WTI Crude Oil

The WTI Crude Oil market initially fell on Friday but found enough support at the $50 level to turn around and form a hammer. The $50 level was a significant psychological barrier that we have to break below for me to start selling, and that remains the case. Not only is the $50 level a large, round, psychologically significant number, but we also have an uptrend line slicing through it just below current pricing. Because of this, it looks like the buyers are still pushing this market, a break above the top the hammer could send the WTI market to the $55 handle.

Longer-term, I believe that we have major structural issues but it’s obvious that the markets are going to continue the reaction to the OPEC production cuts. Because of this, I think the only thing you can do is buy this market until we break down below $50.

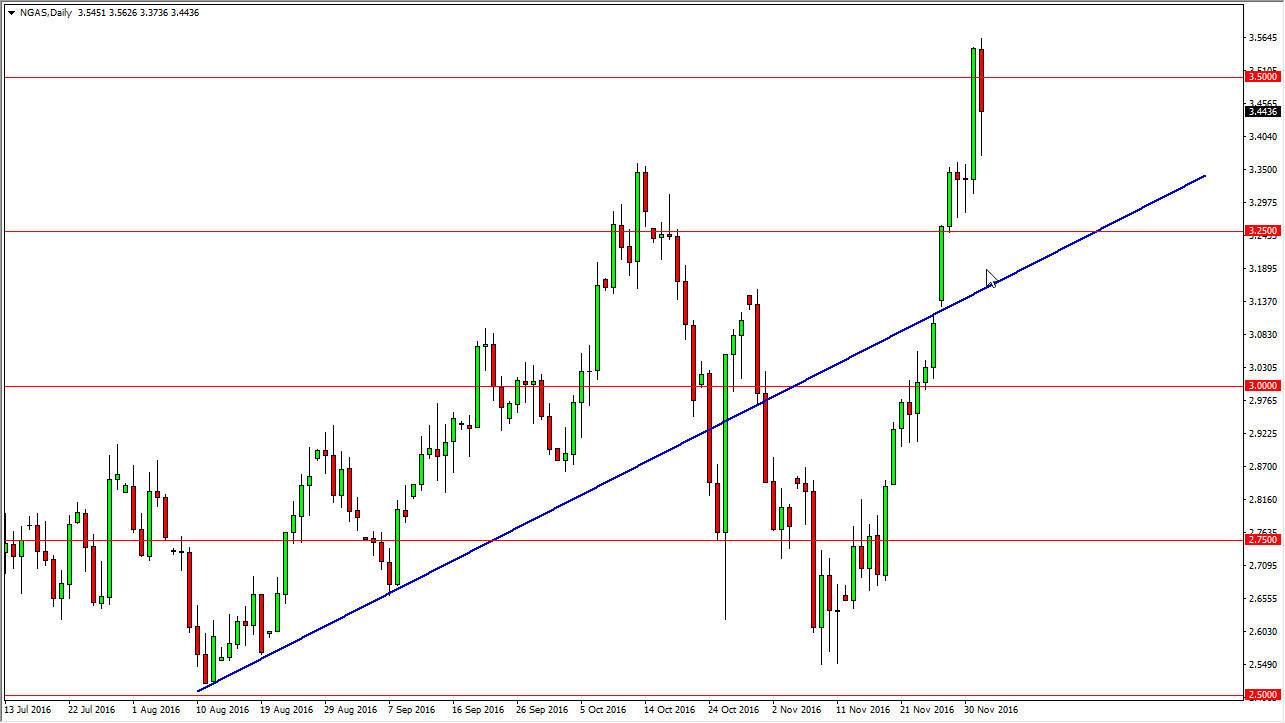

Natural Gas

The natural gas markets pulled back quite drastically during the day on Friday, but only long enough to find support at the $3.35 handle. I suspect that the E3 $.35 level should be supportive, considering it was so resistive in the past. Because of this, the move makes sense that we are still overbought by just about any metric measure this market by. Because of this, I still prefer to see more of a pullback before getting involved, but recognize that selling is almost impossible at this point.

The cold weather in the northeastern United States will drive of demand, but it won’t be enough to wipeout supply in the longer term. One major factor that’s going to contribute to the long-term bearishness of this market is the fact that as prices go higher, more Canadian and American drillers get back to work. Short-term it looks like were bullish, but we could see a massive correction.