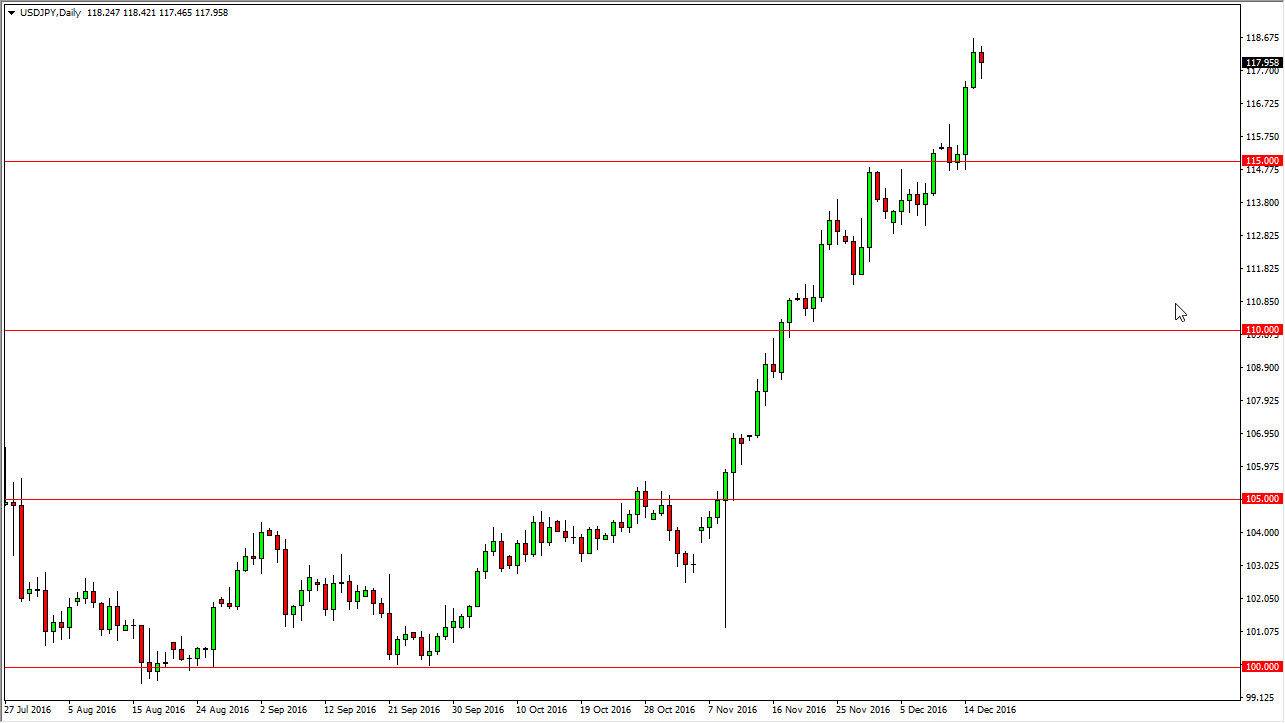

USD/JPY

The USD/JPY pair fell slightly on Friday, but quite frankly there is enough bullish pressure underneath that I believe it’s only a matter of time before the buyers get involved. A pullback from here should continue to offer value that we can take advantage of, as the US dollar continues to strengthen overall. The Bank of Japan is light years away from raising rates, which of course is the exact opposite situation we find the Federal Reserve and. I think that there is essentially a “floor” in this market down to the 115 level, which should now be massively supportive. I have no interest in selling, and believe that there is more than enough reason to think that this market continues to go higher, and at the moment I believe the target is 120.

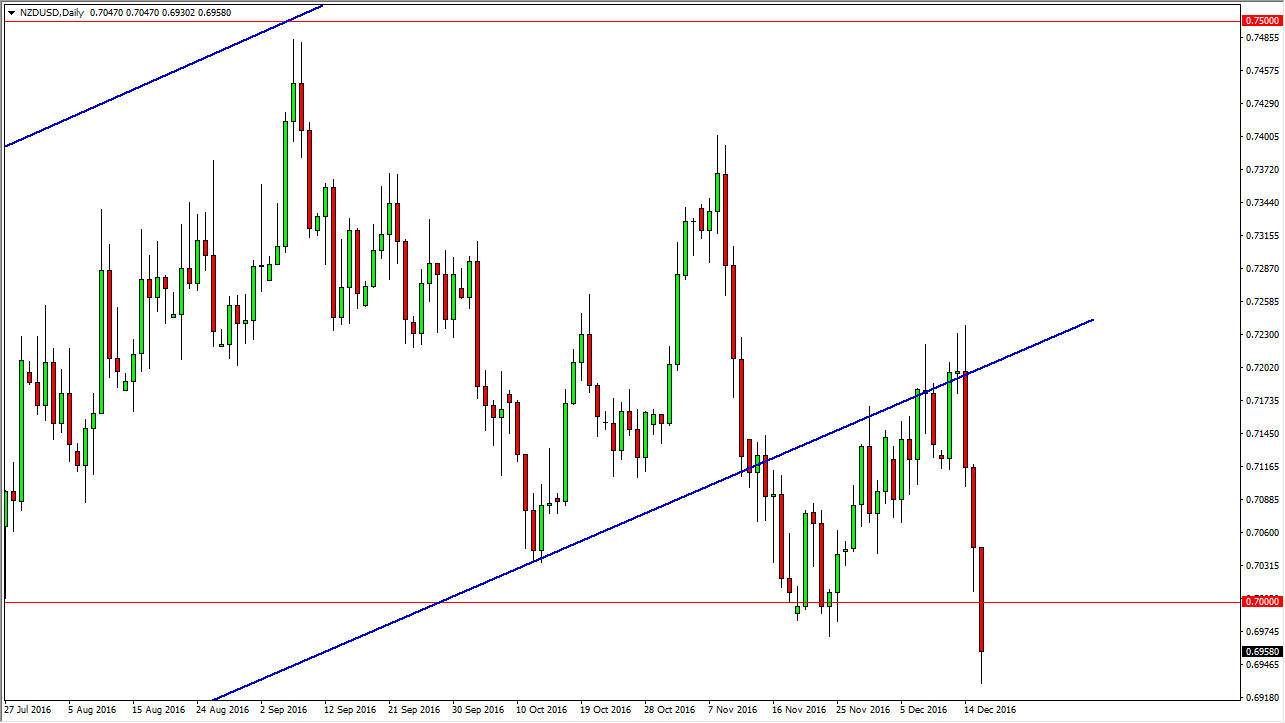

NZD/USD

The New Zealand dollar broke down during the day on Friday, finally slicing through the 0.70 level. This is an area that has been massively supportive, and the fact that we broke down below there signifies that we are going to go much lower. The 0.68 level below is massively supportive, but I think we made a pullback in order to actually reach down there. The 0.70 level above should continue to be resistance, and with that I feel it’s only a matter of time before the sellers get involved on a rally. An exhaustive candle is reason enough for me to get involved. However, if we break down below the bottom of this candle for the session on Friday, that would be reason enough to start shorting as well. Either way, I have no interest in buying this pair as we have clearly broken down with some significance of the last several sessions. The New Zealand dollar is highly sensitive to commodity markets overall, and the overall “attitude” of those markets will influence which direction this currency goes.