EUR/USD

The Euro initially tried to rally during the week but as the ECB added 9 months of quantitative easing, the Euro fell hard. We managed to break down below the 1.05 level, showing real signs of weakness. I believe that any signs of exhaustion on short-term charts should be reason enough to sell, as we are going to start working towards the parity level over the longer term.

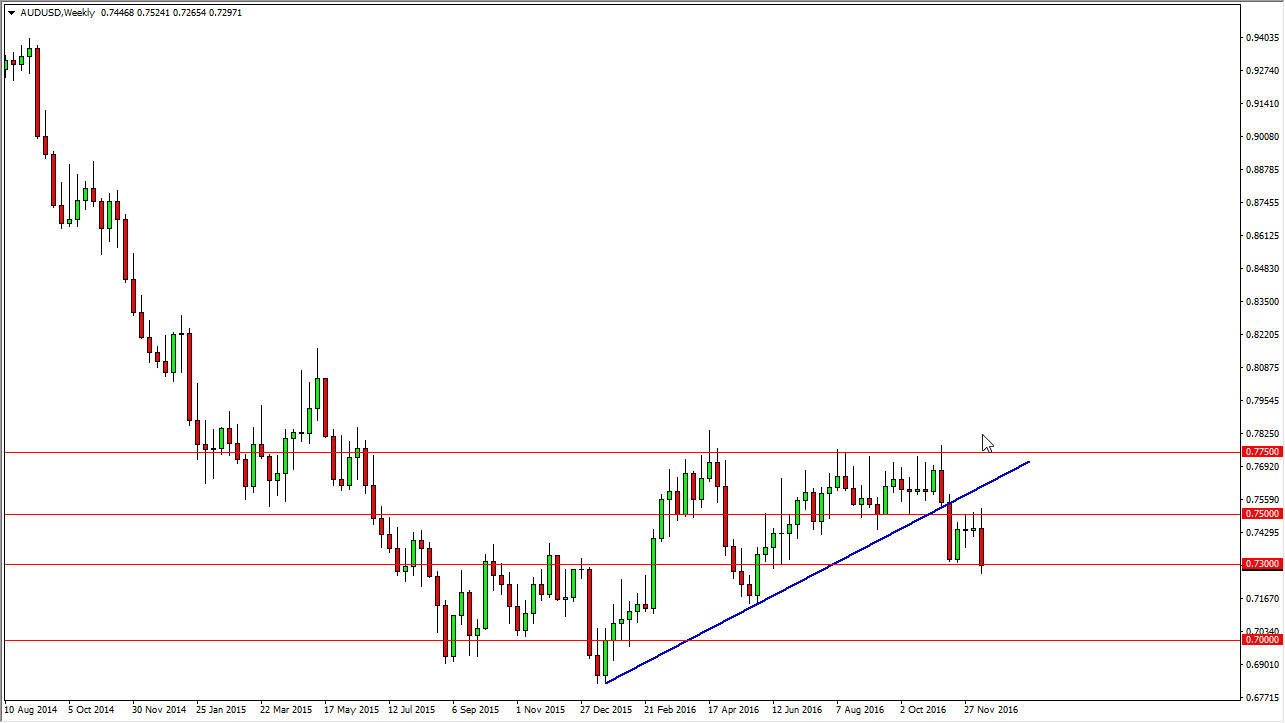

AUD/USD

The Australian dollar initially tried to take off during the week but found the 0.75 level above to be far too resistive. We broke down below there which sends this market looking for the 0.73 level. A break down below the bottom of the weekly range has me selling though, and I believe that the market will eventually try to work its way down to the 0.70 level. I have no interest in buying the Aussie at the moment.

WTI Crude Oil

The WTI Crude Oil markets fell during the week, testing the $50 level for support. In fact, the Thursday and Friday candles were both hammers, so I believe that it’s only matter of time before we bounce from here. The $60 level above could be a target, but ultimately we can break down below the bottom of the weekly range, I believe that the market would then reach down to the $46 level.

EUR/JPY

The Euro broke higher during the course of the week, showing signs of strength. I think at this point we will more than likely try to pullback in order to find buying opportunities. The 120 level below is the “floor” as far as I can see, so I’m waiting to see some type of pullback in order to start going long again as we should then target the 125 handle.