The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 2nd January 2017

Last week, I predicted that the best trades for this week were likely to be long USD against the British Pound and the Australian Dollar. Both these trades were small losers, averaging a small loss of -0.41%. The USD fell in strength last week, against the long-term bull trend in the greenback, across the board.

The Forex market seems to be staying in a more predictable mode now, with a well-established bullish trend in the USD since 8th November.

I therefore suggest that the best trade this week is again likely to be long USD against the Australian Dollar. It also looks strong against the British Pound, but less so.

Fundamental Analysis & Market Sentiment

Fundamental factors are playing a role right now most notably on the USD. Three weeks ago, the FOMC raised the base rate by 0.25%, and the market was expecting that, but the surprise which made the market more bullish on the USD was the upward revision of projections for further tightening through more rate hikes during 2017 and beyond.

There are not really any other fundamental or sentimental factors to pick out this week. It is worth pointing out that volume is likely to increase from Tuesday as major financial centers such as London and New York come back fully online after the holiday season. There are also going to be releases of FOMC Meeting Minutes on Wednesday and Non-Farm Payroll data on Friday, which could be very influential on sentiment concerning the greenback.

Technical Analysis

USDX

The U.S. Dollar made another new 14 year high, but printed a bearish candle within the scope of a wider bullish trend that is manifested over both the long and short terms. The bearish candle is an outside candle, but I don’t feel very bearish about it as it has a relatively robust lower wick. It seems to be a normal pull back within the trend.

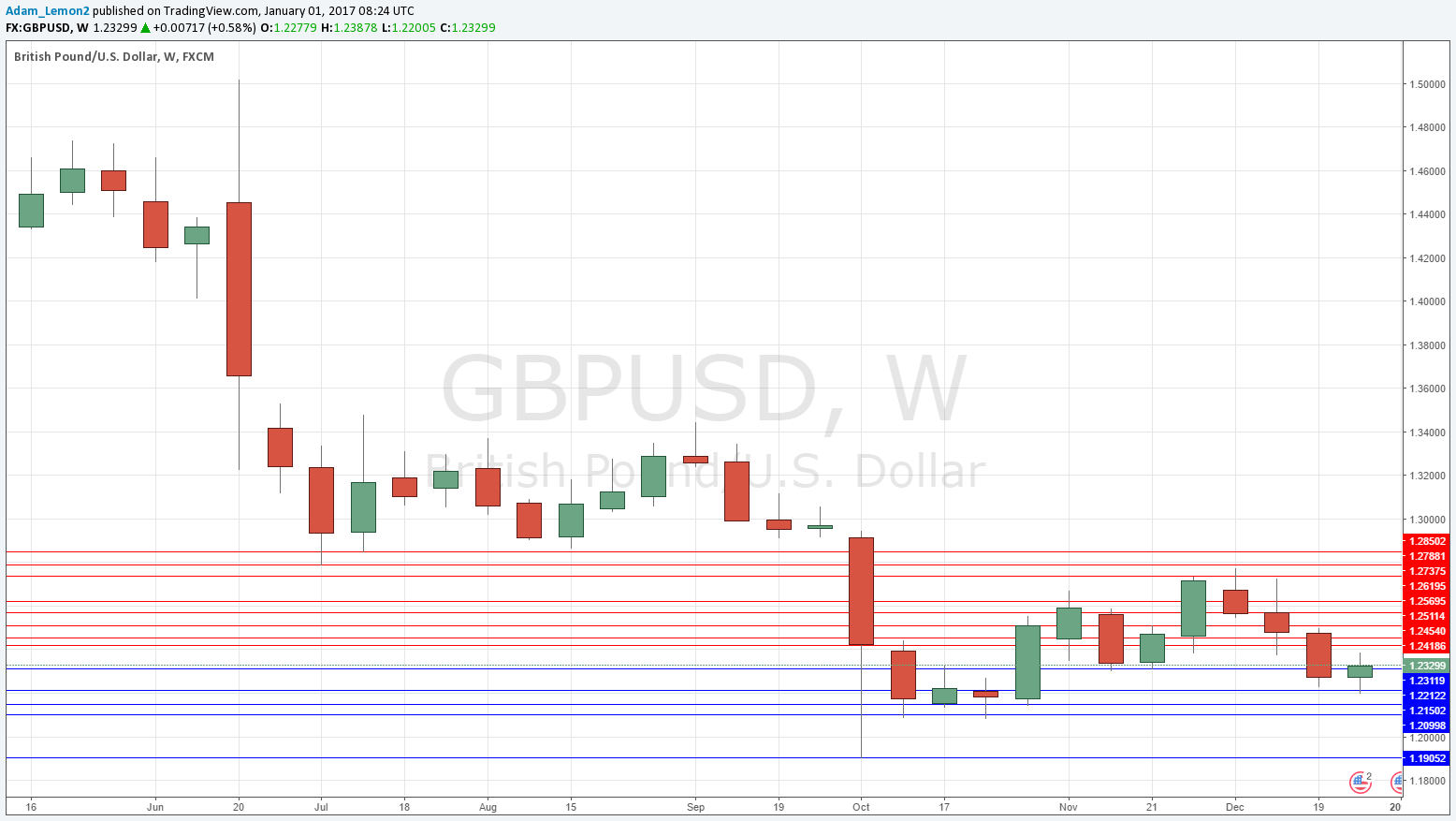

GBP/USD

A small near-doji candle. Note that the price is now approaching a historical multi-year low area with bearish momentum. A note of caution – there may be strong support at the low, and this week’s doji is hinting further at this.

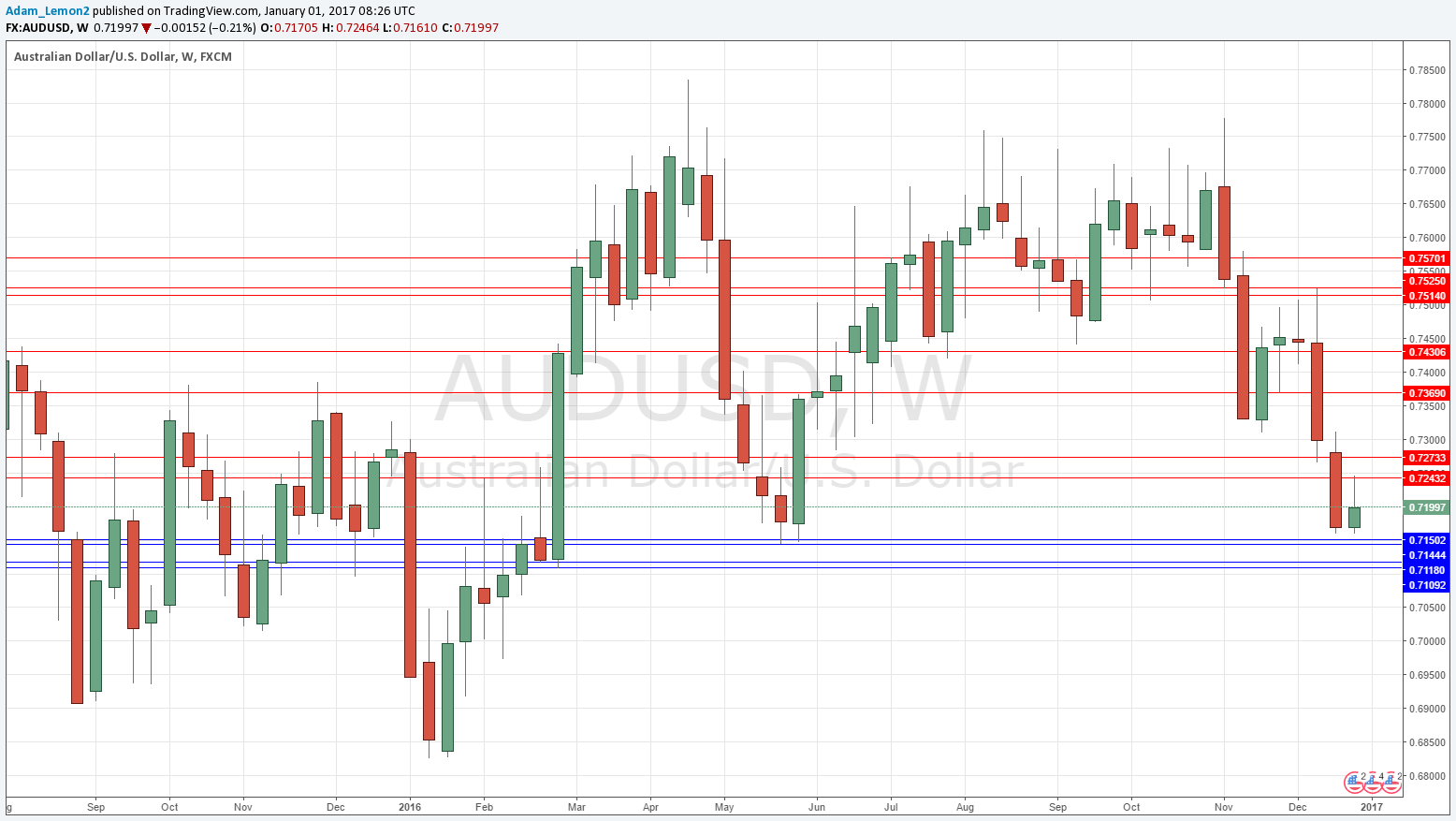

AUD/USD

A somewhat bearish week with a very weakly bullish candle closing in its lower half. Note that the price is now approaching a historical multi-month low area with bearish momentum. A note of caution – the 0.7150 area below was a major inflection and price-flipping point, so there might be strong support if and when it is tested again.

Conclusion

Bullish on the U.S. Dollar, bearish on the Australian Dollar.