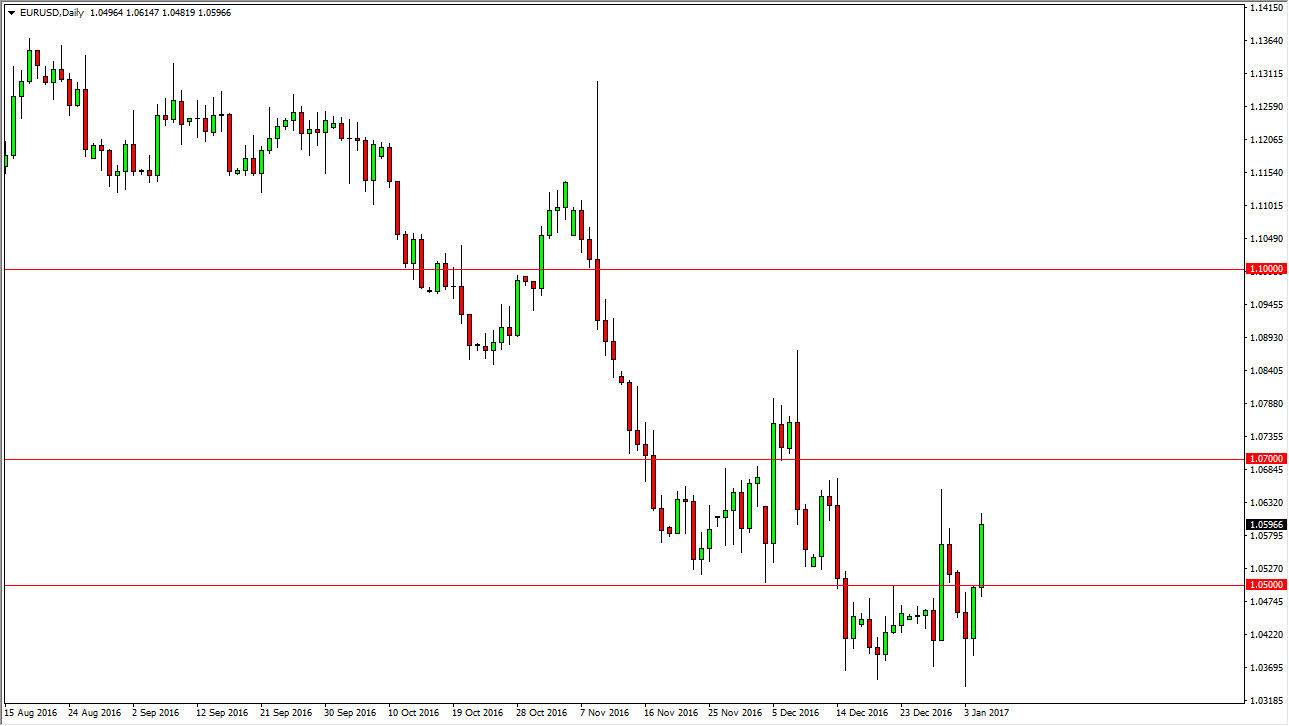

EUR/USD

The EUR/USD pair rallied on Thursday, breaking above the 1.05 level. There is quite a bit of noise all the way to at least the 1.07 level, so I think it’s a matter time before the sellers get involved. An exhaustive candle is what I need to see in order to start shorting, in today’s Nonfarm Payrolls announcement could be the catalyst for something like that. The European Central Bank has extended quantitative easing, and that of course should work against the value of the Euro. Ultimately, the Federal Reserve looks likely to raise interest rates as well, so I believe longer-term we will continue to struggle. Given enough time, I’m waiting to see whether or not we get a resistive candle that we can search selling again. I have no interest in buying until we close above the 1.0750 level on a daily chart.

GBP/USD

The GBP/USD pair initially fell on Thursday but turned around to form a positive candle. We broke above the 1.24 level during the day, and it now looks as if the market is going to continue to grind towards the upside, perhaps testing the bottom of the previous uptrend line. That’s an area where I expect to see quite a bit of resistance, and at the 1.25 level just above there. In other words, I think it’s only matter time before the sellers get involved and at the first signs of exhaustion am willing to sell. The market should then reach down to the 1.22 level below, and then my longer-term target of the 1.20 handle.

If we get a daily close above the 1.25 handle, I believe at that point the trend may change towards the upside again. Ultimately, I still favor the downside, due to the uncertainty when it comes to Great Britain, but I also recognize the easy money shorting this pair has already been made.