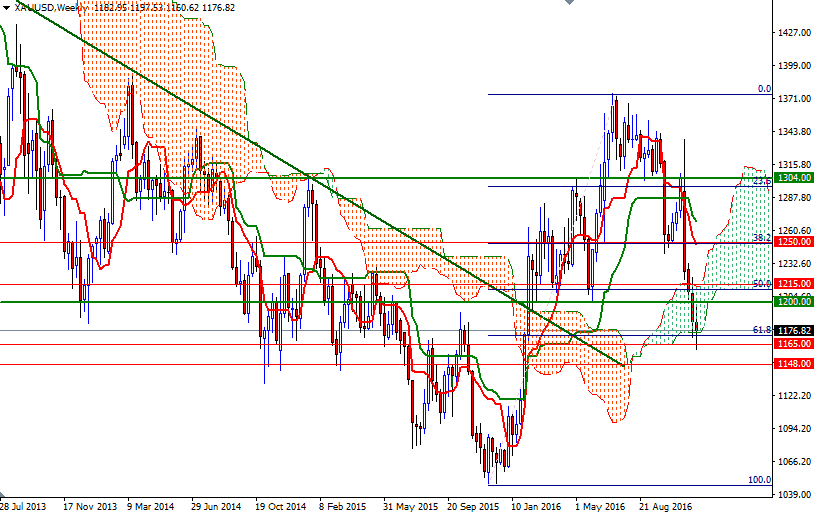

Gold ended the week down $6.13 at $1176.82 an ounce as strong U.S. economic data bolstered the case for the Federal Reserve to take a more hawkish stance on the monetary policy. The XAU/USD pair tried to break through the 1200-1197 area, which I had pointed out as a key to higher levels, earlier in the week but eventually failed and began to crumble. As a result prices dropped below the 1171/69 zone, and tested the support at around 1160 as anticipated.

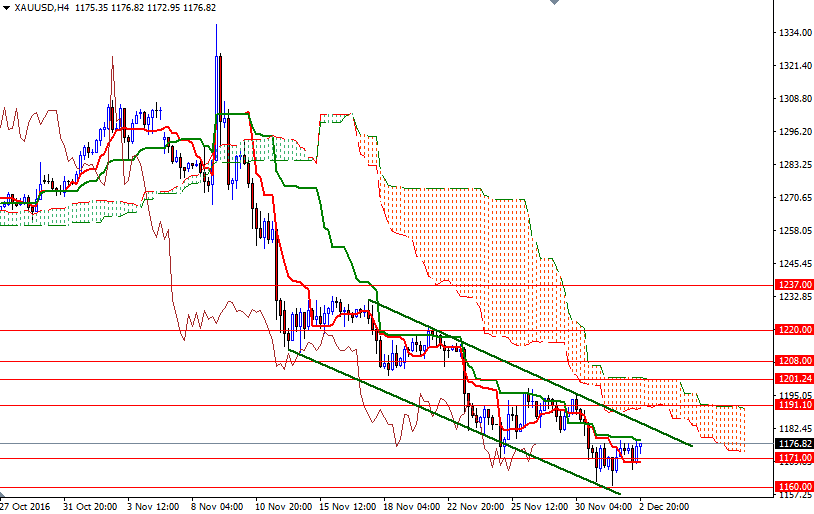

It seems that will continue to struggle against a host of bearish factors, such as the uptrend in equities, a stronger dollar and the prospect of further rate hikes in 2017. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 151570 contracts, from 167085 a week earlier. From a technical point of view, trading below the Ichimoku clouds on both the daily and 4-hourly time frames suggests that gold prices are vulnerable to the downside. The descending channel that the market has been following may contain prices and drag towards 1148/5. However, there is likely to be minor support at around 1169, followed by a significant one in the 1165/0 zone. In other words, we need to get down below there in order to continue to the downside. On its way down, support can be found in the 1154/3 zone.

If the aforementioned support (1165/0) remains intact, keep an eye on the upper line of the descending channel currently sits at 1182.60. If XAU/USD breaks out above the bearish channel, the possibility of an attempt to test the 1191.10 level, which happens to be the bottom of the cloud, would increase. Beyond that, the next stop will be 1197/5. The top of the cloud stands in the 1202/0 zone and the bulls have to clear this barrier in order to so that they can proceed to 1210/08.