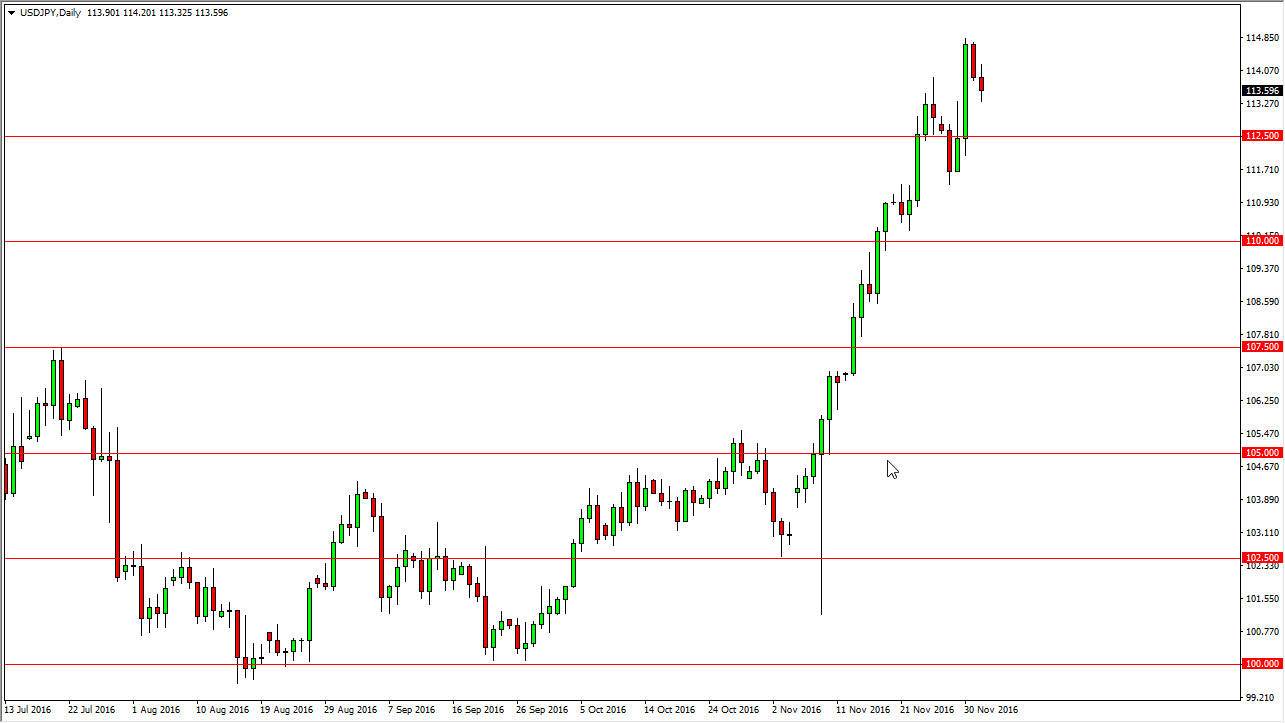

USD/JPY

The USD/JPY pair fell during the day on Friday, drifting down towards the 113.50 level. This is a pretty minor area as far as I can see, so I would not be surprise at all if we pullback a little bit from here. Any pullback will be met with support though, so I think when we fall you cannot start selling this market, rather you have to be thinking about picking up value on at lower levels. Ultimately, I believe that the Japanese yen will continue to soften over the longer term, so I’m only looking for a buying opportunity, and not interested in selling when I think is going to be a significant pullback. I think that the 112.50 level could be supportive, I believe that the 110 level is even more so. With this in mind, I’m simply waiting.

AUD/USD

The Australian dollar had a volatile session on Friday, initially falling but then turning around to test the 0.7450 region. This is an area that begins a significant amount of resistance all the way to the 0.75 handle, so I think that it makes sense that we will see quite a bit of choppiness. I also think it’s only matter of time before the sellers get involved, and of course the gold markets have some type of influence on this particular pair. I still believe that the US dollar will strengthen over the longer term, so makes sense that the Australian dollar all. I think that given enough time we should then reach towards the 0.73 level over the longer term, and possibly even down to the 0.70 level after that. I don’t know selling think that this can be the easiest move to make, but certainly there is quite a bit of bearish pressure on the Aussie overall. The US dollar remains King at the moment.