WTI Crude Oil

The WTI Crude Oil market broke above the $50 level during the session on Thursday, as we continue to see a lot of bullish pressure due to the OPEC production cut. I think part of this was the fact that the Russians did go ahead and decide to join, but quite frankly they're not cutting that much. I still believe that oversupply will be a longer-term issue but in the meantime the knee-jerk reaction certainly shows a lot of strength. It’s almost impossible to sell at this point, at least not until we would close well below the bottom of the previous uptrend line, which is essentially the $49.50 level. A break above the top of the candle should send this market higher, but I would be a bit concerned about the overbought condition that we find ourselves in. Alternately, if we pull back to the $50 level and find support, it would make sense to perhaps take a short-term buying opportunity out of the market.

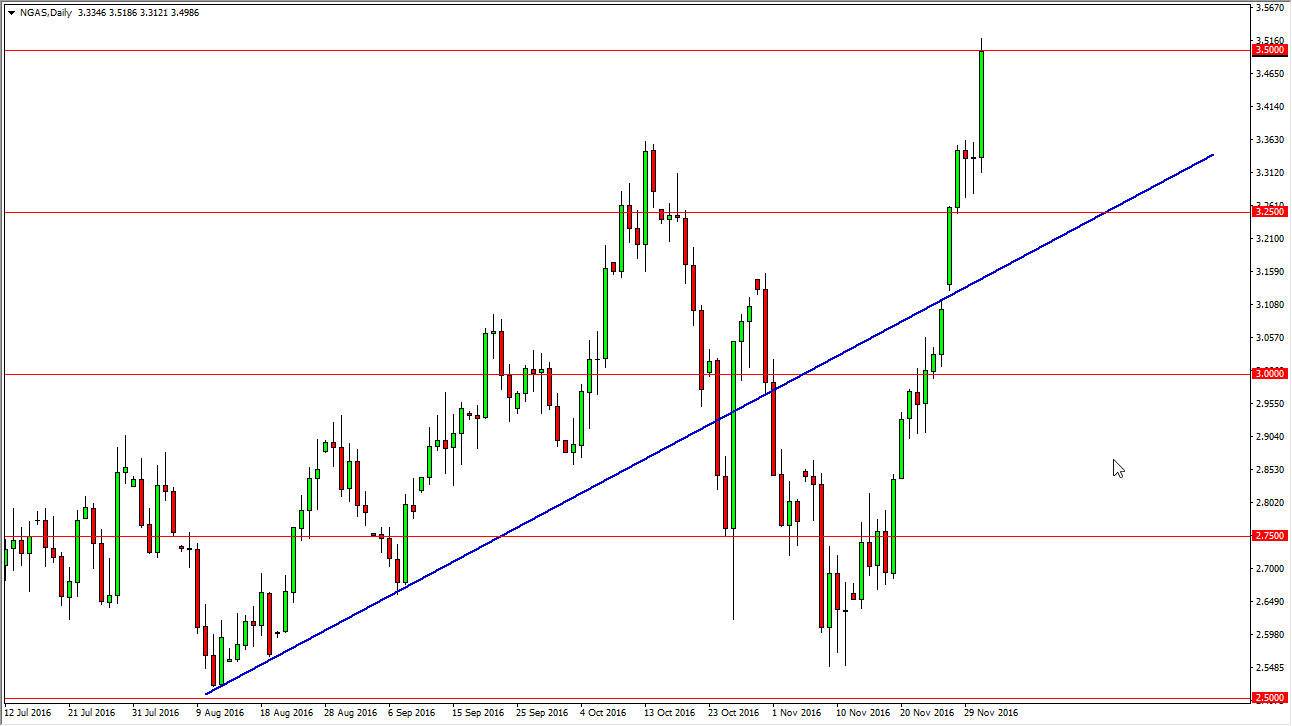

Natural Gas

Natural gas markets rose during the day, reaching towards the $3.50 level. This is an area that offered resistance as you would expect, being a large, round, psychologically significant number. At this point, this market is about as overbought as a gift, and I would not be comfortable going long. I think of pullback to at least the $3.250 level needs to happen in order to build up enough momentum to sustain this rally. I still believe that the oversupply issue will overtake the markets, because the higher this market goes, the more natural gas becomes attractive to US and Canadian drillers.

A break down below the previous uptrend line of course is a very bearish sign but I don’t see that happening anytime soon. More than likely, we will get the pullback and a short-term buying opportunity to the upside.