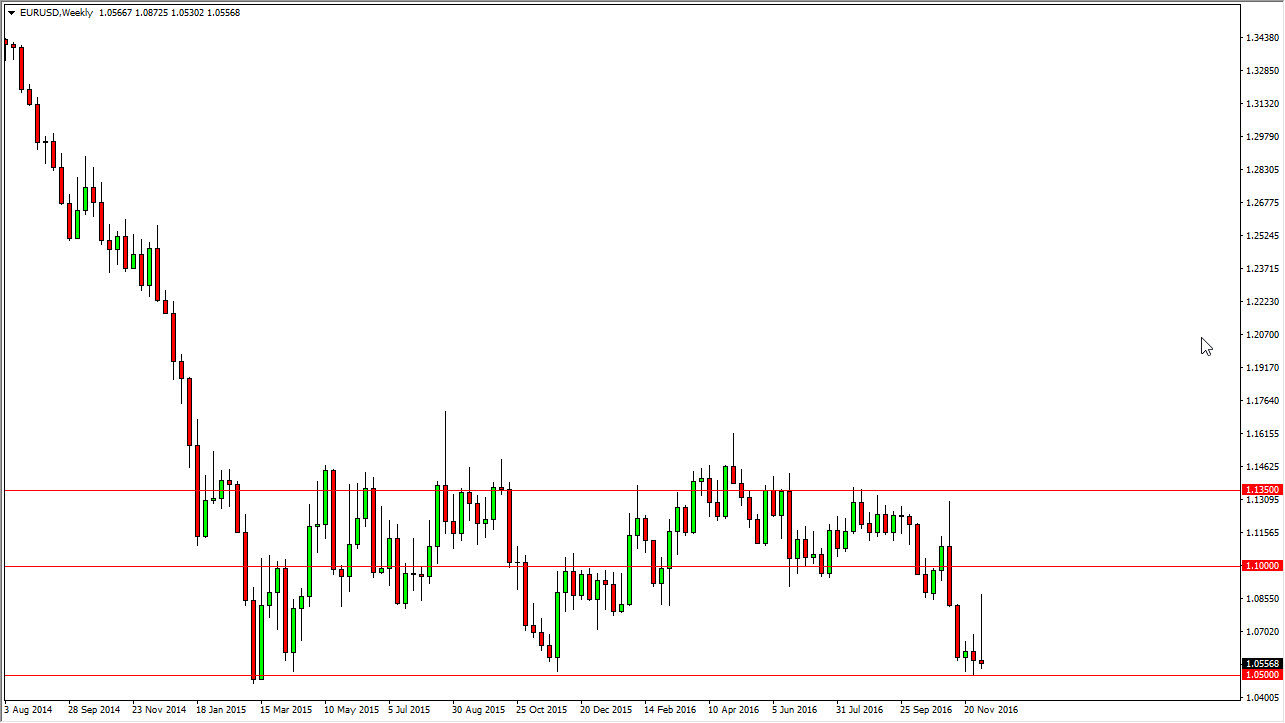

EUR/USD

The EUR/USD pair initially rallied during the previous week, but with the ECB extending quantitative easing by another 9 months. With this, the market looks as if it’s going to try to break down below the 1.05 level, and when it does I feel that the market will drop down to the parity level, possibly even lower. I am a seller only, so I look at rallies as potential selling opportunities as well.

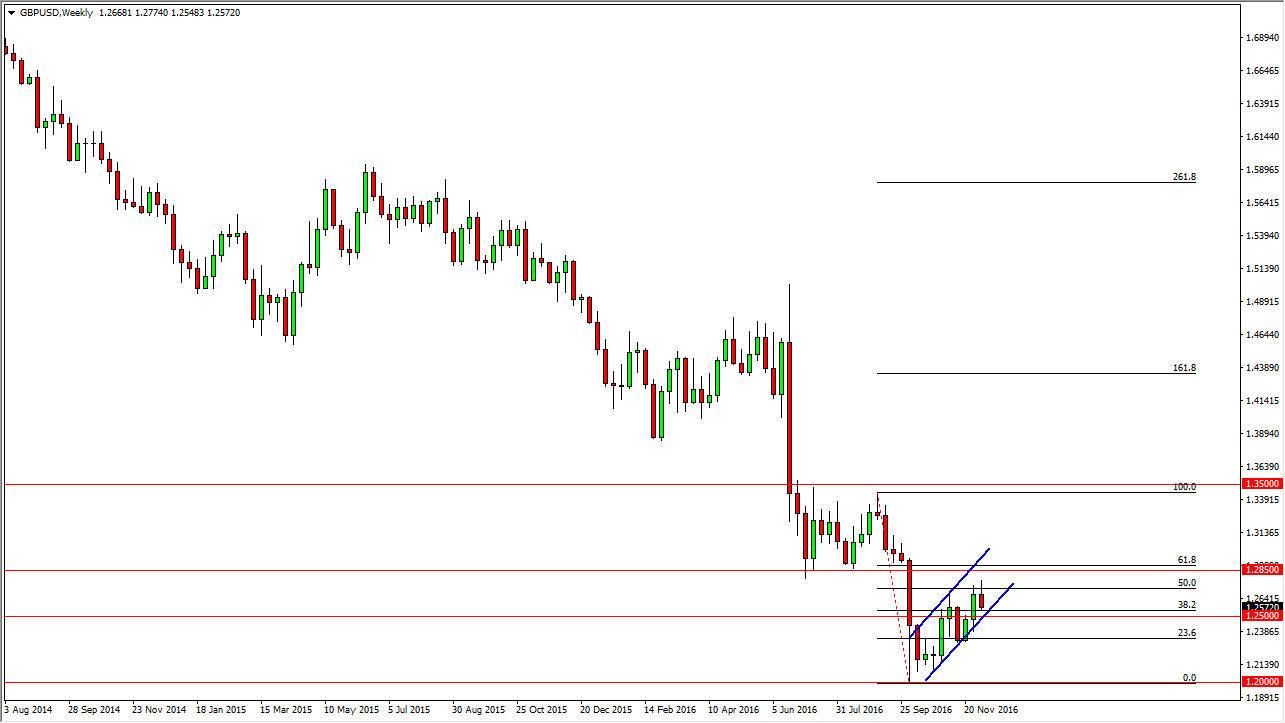

GBP/USD

The British pound initially tried to rally during the course of the week, but found the 50% Fibonacci retracement level of bit too resistive. I think if we can break down below the 1.25 handle, the market should go much lower at that point in time and I would start shorting. I think rallies at this point in time will be suspicious, and I would sell all signs of weakness.

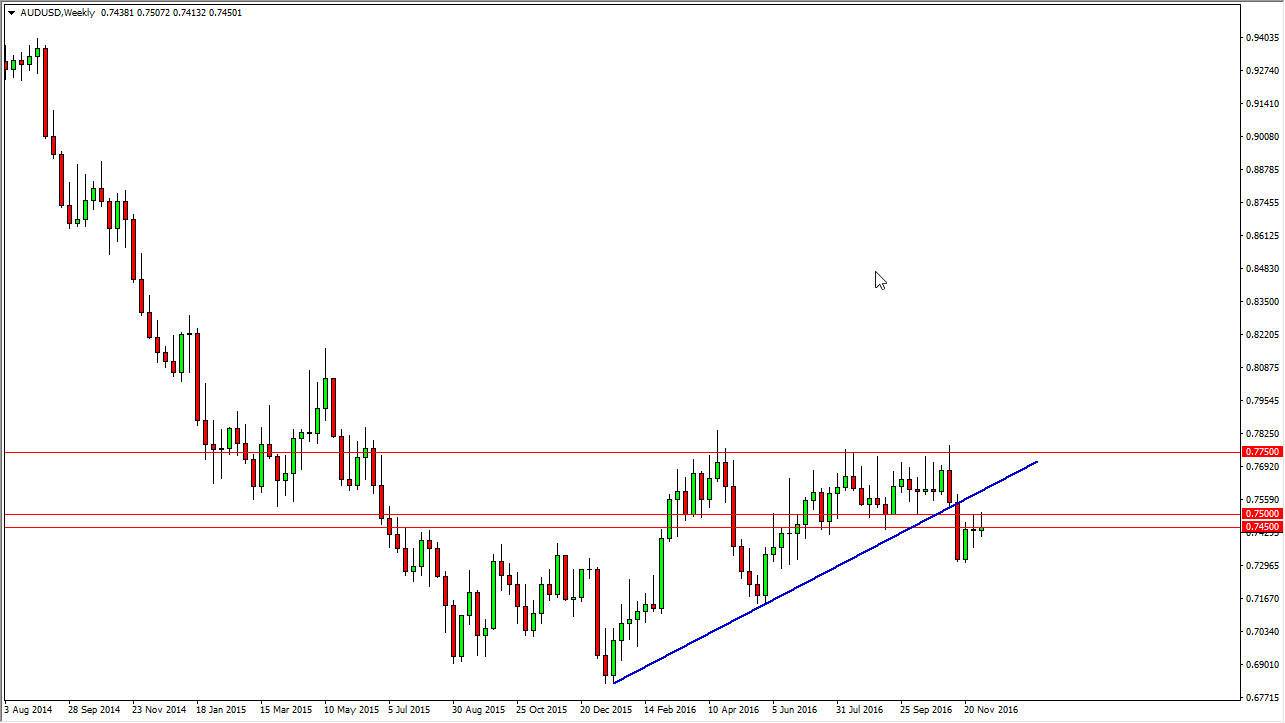

AUD/USD

The AUD/USD pair initially tried to rally, and then turned around to form a shooting star for the weekly candle. I believe that we are getting ready to roll over, and perhaps reach down to the 0.73 level, and then break down below there to the 0.70 level after that. Ultimately, this is a market that looks like it is breaking down longer-term, so if gold drops, that could give us a little push lower as well. I am “sell only.”

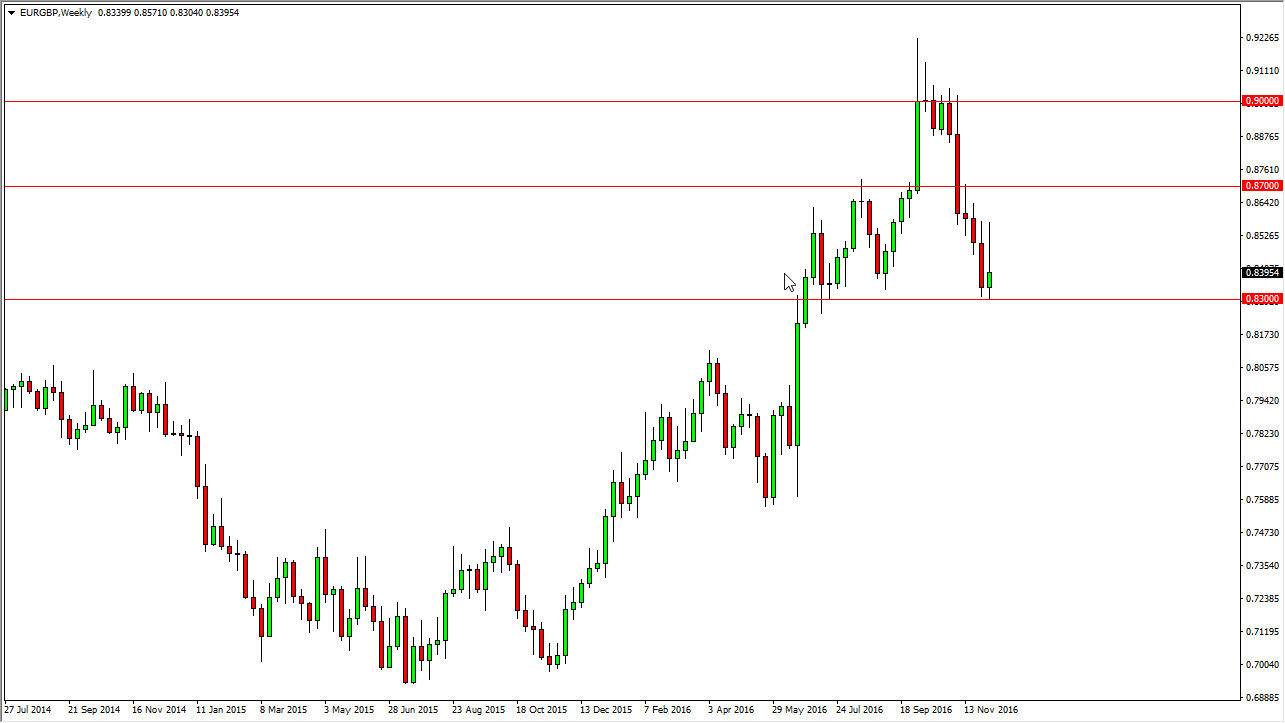

EUR/GBP

The euro initially tried to rally during the course of the week, but turned around to find enough resistance to turn things back around and form a massive shooting star on the weekly chart, that sits on the 0.83 support level. A break down below there would be a very negative sign and should send this market looking for the 0.80 level underneath. Ultimately, every time we rally, I would expect to see exhaustion that we can start selling yet again.