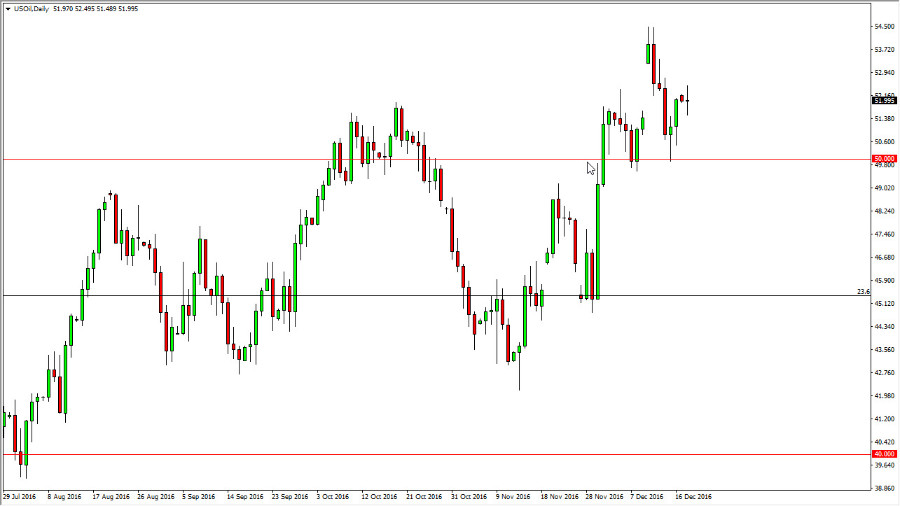

WTI Crude Oil

The WTI Crude Oil market went back and forth during the day on Monday, as we are entering one of the least liquid times of the year. I believe that the market will continue to see volatility in the short-term, mainly because the majority traders will not be interested in risking any serious amount of money during the holidays. The candle shows just how lackadaisical the market is, but I believe that the market has real support below at the $50 level. That’s an area where I feel the market will find buyers, and supportive candles should offer buying opportunities. The $54.50 level above continues to be the resistance, and probably extends all the way to the $55 level. Ultimately, I believe that the next couple of sessions will be very choppy and stay within this consolidation area overall.

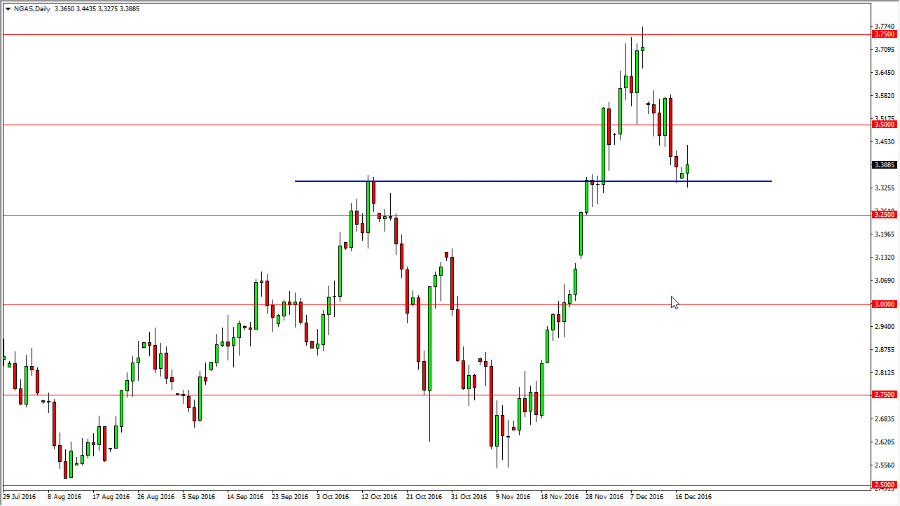

Natural Gas

The natural gas markets went back and forth during the day on Monday as we see quite a bit of volatility. The $3.30 level is massively supportive, and I think that the support extends all the way to the $3.25 level underneath. Any type of supportive candle should be a buying opportunity, and with that being the case I feel that the market will probably reach towards the $3.50 level above. If we can break above there, then we would fill the gap that started the previous week. The $3.75 level above should continue to be a bit of a “ceiling” in this market, so I don’t think that a break above there anytime soon.

If we did break down below the $3.25 level underneath, I feel that the market will go lower, reaching down to the $3.00 level. That’s an area that has a lot of significant psychological weight to it, so I think that we would find buyers in that area if we get down there.