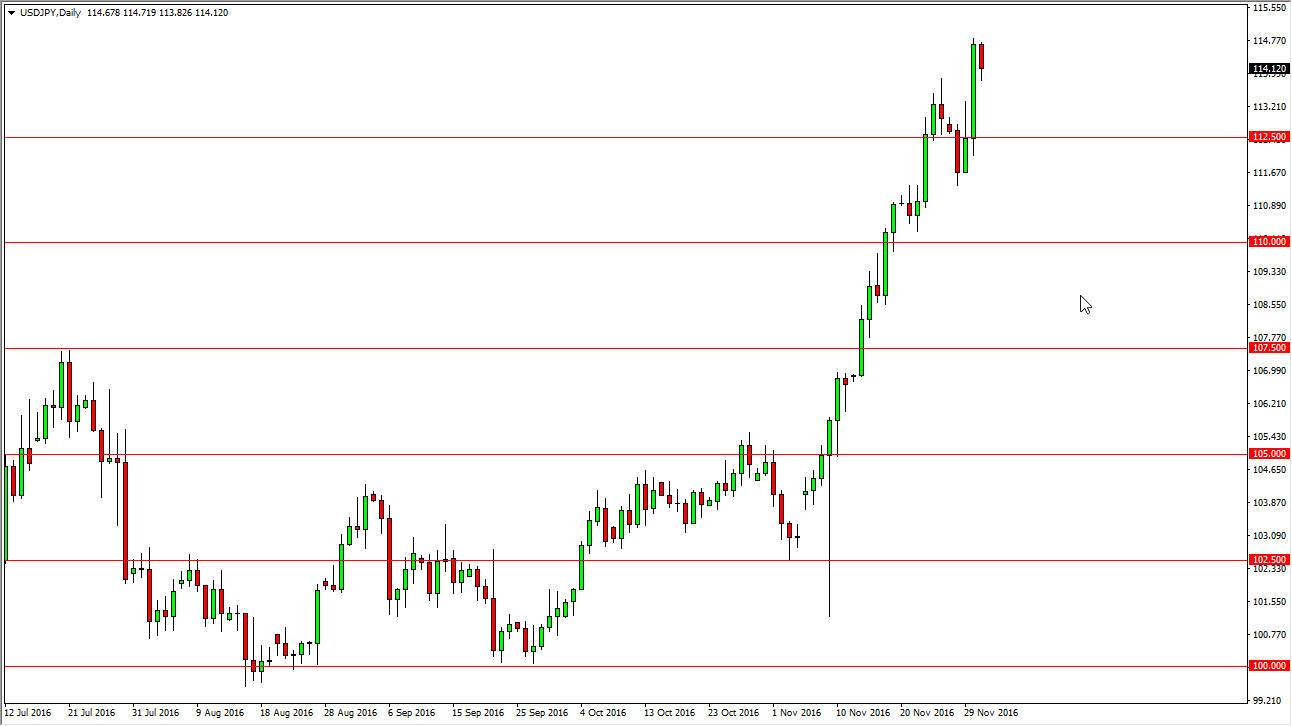

USD/JPY

The US dollar fell a bit against the Japanese yen during the day on Thursday, as traders are starting to take profits on a massive move higher. Of particular interest is the fact that the nonfarm payroll numbers come out today, and they have a massive effect on this pair. I would love to see a pullback to the 104.50 level, or even better yet, a pullback to the 110 level in order to pick up “value” in the greenback. The 115 level offered resistance during the day as you would expect, and at this point I feel that we are overbought. I need to see some type of value into the market so I can put money to work. Until then, I have no interest whatsoever in being involved. I certainly wouldn’t sell this market under any circumstances.

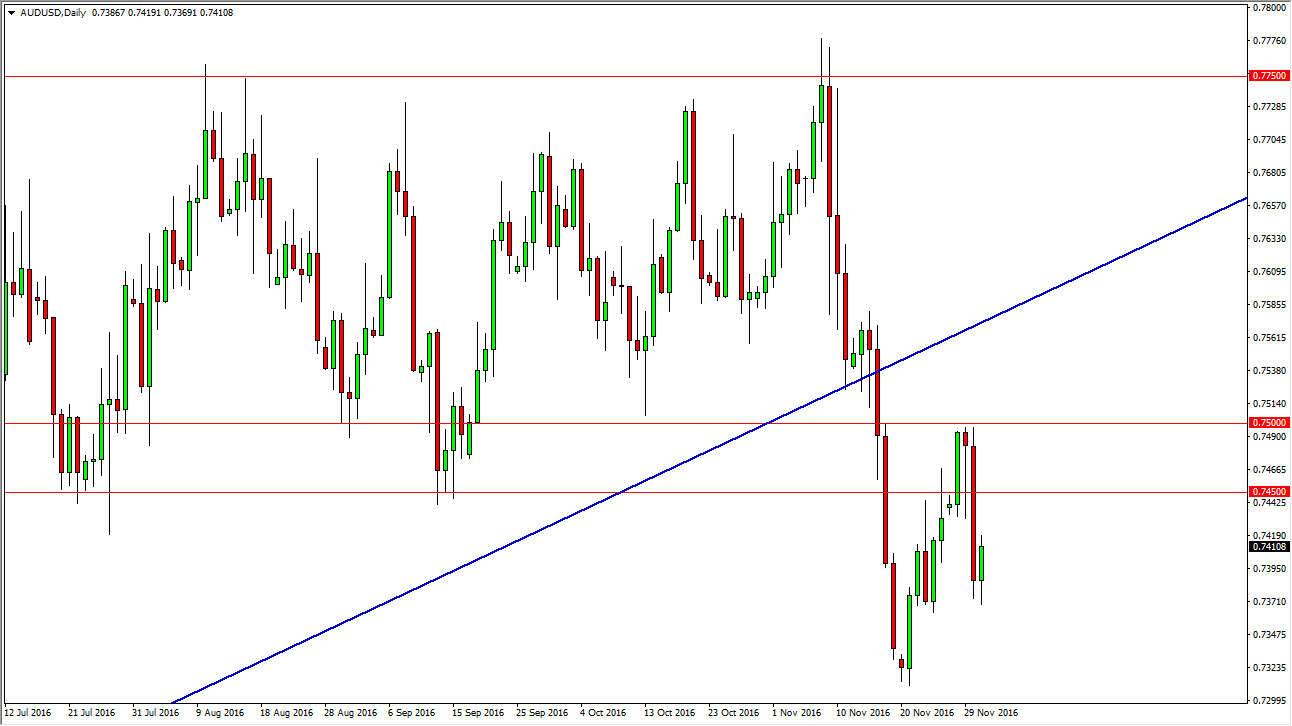

AUD/USD

The Australian dollar initially dipped during the day on Thursday but then rebounded a bit. This is mainly because the gold markets found a little bit of footing towards the end of the day. Ultimately though, I do recognize that there is a lot of resistance above and I believe that the 0.75 level will be extraordinarily tough to break above. The jobs number coming out of America will have a massive influence on the US dollar today, and more importantly for this pair: gold. Gold markets tend to be highly influential when it comes to the Aussies as they serve breaking down, this pair will more than likely to reaching towards the 0.73 level below. This will be exacerbated by a strengthening US dollar against gold, so all in all this could set up for an explosive move to the downside.

If we did manage to break above the 0.75 level I think the next barrier would be the previous uptrend line as marked on the chart. I much prefer selling the Aussie as opposed to buying it.