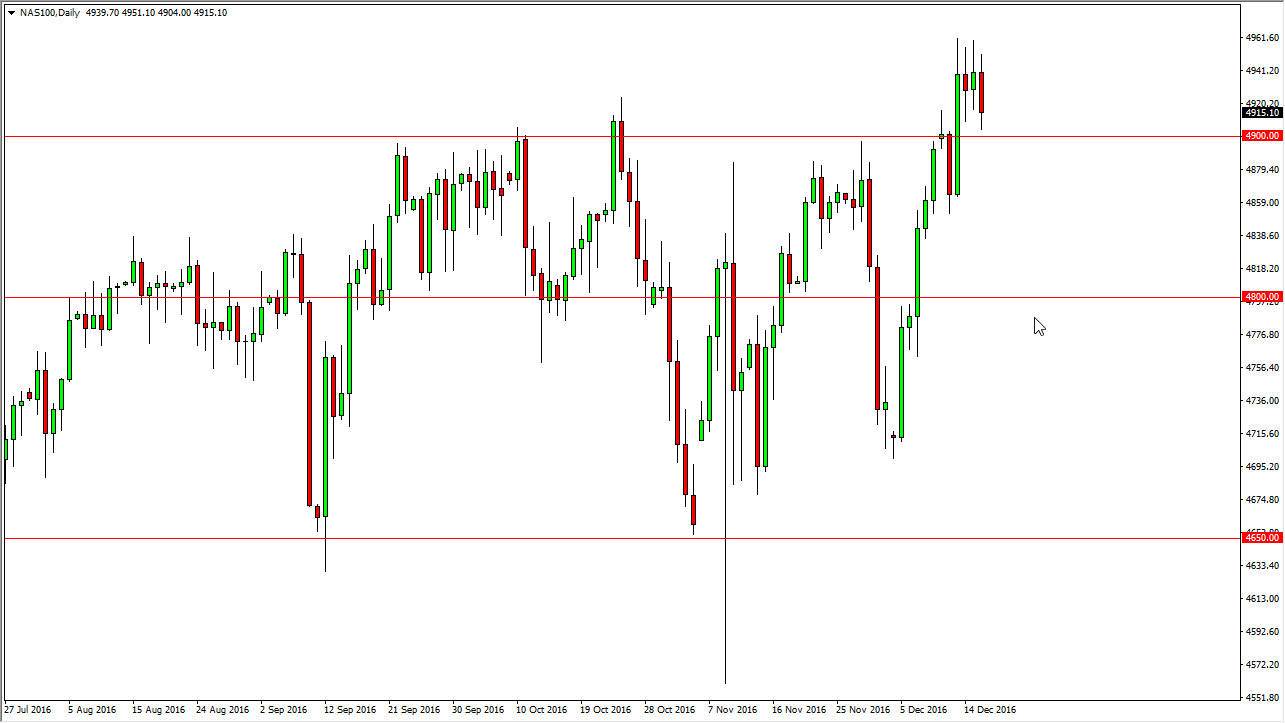

NASDAQ 100

The NASDAQ 100 fell during Friday, testing the 4900 level. This is an area that was previously resistive, so it should now be supportive and that’s exactly what has happened. Any type of supportive action or candle in this area is reason enough to go long as far as I can see, and I believe that we will eventually break to the upside, perhaps reaching towards the 5000 level which is my longer-term target. I recognize that the area will cause quite a bit of resistance to the large, round, psychologically significant aspect of 5000, so that worked just simply trying to build up enough momentum to continue going higher.

Even if we do break down below the 4900 level, I think the market will then find plenty of buyers at the 4850 handle, an area that has already shown itself to be supportive. I think that this market cannot be sold, and as a result it’s a “buy only” type of situation and every time we pullback is going to be thought of as value.