USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades my only be entered before 5pm London time today.

Long Trades

* Go long after bullish price action on the H1 time frame following the next touch of 1.0205 or 1.0168.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

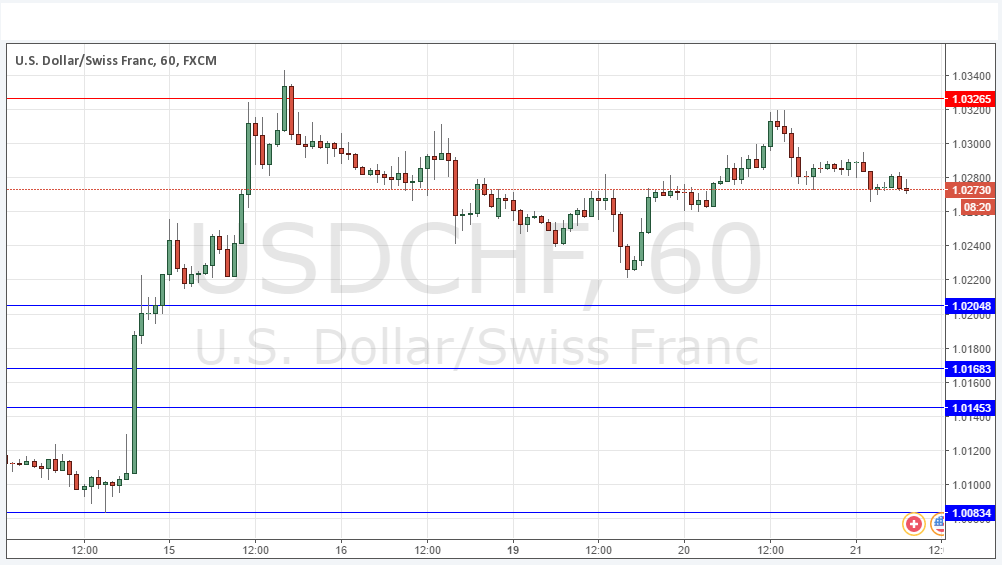

* Go short after bearish price action on the H1 time frame following the next touch of 1.0327.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I have been writing over the past few days about how the situation here is like that of the highly positively correlated EUR/USD, but the Dollar has been weaker here, and that continued to be the case yesterday. The EUR/USD made a new low, but here the price failed a few pips short of the resistance at 1.0327.

The action is suggesting a period of consolidation between 1.0327 and 1.0205.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.