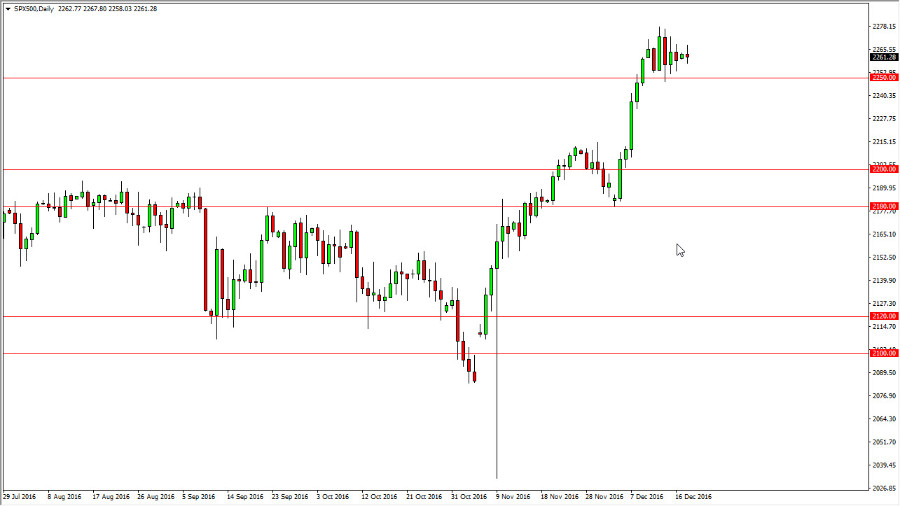

S&P 500

The S&P 500 went back and forth on Monday, as the market did almost nothing. That’s not a huge surprise to me though, because quite frankly we are approaching Christmas, which means that there is a serious lack of liquidity. At this point, I would anticipate that the market bounces around just above the 2250 handle. I believe that we could continue to go higher over the longer term, but at this time of the year it’s difficult to imagine that anybody wants to put major money into the marketplace so that we can take advantage of either direction. I do believe that given enough time we go higher, so I’m looking for buying opportunities or perhaps a short-term buying opportunities this week that will simply be a handful of points.

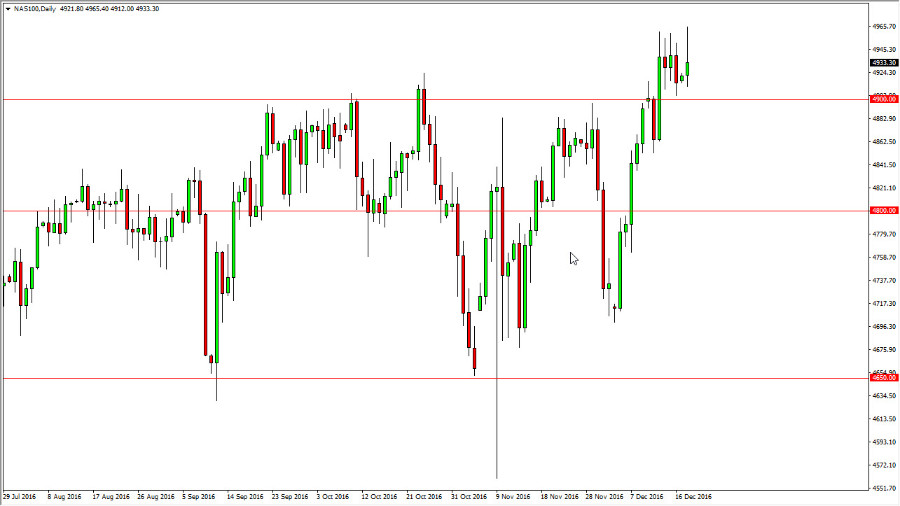

NASDAQ 100

The NASDAQ 100 initially tried to rally on Monday, but turned back around to form a shooting star. The shooting star is a negative sign, which of course could turn the market back around but I see a significant amount of support at the 4900 level, and I believe that it’s very unlikely that we break down below there. Even if we did, the market has quite a bit of support all the way down to 4800 or so. Alternately, if we can break above the top of the shooting star the market should then go to the 5000 handle. With this, the market should continue to go much higher, and I do believe the next year will see quite a bit of bullish pressure in this market. I believe the pullbacks continue to offer buying opportunities, and with this being the case it’s likely that the buyers will continue to approach this market as one that offers value on pullbacks. However, I don’t believe that we will see an explosive move in the next few sessions.