USD/JPY Signal Update

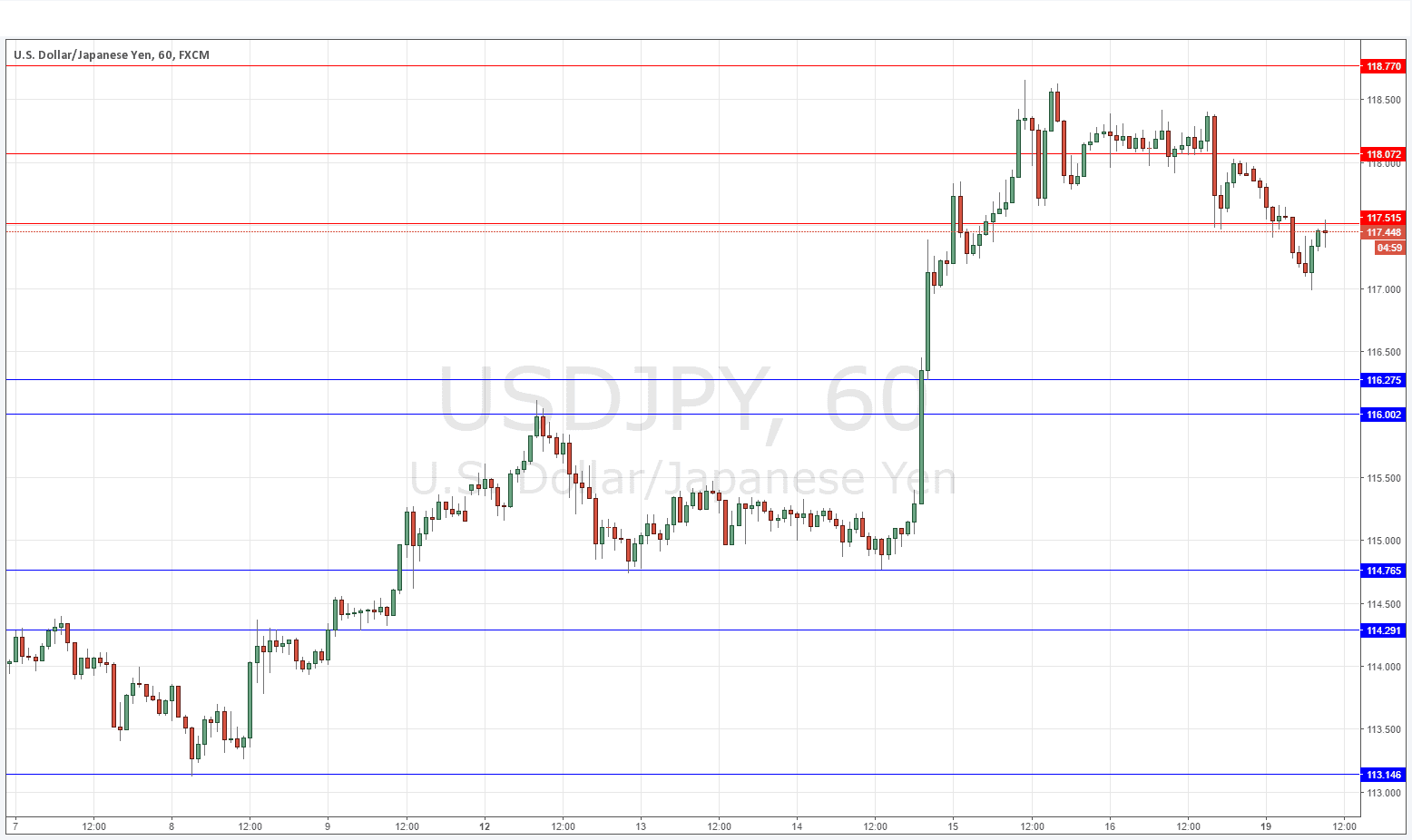

Last Thursday’s signals were not triggered as 118.77 was never reached.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 116.28.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 118.07.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

We have an extremely strong long-term bullish trend in force here. However, we finally seem to have reached an area of significant long-term resistance above 118.00, and this has led to some choppy action, and over recent hours we are even starting to flip support to new resistance (see the level at 117.52 as an example) as the price begins to move down.

It might be that the round number at 117.00 will hold, but I do not see truly significant support until 116.28 so I think we are quite likely to have a deeper pull back next down to below 117.00.

For a longer-term outlook, there is no convincing reason to give up on being bullish yet.

There is nothing due today regarding the USD. Concerning the JPY, there will be releases of the Bank of Japan’s Monetary Policy Statement and Policy Rate followed by the usual press conference, late in the Asian session.