USD/JPY Signal Update

Last Thursday’s signals produced a small yet profitable winning trade following the bullish pin candle rejecting the support level identified at 113.75.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trade 1

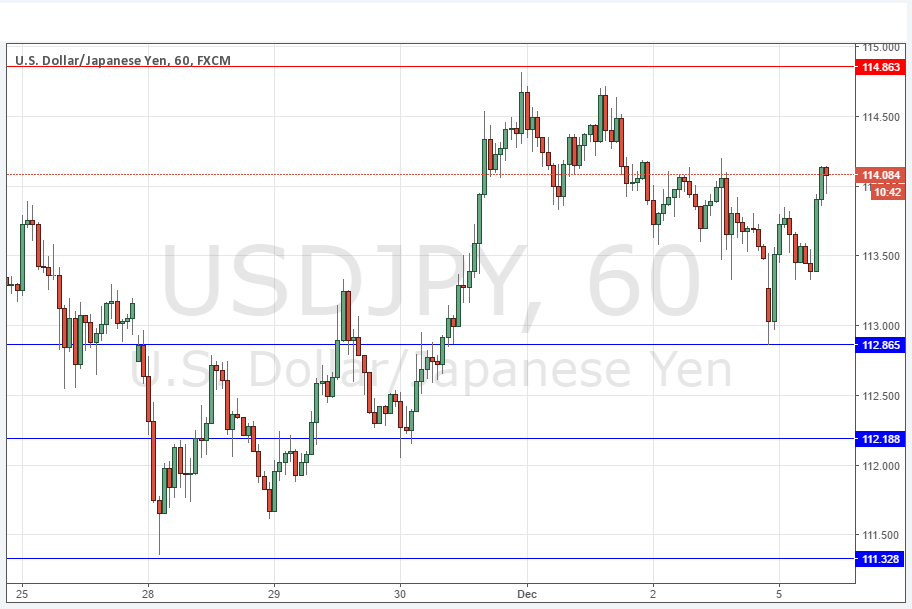

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 112.87.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 114.86.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

It was really starting to look as if this pair was beginning a deep pull back after a long and very strong bullish run by the U.S. Dollar and a big weakening from the Japanese Yen. This pair was at the heart of the action over the past few weeks.

The Italian referendum result yesterday has strengthened the U.S. Dollar however, and breathed some new life back into this pair, although it is hard to see where it is going to go next. The price still has not cleared recent highs. It is worth noting though that after a big move, there is usually some momentum left over for the next few weeks, so bulls have a technical case here.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time.