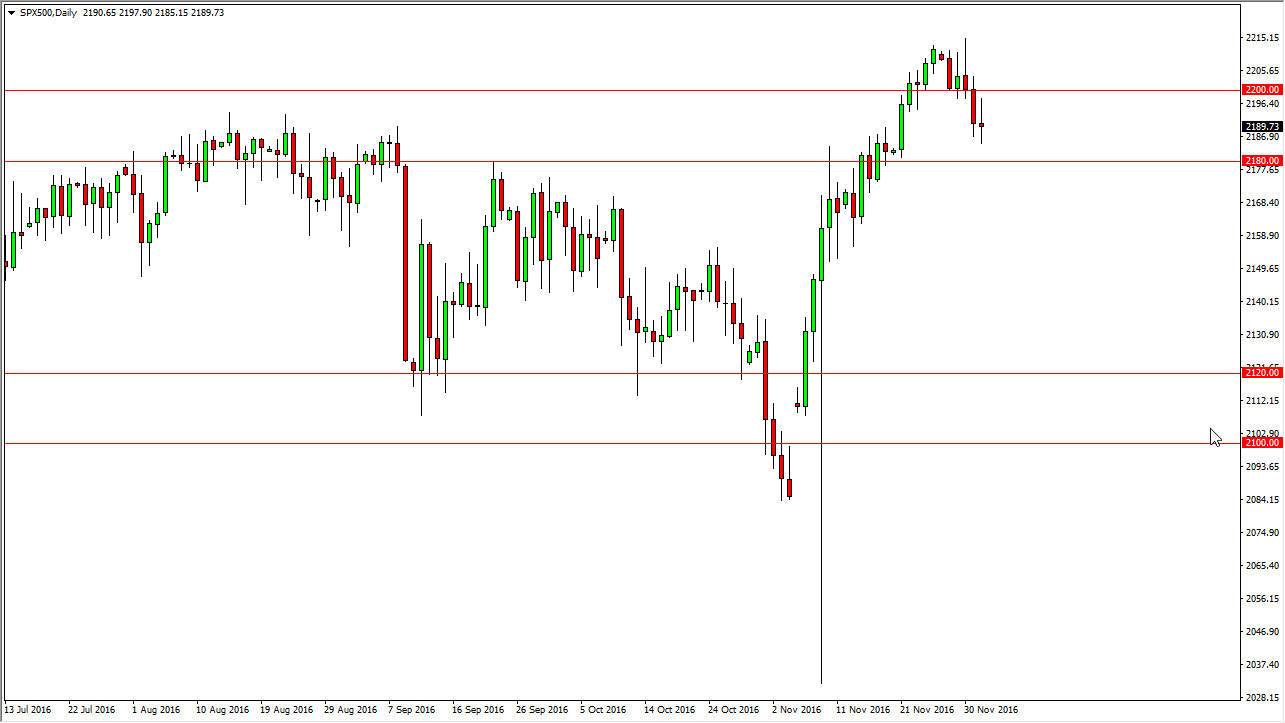

S&P 500

The S&P 500 had a back-and-forth type of session on Friday as the market digested the jobs numbers. With an addition of 178,000 jobs during the month of November, the announcement was essentially right in line. It makes sense that we formed a neutral candle, as there wasn’t really much to take from it. We are in the support area, so you would expect to see buyers get involved. I believe that the 2180 level will continue to offer support, so I am bullish of this market but I recognize we could chop around for a few. Given enough time, I believe that we eventually reach out to a fresh, new high. With this in mind, I have no interest in selling and even if we did break down below the 2180 handle, there is a lot of noise just below that could continue to aid the buyers.

NASDAQ 100

The NASDAQ 100 and a choppy session as well, essentially ending up all but unchanged. I think if we can break the top of the candle, then the market will rebound and reach towards the 4800 level. A break down below the bottom of this candle will more than likely be a retest of the 4700 level, and then possibly even the 4650 level. This is a bit of a laggard when it comes to the US indices at the moment, so I’m not really holding my breath for a massive bullish move. Because of this, I’m actually on the sidelines when it comes to the NASDAQ 100 at the moment, as I believe that the S&P 500 and the Dow Jones 30 will both continue to outperform this index due to its reliance on foreign sales. Nonetheless, I have zero interest whatsoever in selling this market.