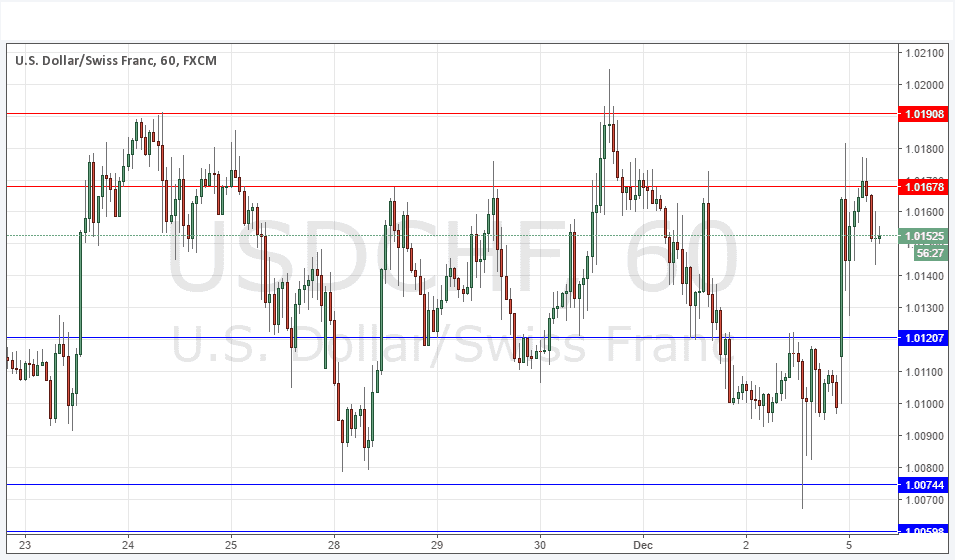

USD/CHF Signal Update

Last Thursday’s signals produced a small but profitable long trade following the bullish pin bar rejection of the support level identified at 1.0121.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 1.0121 or 1.0074.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0191.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair was beginning to break down below its range at the end of last week as the USD finally turned around, but was boosted at the weekly open last night as funds went flowing into the U.S. Dollar following the unpalatable result of the Italian constitutional referendum. This pushed the price into the resistance zone between 1.0168 and 1.0191 from where it is now falling.

The pair must be said to be in a range, and if it should reach the upper band of the resistance at 1.0191 and turn bearish again, that would be likely to be a good short trade entry.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time.