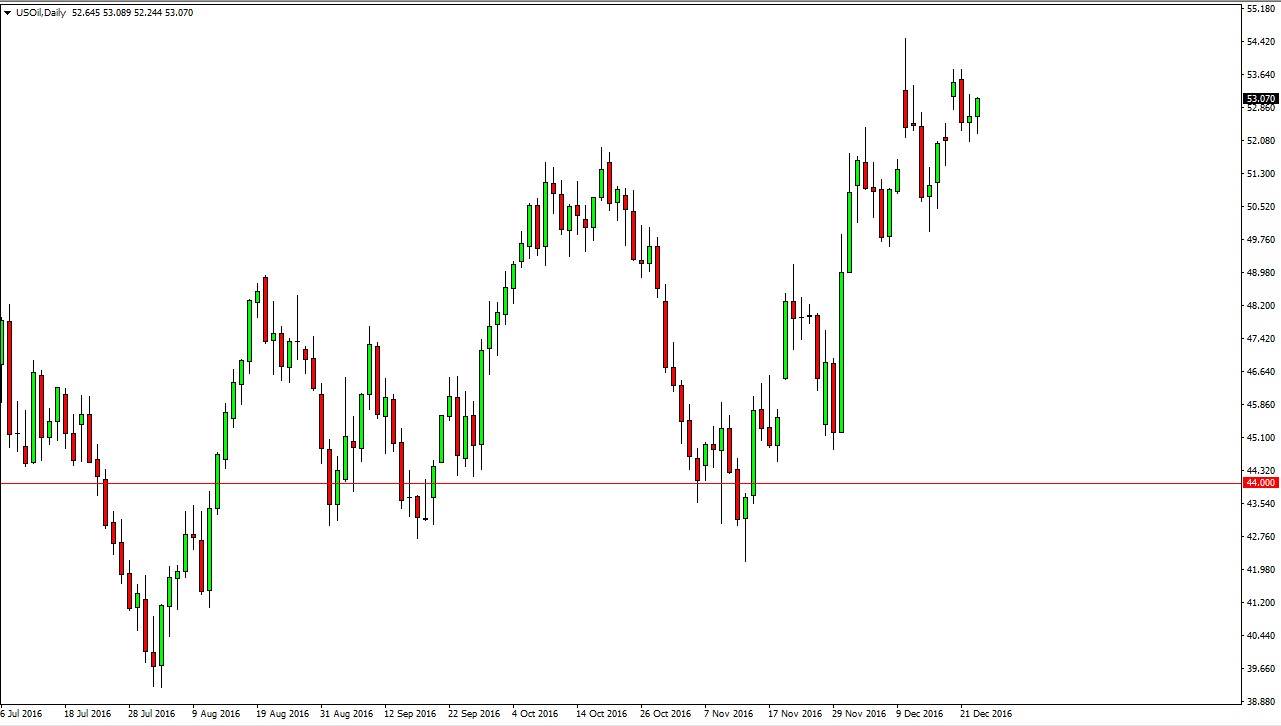

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday, but then found buyers as we got a bit bullish later in the session. The market will more than likely look to get to the $54.50 level above, and more than likely try to reach to the $55 level. The pull backs coming will be opportunity going forward to take advantage of value in a longer-term uptrend. The market will continue to be choppy though, as the holiday lack of volume will work against any larger moves. The $50 level below continues to be a ‘floor’ in this market, so going forward I think short-term buying is about as good as it will get.

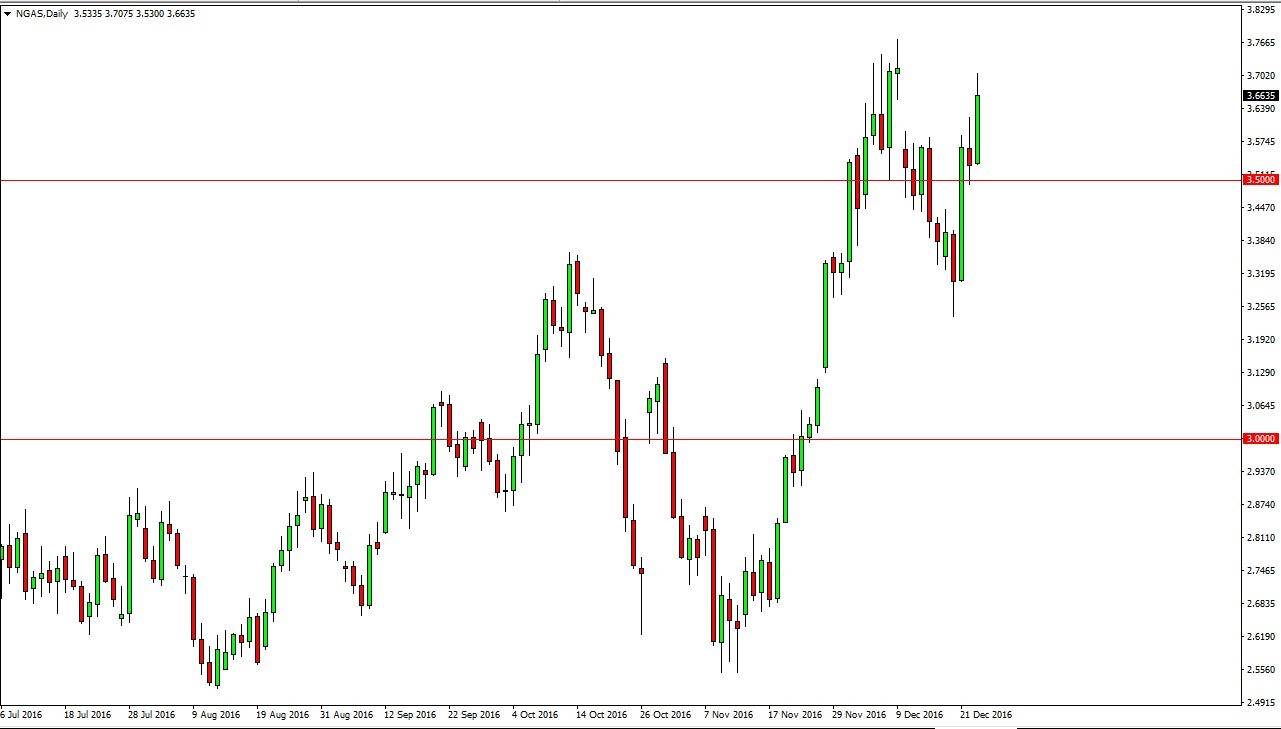

Natural Gas

Natural gas markets rose on Friday, trying to fill the gap above. This gap is looking like an area that should continue to offer resistance, and this is the main point now as the markets will continue to offer choppy conditions. The colder temperatures should continue to help the overall values in the north-east US, and therefore the world. However, the area above $3.75 offers enough resistance on the longer-term charts to turn things around in that area. The markets will eventually focus on the longer-term outlook of natural gas, and this is when the sellers will get involve.

The Canadian and US natural gas fields offer a massive amount of gas to the markets, and this is well known. I believe that given enough time the massive oversupply out there becomes an issue. The candle on the Friday session was strong, so this is possibly a sign that the markets could fight the above resistance for some time. However, the area above is massive – and it is only a matter of time before it becomes too much to bear. Short-term, this market rises. Long-term, it falls apart.