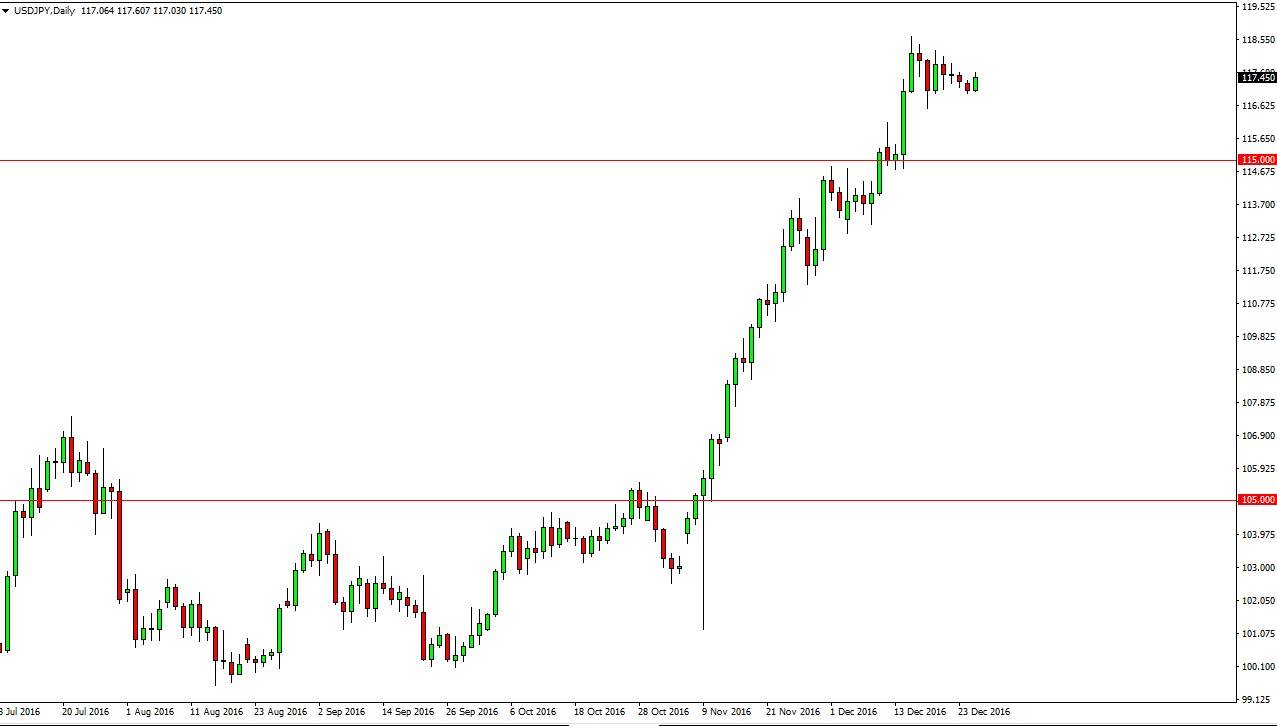

USD/JPY

The USD/JPY pair rallied slightly on Tuesday, and what would have been a low-volume environment. The market should continue to go higher given enough time, so I think pullbacks at this point will be thought of as value in the US dollar as we have seen such a massive move higher. If the Federal Reserve is going to raise interest rates next year, it makes a lot of sense we continue to go higher as the Bank of Japan will keep interest rates ultra low for the near future, if not well beyond that. I believe that the 115 level underneath is massively supportive, and essentially the “floor” in this market. I believe that we are heading towards the 120 handle given enough time and that’s my target.

AUD/USD

The Australian dollar went back and forth on Tuesday, showing very little in the way of volatility. The range wasn’t much in the way of impressive, so I think what we will eventually see is a bounce after this significant selloff, that gives us an offer for “cheap dollars”, meaning that we should continue to go lower given enough time. However, we are oversold at this point so it’s not too much to ask for some type of reprieve to pick up more sellers and build up more negative selling pressure. I think that the goal markets will continue to work against the value of the Australian dollar, and of course the interest rate hikes coming on the United States this next year should continue to put quite a bit of a bid underneath the US dollar.

I think that any bounce will struggle to break above the 0.73 level, and as a result would be very interested in selling this pair near that level. Ultimately, I think we are reaching down towards the 0.70 level.