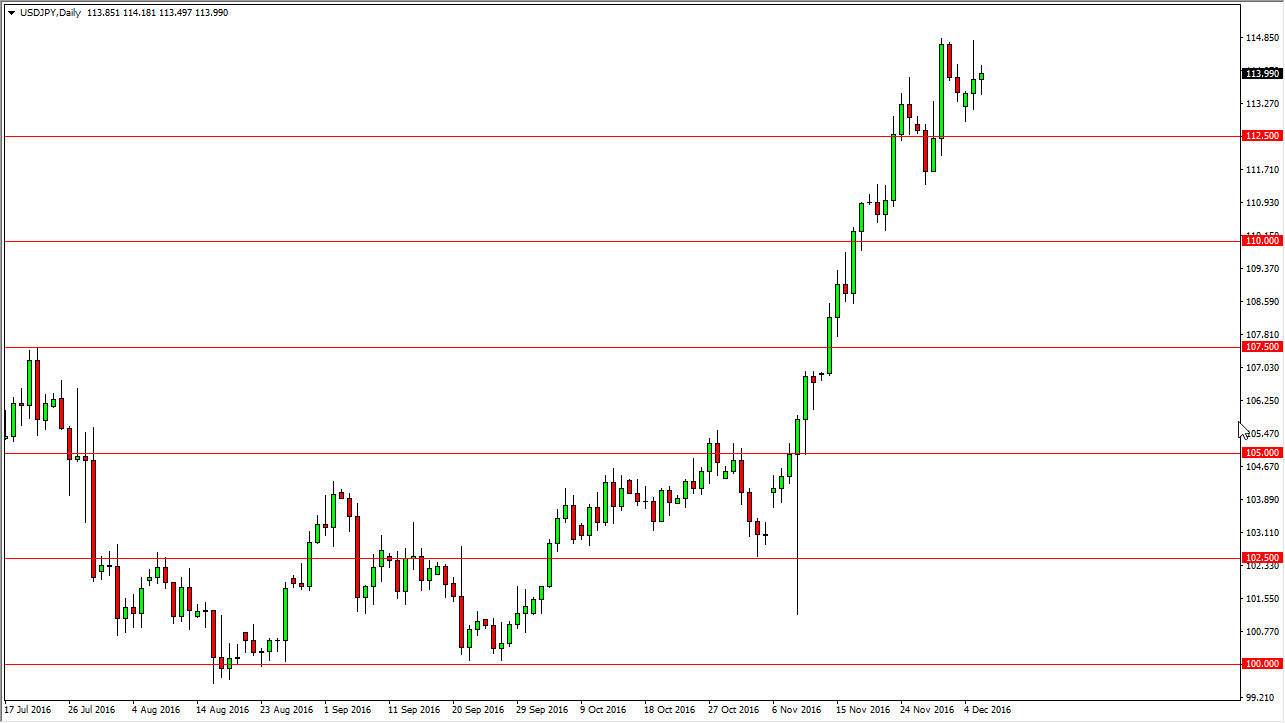

USD/JPY

The USD/JPY pair had a fairly quiet session on Tuesday, as we continue to go back and forth. Ultimately, this is a market that has a massive amount of support just below, so a pullback to the 112.50 level makes a lot of sense, but quite frankly I want to go lower than that. I believe that the 110 level underneath there is even more interesting. I have no interest in shorting this market, as I believe that it is in an uptrend now, so we should only be buying. A pullback should be thought of as value, and what has been an overextension of bullish pressure. Coinciding couple of weeks before the holidays may be reason enough to see that pullback that’s necessary.

AUD/USD

The Australian dollar fell during the day on Tuesday as well, breaking below the 0.7450 level. However, there was enough support below to turn things around and form a hammer. The hammer of course is a bullish sign but I feel that the 0.75 level above should continue to be resistive. Even if we break above there, I feel that we will then run into quite a bit of noise near the previous uptrend line. Gold markets haven’t exactly been on fire, so every time they fall I look at the Australian dollar as a potential short. A break down below the bottom of a hammer should be reason enough to start selling just as an exhaustive candle would be near the aforementioned 0.75 handle.

I have no interest in going long, which not until we clear the top of the previous uptrend line, which of course won’t happen anytime soon. There will continue to be a bit of a flood of money towards United States in general, and I think that this pair won’t be any different. I remain bearish.