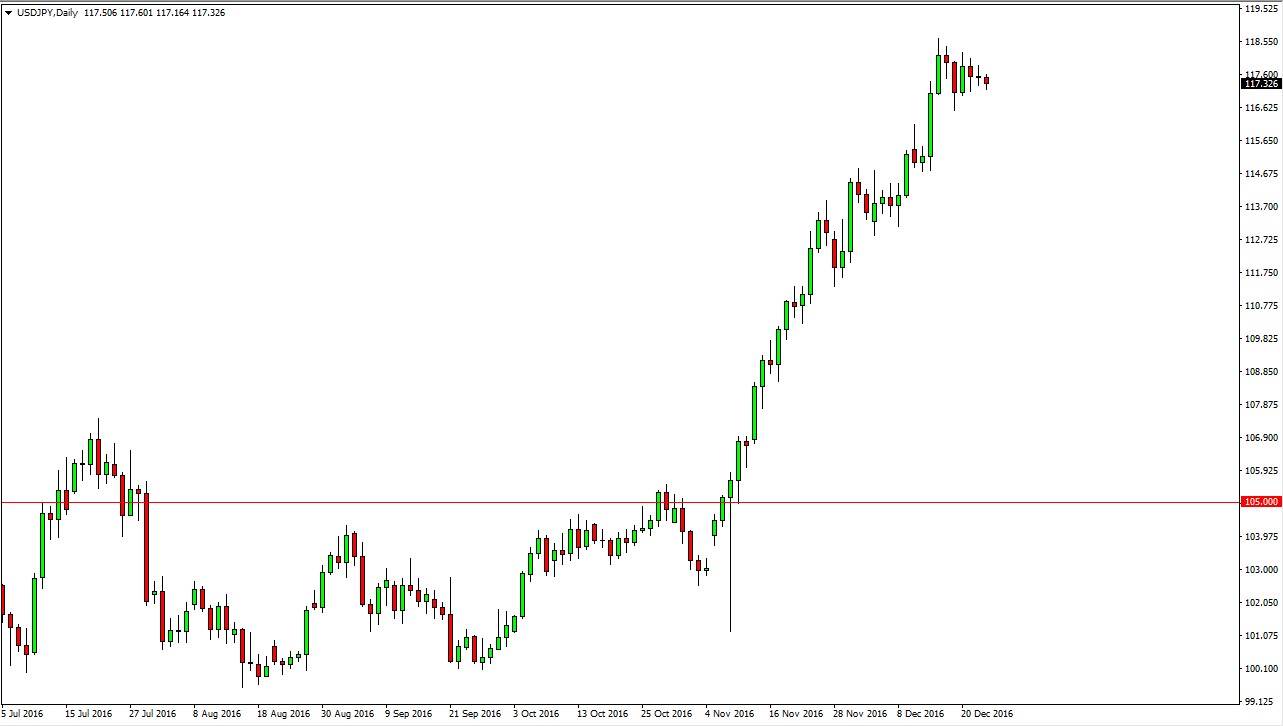

USD/JPY

The US dollar fell slightly against the Japanese yen on Friday, but quite frankly that’s a trading session that I would ignore. There was almost no volume, as traders will have worried more about Christmas than putting money into the Forex markets. It appears that the 117 level is a short-term floor in the market, but I think there’s more support to be found down at the 115 handle, and it would not surprise me at all if we end up breaking down a little bit to test that area. A pullback of significant distance would be favorable at this moment as we have seen so much in the way of overbought conditions. I still am bullish, and will look at those moves as value.

AUD/USD

The AUD/USD pair fell on Friday, as traders will continue to look to the gold markets for guidance. The gold markets have been falling for some time, and this of course has a negative effect on the Aussie overall. This is a market that has a lot of support to be found below at the 0.70, in a bit of a correlation to the gold markets that are looking for support at much lower levels. I think that they will move in concert over the next several sessions, and with this I am a selling of rallies going forward, as long as there are signs of resistance.

The 0.72 level above remains resistance, and because of this I look at exhaustion in that area as a nice selling signal. The candle on Friday is reasonably long, so it looks as if there will be continuation in the move lower. With all the interest rate talk coming out of the Federal Reserve, it is likely that the US dollar will continue to strengthen overall, and this pair won’t be any different.