USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

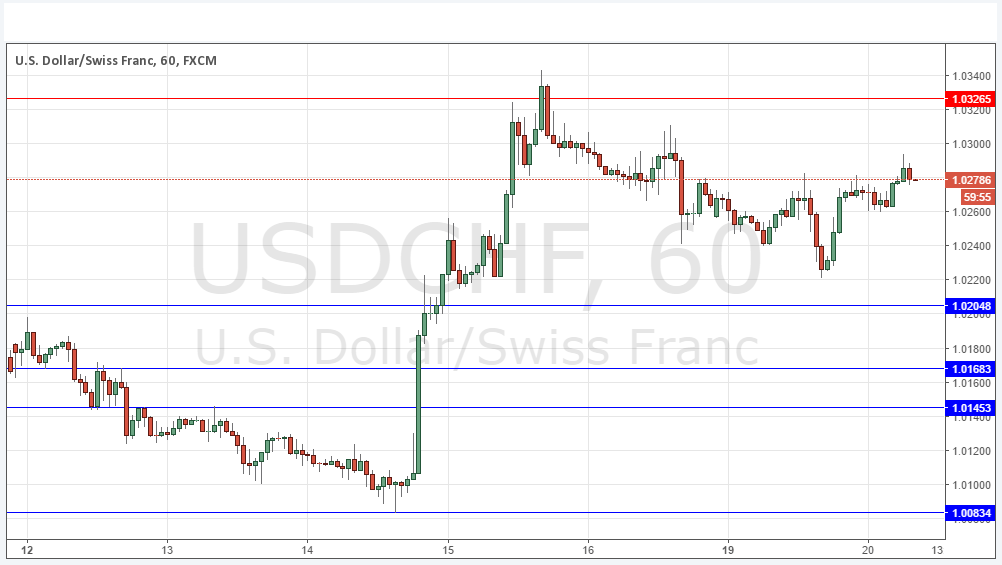

Long entry after bullish price action on the H1 time frame following the next touch of 1.0205 or 1.0168.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.0327.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This pair continues to be overshadowed by its sister pair, EUR/USD, as it has made only a new 5-year high unlike the EUR/USD which made a new 13-year low. I wrote yesterday that it was starting to look as if this pair was due a deeper pull back to at least 1.0205. We did get a move down to 1.0220 where the support finally came in and the price has now been bought up. Unfortunately, however, we are now in between any useful key levels, so over the short-term it is hard to have an idea of the next move.

Overall, there is still a fairly strong long-term bullish trend, so taking long trades should give a positive edge.

There is nothing due today concerning either the CHF or the USD.