The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 15th January 2017

Last week, I predicted that the best trades for this week were likely to be long USD against the British Pound and the Japanese Yen. The GBP/USD trade was a winner by 0.72% but the USD/JPY trade was a loser by 2.11%, so the average was a loss of -0.70%. The USD fell in strength last week, against the long-term bull trend in the greenback, across the board except against the British Pound.

The Forex market seems to be moving into a less predictable mode now, with the well-established bullish trend in the USD since 8th November being called into question, yet still being technically intact.

I therefore suggest that the best trade this week is again likely to be short of the British Pound, the difficult question is against which other currencies. As the Australian and New Zealand Dollars have a lot of bullish momentum behind them, it could be a good idea to use these currencies as well as the U.S. Dollar as long counterparts to spread the risk.

Fundamental Analysis & Market Sentiment

Fundamental factors are not playing a great role in the market right now, except against the British Pound as the British Government gives stronger signals that it will pursue a “hard Brexit” which is causing weakness in the Pound.

Sentiment turned against the U.S. Dollar, partly on profit taking after a strong move since 8th November maturing, partly also on President-Elect Trump’s first press conference which disappointed the market as few details regarding economic policy were provided.

The unravelling in the USD may be temporary, but is boosting currencies that have been the primary beneficiaries of a weakening USD for the past year or two: New Zealand and Australian Dollars, and this is at least partly due to the relatively high interest rates these currencies still pay.

Technical Analysis

USDX

The U.S. Dollar printed a solidly bearish candle within the scope of a wider bullish trend that is manifested over both the long and short terms. The bearish candle is strong, but the move can still be called a normal pull back within the trend. Additionally, the price is reaching an area where it had faced a cap a few weeks ago, so there may be support here.

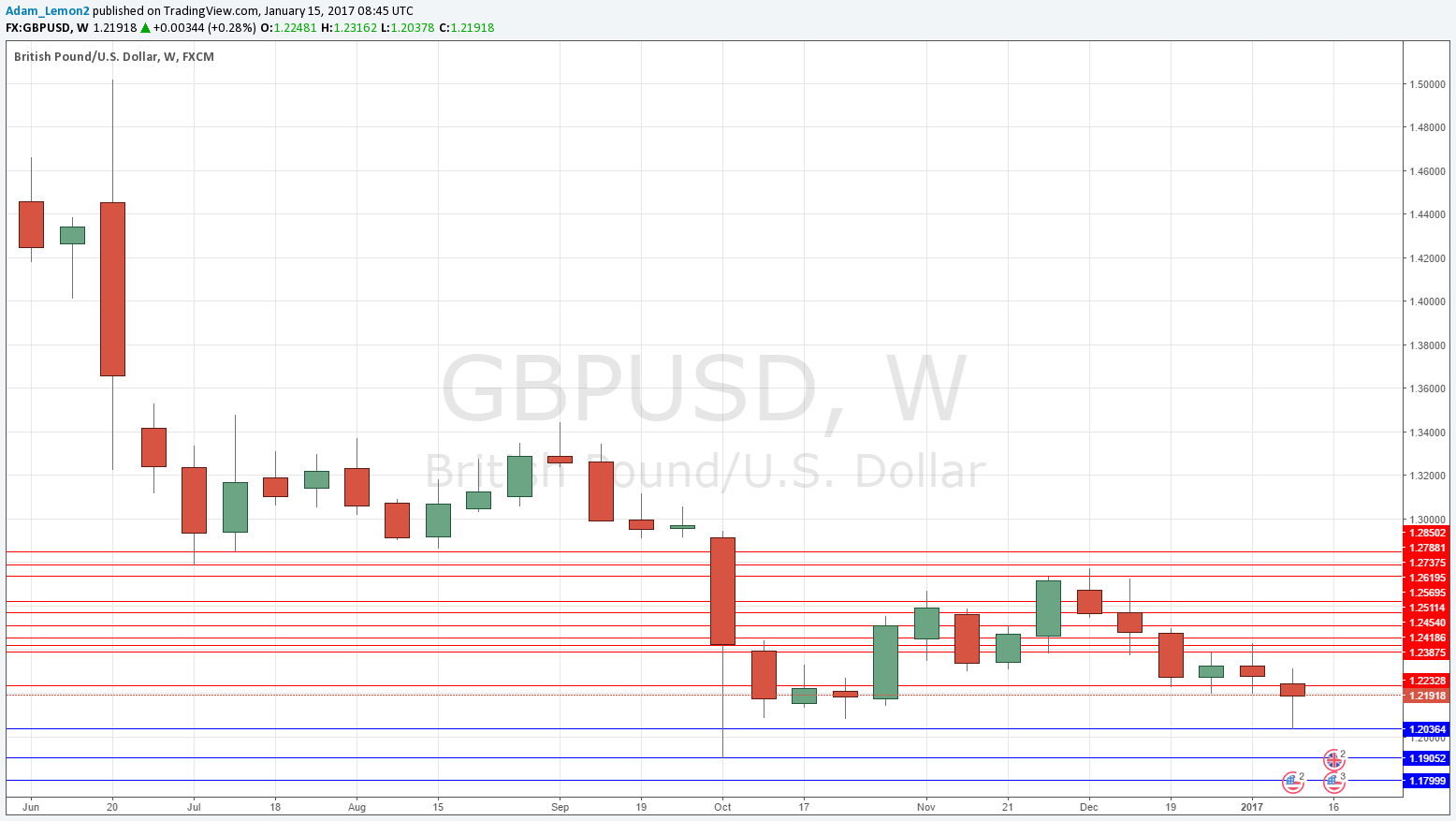

GBP/USD

A slightly bearish yet pin-shaped candlestick, which is significant for its indecision. Note that the price is now approaching a historical multi-year low area but running out of bearish momentum. The long-term momentum is pressing down but there are signs of support.

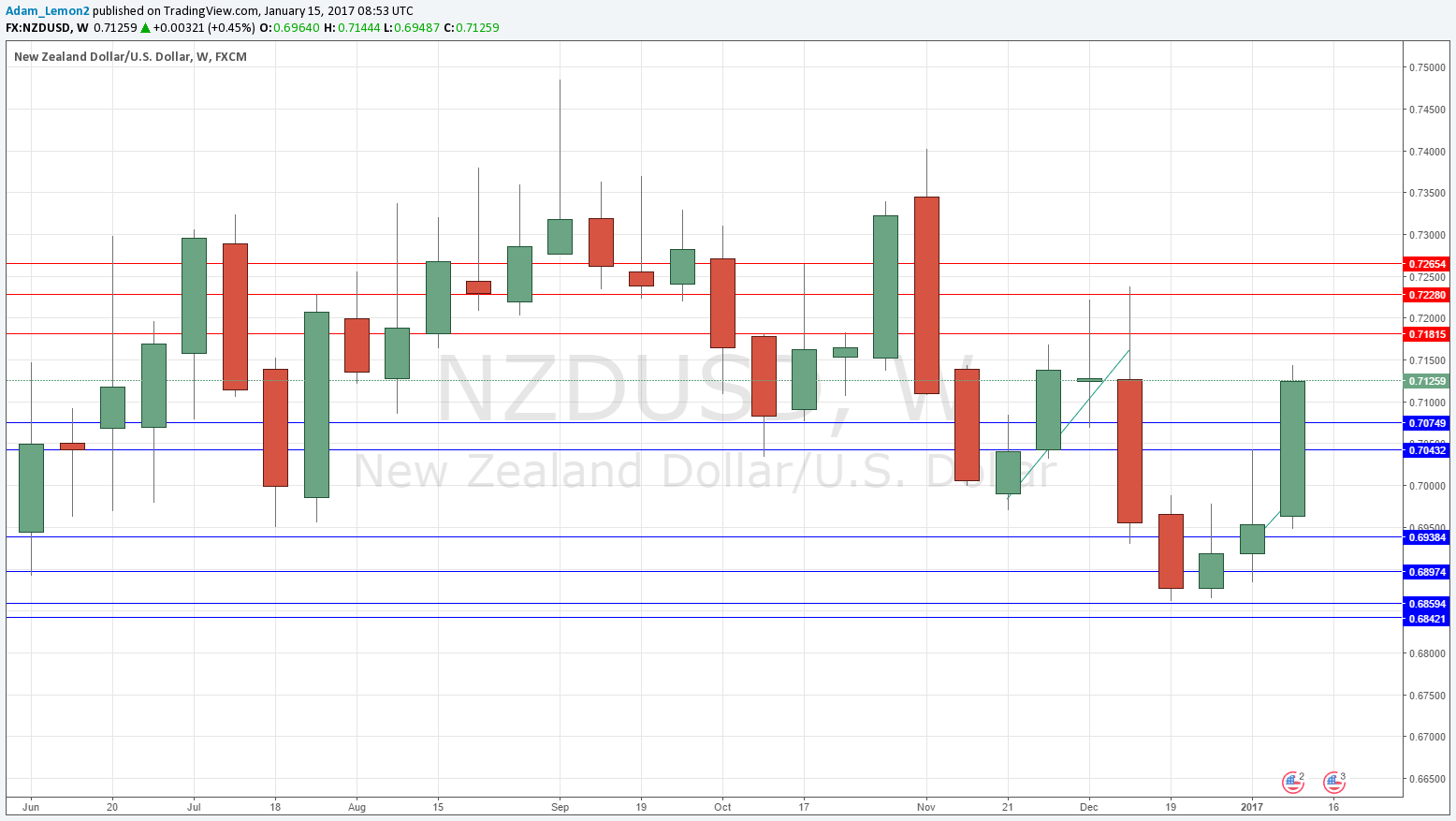

NZD/USD

We can see that last week closed with a strongly bullish candle, and the close was above its weekly close of 13 weeks (3 months) and not far off its close of 26 weeks (6 months). This is suggestive of a major trend change, with the New Zealand Dollar being the strongest currency to show this against the U.S. Dollar. A note of caution – this area above 0.7150 was clearly very resistant the last time the price reached it.

Conclusion

Bearish on the British Pound, bullish on the New Zealand, Australian and American Dollars.