USD/JPY Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at 113.30.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time, over the next 24-hour period.

Long Trade 1

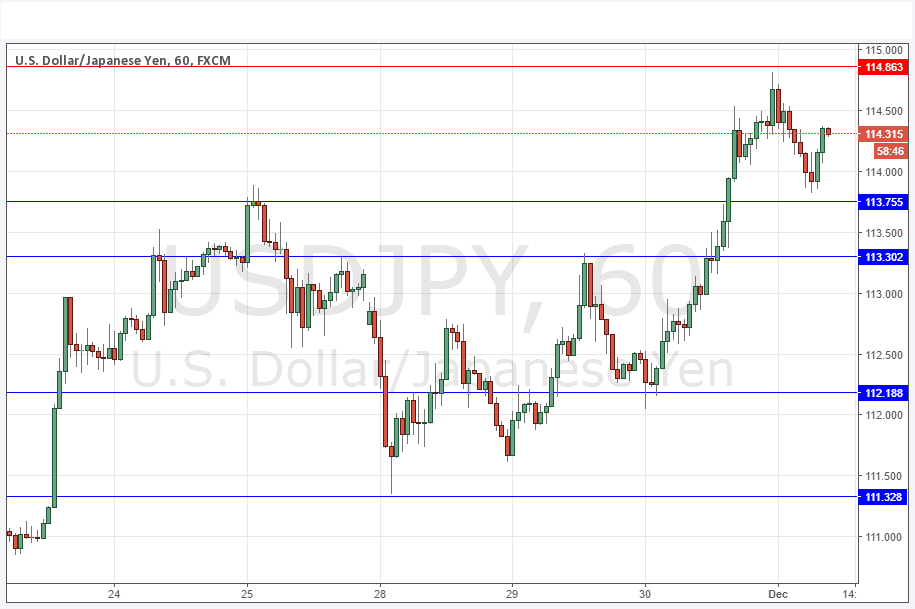

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 113.75 or 113.30.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 114.86.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I wrote yesterday that there are still going to be a few bullish moves in this pair yet, and this really proved to be the case with the price rising over the day by almost 2%, which is a huge movement for any major Forex currency pair.

The price eventually halted and pulled back close to the resistance level I had identified at 114.86. At the time of writing, it appears that it may be rising again in another bullish wave.

There is no question that this pair is at the heart of the Forex market and it makes sense to be bullish still during this amazing one. It has been an easy and predictable way to make money and these chances do not come around too often. Although the move is mature, I would not call a top yet.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time, followed later by ISM Manufacturing PMI at 3pm.