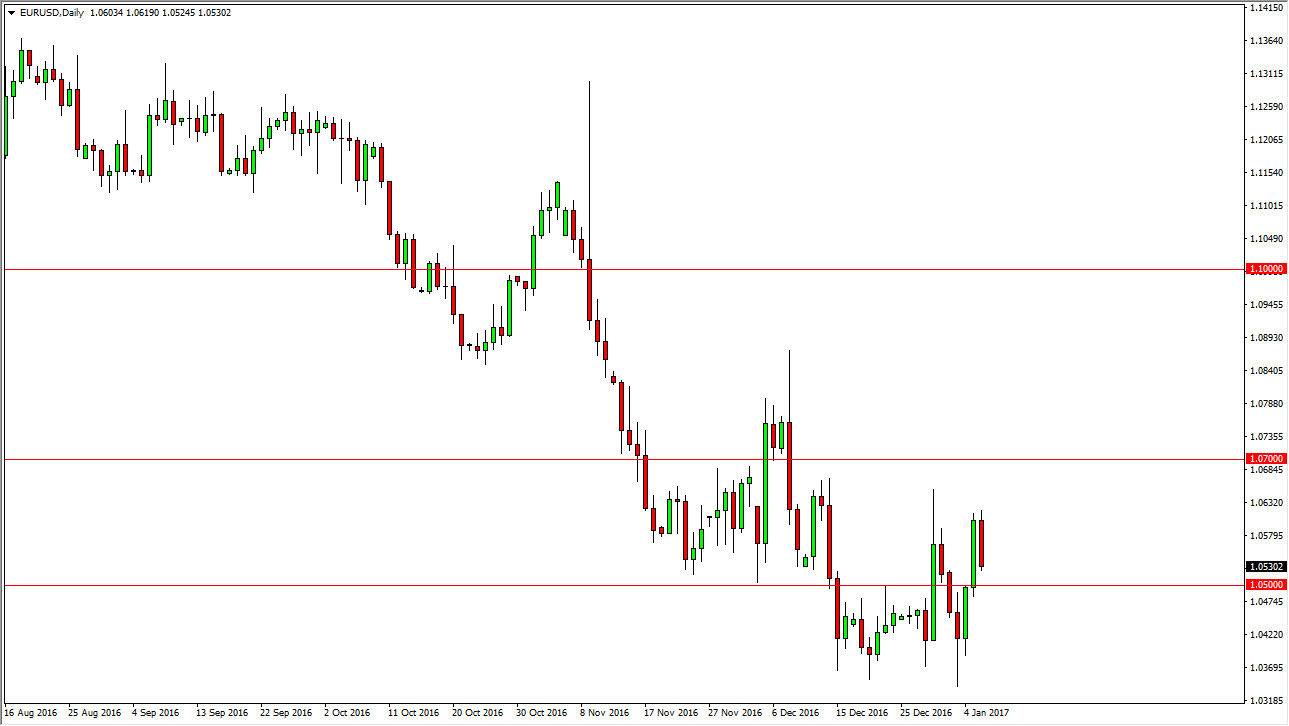

EUR/USD

The Euro fell during the session on Friday, as the jobs number came out roughly as expected. Because of this, it appears that the traders of the world are starting to look at the extension of quantitative easing by the European Central Bank as a main driver in this pair, and if we can break down below the 1.05 handle, I feel that the market will then reach to the 1.0350 level which had in supportive in the past. If we can break down below there, the market should then reach to the parity handle. Rallies at this point will have to deal with resistance at the 1.07 handle above, and extending all the way to the 1.0750 level. If we do rally, an exhaustive candle would be a nice selling opportunity as well.

GBP/USD

The GBP/USD pair fell also, forming a rather negative looking candle for the day. The candle has a long range, so I believe that the bearish pressure is starting to pick up again. If we can break down below the 1.22 handle underneath, I think that the market will then reach to the 1.21 handle underneath, and then eventually the 1.20 level under that. Any rally at this point in time should attract sellers, and I believe that the 1.25 level will offer enough resistance to keep the downtrend intact.

Longer-term, there is a major bottom of the 1.15 handle, and I think that’s where were trying to get to. It’s going to take a lot of momentum and downward pressure in order to make the breakdown happen, and I think this is a longer-term story. However, I certainly don’t feel comfortable buying this market as the British pound has far too many question marks with it. With this being the case, I remain bearish but I also recognize that it will probably be several trades again and again.