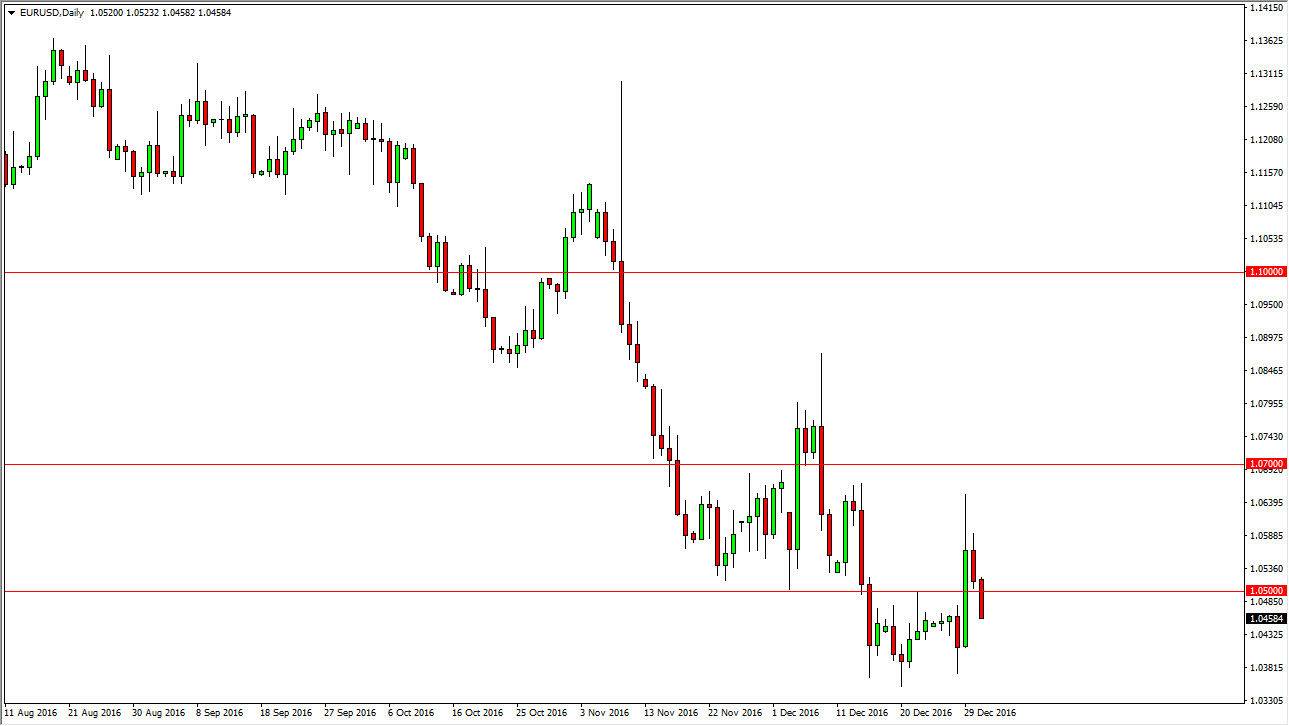

EUR/USD

The EUR/USD pair fell on Monday, dropping below the 1.05 level again. This is a market that simply cannot get out of its own way, and I feel that it is only a matter of time before we break down to a fresh, new low. We have seen quite a bit of support at the 1.0350 level recently, but I feel it’s only a matter of time before that level gets sliced through and we reach towards the parity handle. Because of this, I look at short-term rallies as selling opportunities, and will continue to treat them as such. I have no interest in buying this market, and believe that the US dollar should continue to be favored over most currencies, and especially the Euro as the ECB has recently extended quantitative easing by 9 months.

GBP/USD

The British pound fell on Monday, showing signs of weakness and it appears that the market is going to continue the downtrend that we have seen recently. Because of this, the market should then reach down to the 1.21 handle, and then eventually the 1.20 level underneath. This is a market that continues to focus on the British leaving the European Union, and of course the Federal Reserve raising interest rates. I think that we will eventually break down below the 1.20 handle, but the 1.50 level underneath there is a major long-term bottom that I think will be defended. Because of this, I believe that we will see selling in the meantime, but eventually the buyers will return. They are not anywhere to be found now, but I will be paying attention to longer-term charts as we drift lower. The easy money selling the British pound has been made quite some time ago.

It is not until we break well above the 1.25 level that I would consider buying this pair, as it would show a significant turnaround in momentum.