EUR/USD

Towards the end of the week, the Euro managed to rally against the US dollar. However, I still see a significant amount of resistance at the 1.05 level, and further above. Because of this, I believe that in the short-term rally will end up offering short-term selling opportunity. However, this is the last week of the year, and therefore volume tends to be fairly light, keeping this the short-term traders market.

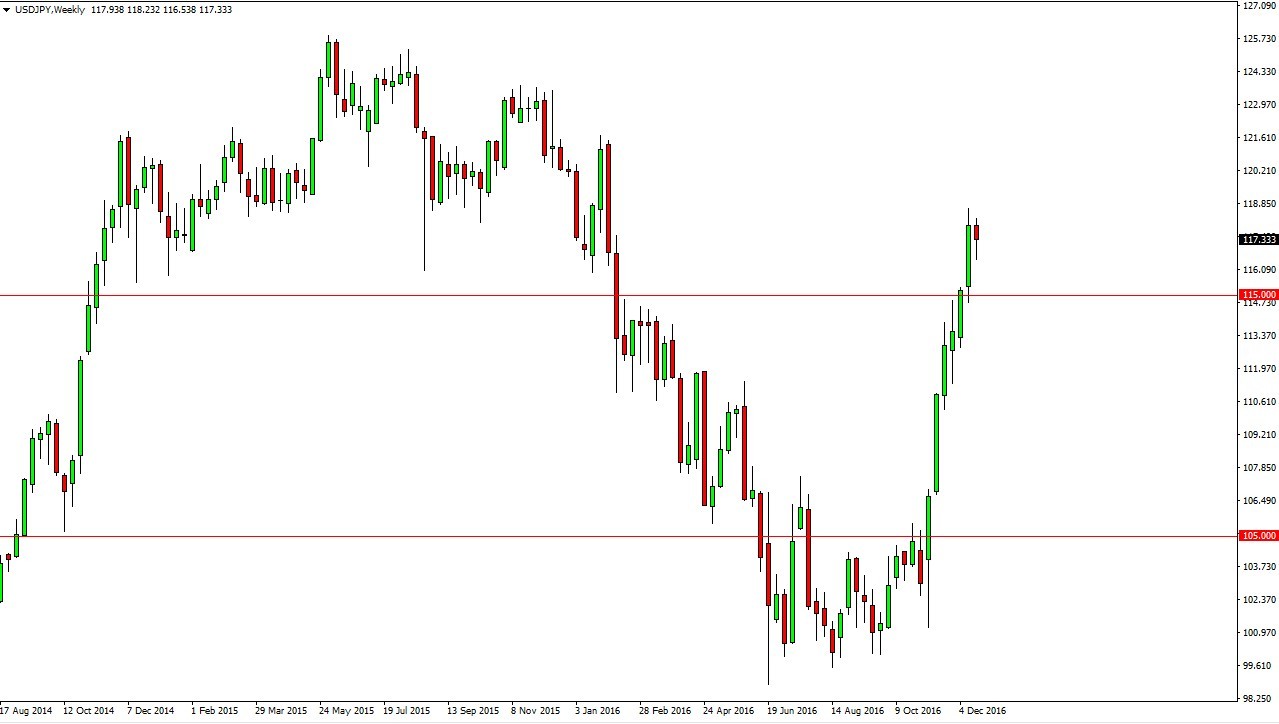

USD/JPY

The dollar fell against the yen during the past week, but quite frankly I think we need to pull back even further. I think that the 115 level is a much more interesting “floor” in this market, and although the weekly candle is a bit of a hammer, I still think that we need to pull back. With this, I’m waiting for value to go long in this market.

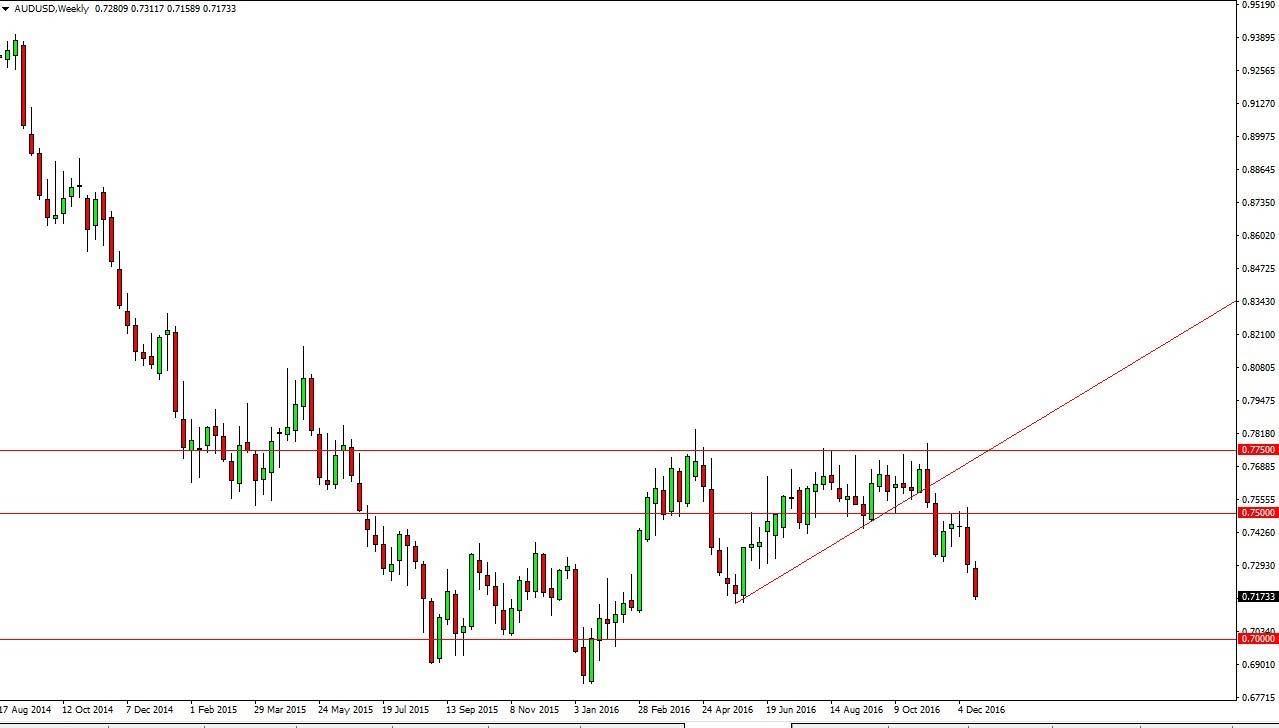

AUD/USD

The Australian dollar had a fairly negative week, breaking below the 0.72 level. At this point I don’t see any reason why we will reach down towards the 0.70 level, and that eventually the 0.68 handle. Rallies at this point should be selling opportunities, as they were present value in the US dollar which of course is one of the strongest currencies in the world right now.

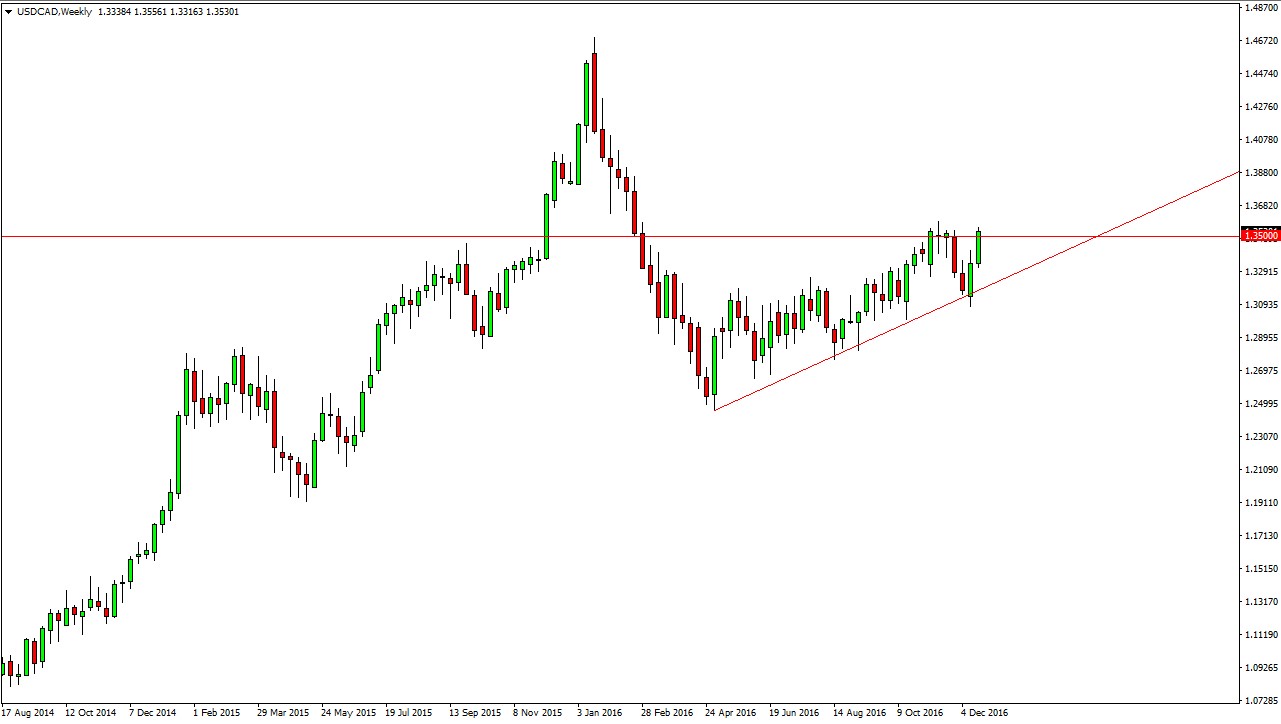

USD/CAD

The US dollar continues to grind higher against the Canadian dollar, and the less than anticipated GDP numbers coming out of Canada certainly will help that move higher. Ultimately, I feel that the market will break out to the upside and reach towards the 1.40 level. I am a buyer dips, and a break out above the 1.3550 region.