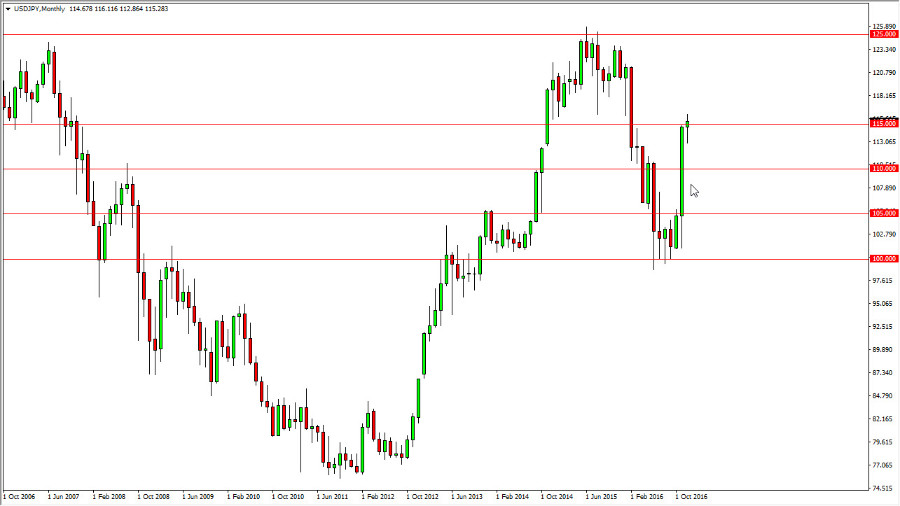

This has been one of the most explosive markets in the Forex world over the last couple of months. November was an absolute monster of a month, as we essentially gained 14 handles. That’s an incredible move, and it shows that there is real bullish pressure in this marketplace. Ironically, this is mainly due to the election of Donald Trump. Initially, the market sold off but then exploded to the upside as traders began to think about the pro-business attitude of the new administration. Donald Trump has long been critical of the Federal Reserve for not raising interest rates, and it believe that the Federal Reserve must do so now. And that’s the case, we should continue to go higher and I believe that we will eventually reach the 125 level during the course of the next 6 months.

Japanese yen

With Federal Reserve being the only major central bank in the world that is looking to raise interest rates, it makes a lot of sense of the US dollar continues to rally. On top of that, the Bank of Japan looks very soft and accommodating still, so this is a bit of a “perfect storm” when it comes to trading the Forex world. I think that every time you get a pullback near a 500 PIP level, you have to start looking for a buying opportunity.

This tend to be a very explosive pair, but it is probably a little overdone as we enter the new year. Given enough time, I expect this market to reach higher levels, even more high than the previously mentioned 125 handle. My longer-term target is actually 130, which while seems like a very big move at this point, November was almost that take by itself. Expect a lot of volatility, this pair tends to be that way, but I don’t think the Bank of Japan is going to step in the way and the Federal Reserve has almost painted itself into a corner as far as raising interest rates.