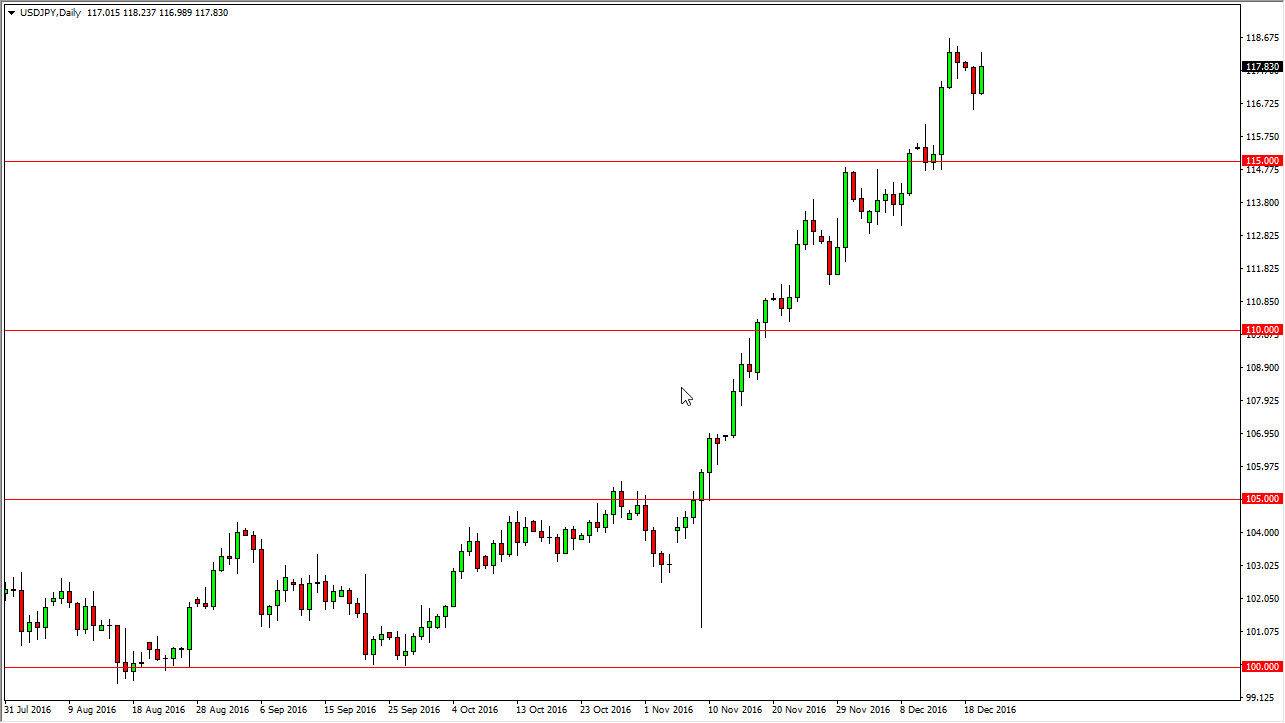

USD/JPY

The US dollar rallied on Tuesday as we continue to see weakness in the Japanese yen. I believe that given enough time we will continue to reach to higher levels, perhaps reaching towards the 120 level. I think that will of course be a massively resistive area, but I also recognize that we are a bit overextended at that point and pullbacks are not only necessary, but going to be an invitation to start buying the US dollar yet again. I believe that the 115 level underneath is going to be massively supportive, and that that support extends all the way down to the 111 level. Ultimately, a supportive candle is reason enough to go long again and again, as I believe this becomes a “buy on the dips” type of marketplace.

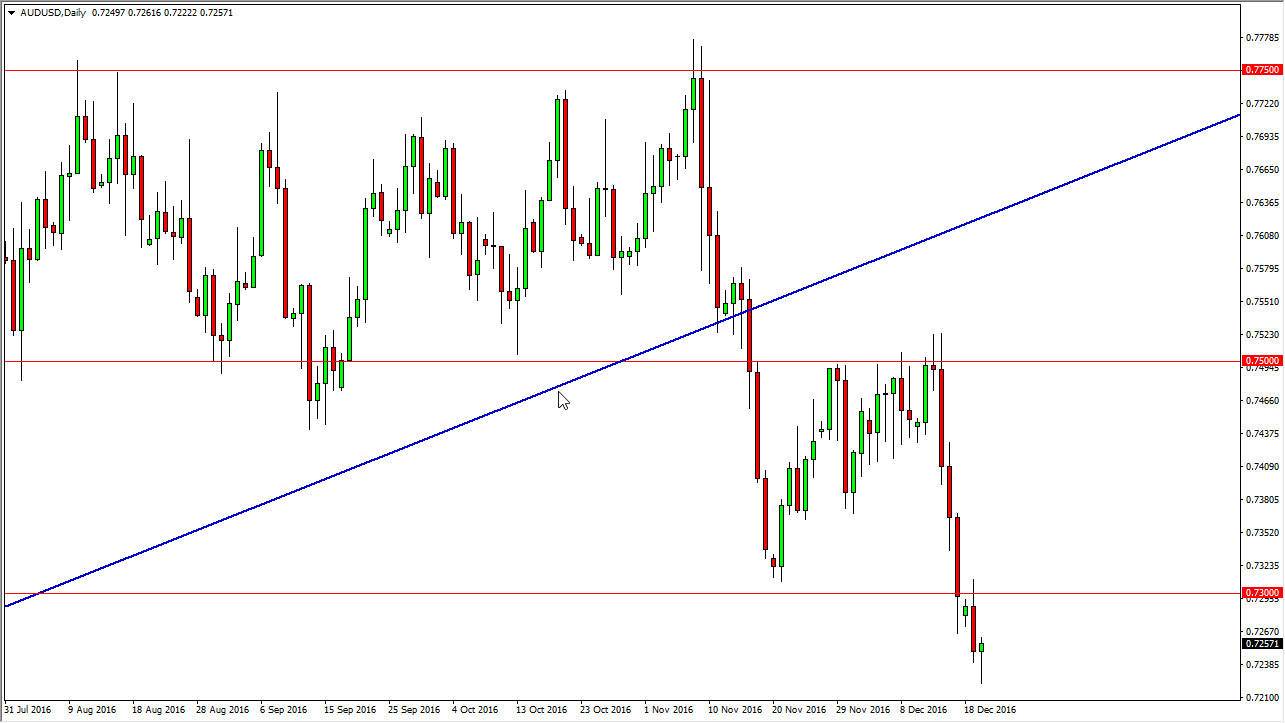

AUD/USD

The Australian dollar initially fell on Tuesday, reaching to fresh, new lows. However, there was enough support to turn things around and form a hammer which of course is a bullish sign. A break above the top the hammer is technically a buying signal, but I also recognize that the 0.73 level above will be massively resistive. Because of this, I think the given enough time we will get an opportunity to short from higher levels, on signs of exhaustion. I think that exhaustive candles will be the queue to take advantage of “value” in the US dollar.

Keep in mind that the gold markets are rolling over rather significantly, so I believe that the bearish pressure will continue to mount against the Australian dollar. I have no interest in buying this market, I believe that we will eventually reach down to the 0.70 level, which of course is a large round, psychologically significant number. I think that a bounce from there will be significant, but in the meantime, it’s likely that the bearish pressure will return after that as well.